OUR INSIGHTS AT A GLANCE

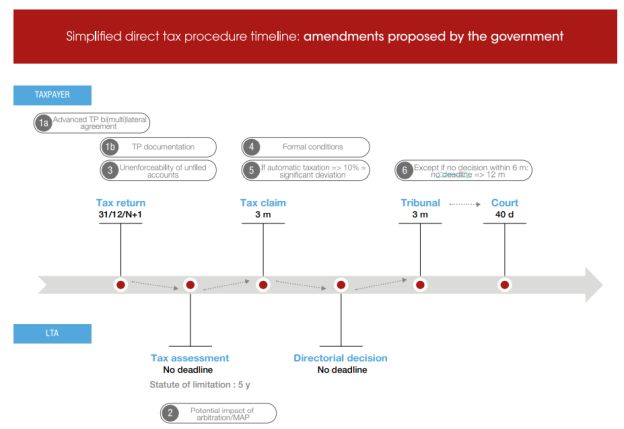

- On 28 March 2023, a new draft law was released in order to simplify and modernise the rules governing the direct tax procedure in Luxembourg.

- Even if some provisions are positive, it seems that the main purpose of the changes to be introduced is to ease the duties of the tax authorities or to relieve their congestion rather than to increase the tax certainty for taxpayers.

- We provide hereafter a commentary of the main amendments proposed by the government and some of the shortcomings of the current direct tax procedure.

On 28 March 2023, the Minister of Finance presented a new draft law n° 8186 (the "Draft Law") to the Parliament which amends the Abgabenordnung ("AO") as well as some other laws on tax procedure in order to simplify and modernise the rules governing the tax procedure in Luxembourg. Afterwards, drafts of Grand-Ducal Regulations aiming at implementing various provisions of the Draft Law were also released.

As we reported in our Alert on the subject, some provisions to be introduced are positive as they will bring more certainty for taxpayers. Nevertheless, it seems that the main purpose of the changes to be introduced is to ease the duties of the tax authorities or to relieve the tax authorities' congestion rather than to increase the tax certainty for taxpayers. This is also the conclusion reached by the Council of State in its opinion on the Draft Law released on 11 July 20231.

Unfortunately, from our point of view, and also from the point of view of other commentators, this Draft Law clearly lacks ambition in respect of the current needs to modernise the Luxembourg tax procedure. In the press, a lot has been written about this Draft Law, and in Parliament the amendments have for the most part been criticised during the meetings of the Finance and Budget Committee held on 31 March, 24 April and 28 April 2023. In particular, the following comments were made, among others: the need to introduce clarity in the law regarding the deadlines to be respected by both parties, the failure to take into account the comments made by professional chambers in the past years, the limitation of the deadline for the taxpayer to appeal to the Tribunal in the event of silence of the Director of the Administration des Contributions Directes ("ACD") rather than guaranteeing an answer from the Luxembourg tax authorities ("LTA") (cf. infra), the necessity to introduce in the law the right for the taxpayer to ask for an oral exchange of view with the LTA (cf. infra), the 10% threshold for filing a claim against an automatic taxation, which can represent a substantial amount and looks like a kind of additional penalty (cf. infra), etc.

This article provides a commentary on the main changes proposed by the government and some of the shortcomings of the current direct tax procedure which, in our opinion, should be (should have been) amended.

1a Transfer pricing documentation requirements and new advance pricing procedures

Request for advanced bilateral or multilateral agreement on transfer pricing

The Draft Law introduces a new procedure (new § 29c AO) for requesting an advanced bilateral or multilateral agreement on transfer pricing pursuant to the double tax treaties ("DTT") concluded by Luxembourg. The advanced agreement will be concluded between the competent authorities of the State(s) concerned based on the mutual agreement procedure ("MAP") provided in DTTs concluded by Luxembourg with this/these State(s) (Article 25 (3) of the OECD Model Tax Convention ("OECD MTC")).

To obtain an advanced bilateral or multilateral agreement on transfer pricing, a written request will have to be sent to the Director of the ACD. A Draft Grand-Ducal Regulation provides more details on the procedure to follow to obtain such advanced agreement and lists all the information the taxpayer's request must contain. The request for an advanced bilateral or multilateral agreement on transfer pricing will be subject to a fee varying from EUR 10,000 to 20,000 depending on the level of complexity and amount of work required.

In our opinion, this price range is too wide, especially as the final price depends on abstract criteria left to the discretion of the LTA, such as the complexity and amount of work. Taxpayers should know the cost of such a procedure with certainty beforehand, for this procedure to be effective and prevent many litigations afterwards, which would be far more time-consuming for the LTA.

In addition, we find it regrettable that the Draft Grand-Ducal Regulation does not provide for a reasonable response time, nor for the possibility of a physical meeting with the LTA to present the various elements of the request or for a communication from the LTA on the status of the request.

We feel that these points are, however, essential to achieve the objectives of this new procedure and bring it in line with the constraints of economic operators.

Finally, it remains unclear how this new provision will be articulated in practice with the current provision according to which taxpayers can ask for advanced pricing agreements ("APA").

Click here to continue reading . . .

Fotnote

1. Council of State, Opinion n°61.390 dated 11 July 2023, p. 3: "le Conseil d'État relève que de nombreuses modifications ont pour objet d'imposer des obligations procédurales plus strictes au contribuable".

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.