It seems that transfer pricing is the topic of the moment: in conferences, articles, and boardrooms you hear about it... but what does it really mean?

When third parties enter into commercial transactions with each other, the terms and conditions of their arrangement are governed by market forces and the price they negotiate is by definition a market price. However, this is not the case when two entities of the same group enter into similar commercial transactions. The negotiation is influenced by market forces, but also by the position of the entities within the group, by group synergies, and other biases that, all together, can lead to a price that is not at arm's length.

The purpose of transfer pricing rules is thus to ensure that the price of a transaction between two related parties corresponds to the price charged between independent parties involved in a similar transaction.

For tax authorities, the arm's length principle is important because their aim is to tax the profit that corresponds to the actual economic activities taking place in their respective jurisdictions, and to ensure that these profits are not shifted to a low-tax jurisdiction or from a profit-making company to a loss-making company of the same group.

Recent transfer pricing developments in Luxembourg

The latest transfer pricing news is related to the OECD's BEPS action plans. Part of these plans, which are being closely followed by tax authorities around the world, focuses on transfer pricing and more particularly on the alignment of profits with the value created through underlying economic activities or economic substance.

Two recent important transfer pricing developments show that the Luxembourg tax authorities (LTA) are no exception in how they're following the action plans:

- The introduction of article 56bis (with effect from 1 January 2017), transposing into law the five comparability factors as established in the OECD guidelines, reinforces the existing Luxembourg transfer pricing practice with regards to transfer pricing analysis and documentation.

- As from FY2017, all taxpayers need to disclose, in their tax returns, if they are engaged in inter-company transactions. The LTA will accordingly have an immediate view of those taxpayers with potential transfer pricing concerns. Further to this measure, we expect an increase of transfer pricing documentation requests from the LTA, which has actually already begun in the asset management sector (see below).

Transfer pricing for asset managers

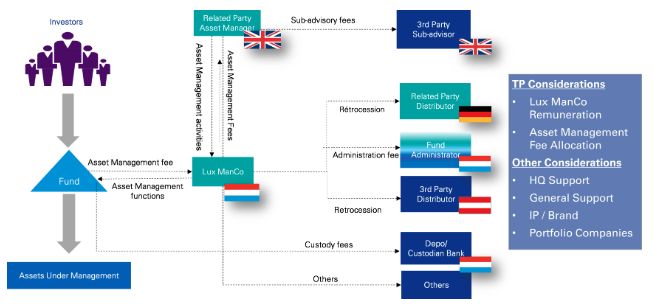

As it does in every industry, transfer pricing in asset management looks at the prices set in intercompany transactions. The figure below illustrates the typical setup of a Luxembourg management company (ManCo).

Frequently, asset management fees are considered at arm's length, being agreed on by the investors and the fund or promoter through the prospectus. Transfer pricing kicks in on the delegation models set by the ManCo: where the ManCo delegates some of its asset management functions (typically investment advisory, portfolio management, and distribution) to another party within the group, the delegation fees need to be determined at arm's length. The main questions are thus:

- How the fees are split up—was that determined at arm's length?

- How do the delegation fees compare to third-party fees (particularly relevant for distribution fees where both internal and external distributors are active)?

- What margin remains at the level of the ManCo?

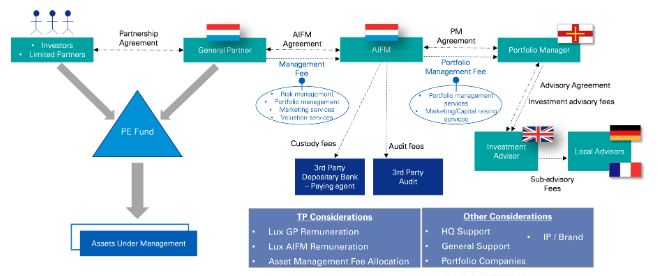

The alternative investment world is equally concerned. Though its operating models differ, as depicted below, the transfer pricing questions on functions delegated by the AIFM are the same.

Asset management is one of the most important industries in the economy of Luxembourg, so scrutiny in this area is only natural—even more so in light of Brexit, which has put a spotlight on the fund management industry. Many big players in the industry are restructuring their businesses so as to continue their operations in Europe after Brexit. All these changes in business models have an impact on existing transfer pricing policies, however, and may create new issues.

Both the LTA and the CSSF are well aware of this, which is perhaps one reason why the LTA has recently sent out official letters to several Luxembourg ManCos requesting transfer pricing documentation that shows the arm's length nature of their different intra-group transactions for FY2017. The LTA's deadline to receive this documentation is quite short—a couple of weeks—and extensions, if granted, are not usually much longer.

Furthermore, the CSSF has recently issued a new circular (18/698), effective immediately, that relates to the approval process and organisation of ManCos. Notably, it sets out extensive guidance on the organisation, operations, and substance of Luxembourg ManCos. Existing ManCo operating models and, consequently, transfer pricing practices, may need to be revisited in light of this new circular.

Takeaways

These developments have opened many questions for Luxembourg's asset managers, such as:

- What is the arm's length management fee to be retained by the Luxembourg ManCo given its functional profile and footprint within the overall asset management value chain?

- Is the existing transfer pricing documentation (if any) sufficient to comply with the Luxembourg transfer pricing documentation requirements? Is it in line with the best practices in Luxembourg?

- Is the transfer pricing documentation consistent with the operating model disclosed to the CSSF, and would that documentation satisfy the scrutiny of the CSSF if they wanted to see it?

The international tax and transfer pricing developments call for an alignment of profit allocation to where value is created. Now is the time for the asset managers to begin filling in the gaps and putting together a roadmap for the future. Asset managers should be prepared to answer questions from the LTA and CSSF regarding their operating models, as well as to produce transfer pricing documentation supporting those models where intercompany transactions take place.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.