Outstanding tax debts are, in principle, subject to forced collection by the Luxembourg tax authorities. Recovery procedures involve several phases and commencement is directly or indirectly linked to the occurrence of the taxable event.

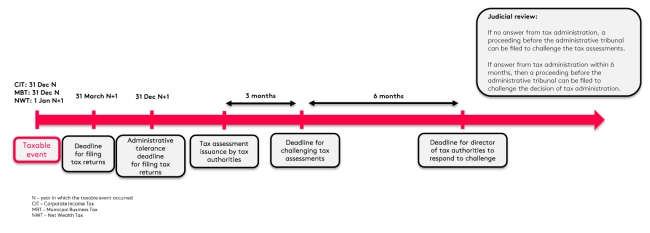

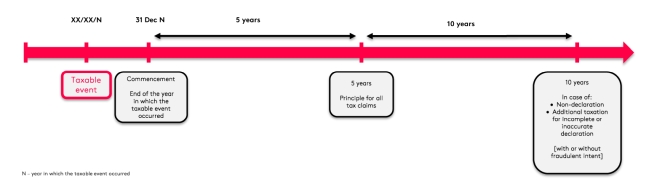

Below we summarise the main deadlines relevant in Luxembourg tax filings and litigation proceedings, applicable statutes of limitations, as well as the key steps of forced collection (based on the taxpayer's country of residence).

Tax litigation main steps

Statutes of limitations

Forced collection of outstanding tax debts

Resident taxpayer

Administrative phase

- Warning sent by the competent revenue office for the outstanding amount to be settled within 5 days

- If not settled within the deadline, second warning with another 5-day deadline sent

Forced recovery phase

- Recovery notification / payment order sent by the relevant revenue office

- Failure to comply – tax authorities may seize assets/funds (including via third party debt orders)

Non-resident taxpayer

- If no international agreement, the payment order is served by registered letter to the addressee's domicile or residence abroad (or if this is not allowed by the foreign country, by diplomatic channels)

Domicile or residence unknown

- Officer of the competent revenue office draws up a report on the diligences carried out in order to seek for the addressee and sends it, alongside the payment order, to the last known address

- Establishment of the report mentioning the dispatch is deemed equivalent to notification

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.