To many outsiders, Africa is a paradox — a continent where the world's youngest population is governed by its oldest leaders, an up-and-coming technology hub where one in three citizens lacks access to electricity, an economically disadvantaged continent that is home to the five fastest-growing economies in the world. But where some see contradiction, others find potential — and a destination for ambitious investment.

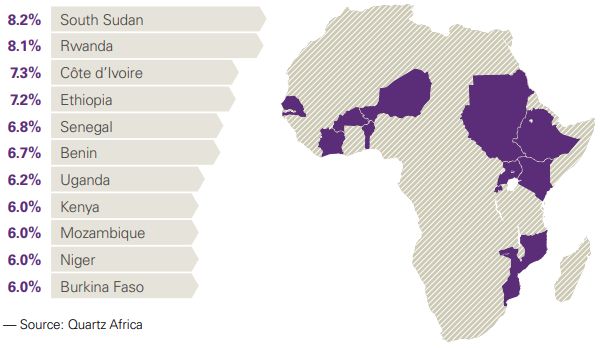

Fastest growing African economies as of Jan 2020

"There's a growing population, huge amounts of talent and demand for goods and services.(Africa) is really the last untapped continent in terms of economic potential."

What makes Africa attractive to investors?

Weyinmi Popo: I think the attraction of Africa has always been the relative youth of the population and the growth in the middle class.

Nnedi Ifudu: It's the youngest continent in the world with an average age of 19. There's a growing population, huge amounts of talent and demand for goods and services that hitherto have not been available. There are challenges around infrastructure development and security in some countries, but it is really the last untapped continent in terms of economic potential.

How has COVID-19 impacted the investment climate?

WP: The good news is the health impacts have been relatively limited compared to North America, South America and Europe. The public health systems haven't been overwhelmed. However, on the economic side, prolonged lockdowns meant huge economic contractions, particularly between April and July 2020. South Africa, as a case in point, contracted by 50 percent in the second quarter.

Governments then had to spend money to alleviate the effects of the lockdown. They created stimulus packages, cut interest rates, provided business loans and supported employers. That's put pressure on countries' balance sheets, and we're starting to see economic stress at country level. Some countries like Zambia, for example, called for a restructuring of their bonds and other international debt.

Are there any positive changes coming out of this very difficult time?

NI: In the legal area, we've seen an increasing adoption of technology. Law firms in Nigeria were already steering this way, but we've seen a more full-scale adoption of technology, not only with the firms, but also with the courts. This has elevated access to the courts and allowed for the continued availability of legal services. It's helped on the confidence angle as well. It projects that these jurisdictions are agile and adaptable, and up to speed on technological offerings.

WP: Another good thing that might come out of all of this is economic structural reform, which will be attractive for foreign investors. During the pandemic, some African governments came together to ask for debt-servicing relief on their sovereign loans. The International Monetary Fund (IMF) required them to introduce structural economic reforms before loans can be forgiven and new money advanced. Those structural reforms will be fantastic for investors coming into the continent.

Things like fuel subsidies are going to have to go. Dual or triple exchange rates are going to have to go, which had put off a lot of foreign investors. There are going to be a lot of privatizations and labor market reforms.

Which sectors are sparking particular interest among investors?

WP: Technology related investments have already been growing rapidly in Africa. There is a burgeoning tech scene in Nigeria, and in Kenya, and in Cape Town, South Africa. A lot of those companies deal with financial payments - international remittances, providing insurance to the underinsured, banking to the underbanked.

Deals around infrastructure will also continue to attract investment. Telecoms infrastructure, of course, which is the backbone of modern economies, but even hard infrastructure, like roads, railways and projects that power electricity. Renewable energy is showing growing interest, solar power in particular. Gas remains interesting to people because it powers electricity, which, in a country like Nigeria, is very important.

NI: Two sectors where I would like to see more investment, and I think would do well in these COVID times, are health and agriculture. Typically, when the elite in Africa get sick, they get on a plane and go to Germany, or London, or the United States. In countries like Nigeria and others where you've had lockdowns, folks have not been able to travel, and so you've had top government officials and elite die because our health systems are, in some cases, broken.

Then, of course there's agriculture. Pandemic or not, people need to eat, so I think investments in the food and agricultural sector should continue to remain attractive to investors.

What are the major concerns or issues for someone who is interested in investing in Africa?

WP: As with everywhere else, the primary concern is to have a profitmaking investment. People look for countries where there's relative political and economic stability, where they can see a decent commercial return and the ability to repatriate that return into the currency of their investment. Africa comes with issues around governance and corruption, but these can be addressed to a large extent by proper upfront diligence and knowledge about your counterparty.

The rule of law is clearly something that people look for. Contracts are often enforced through English law or New York law, and arbitration in London or in Paris. But even those judgments have to be enforced locally.

NI: Security has also become an issue. Unfortunately, terrorism has taken root in a number of African countries. People want to know that they can be physically secure.

More than half of global population growth between now and 2050 is projected to occur in Africa. - Source: United Nations

How are these issues being addressed?

NI: A lot of U.S. trade initiatives vis-à-vis Africa tend to have a corporate governance, rule of law angle. For example, there is AGOA, the Africa Growth and Opportunity Act, the anchor U.S. Africa agreement that allows for duty-free access to the U.S. market. To be eligible, the African nations must abide by a number of guidelines, including paying attention to rule of law, worker rights, human rights, good governance, elimination of barriers to U.S. trade and investment.

The U.S. president can rescind access to AGOA from any country that the U.S. determines is not working toward these eligibility requirements. In December of 2019, the U.S. terminated Cameroon, Niger, the Central African Republic, and Gambia from the AGOA program for failing to meet eligibility requirements.

WP: I do think the Africa Continental Free Trade Agreement will address some of the concerns around investment, because it's very broad, and is even looking at issues around enforcement of judgments, intellectual property and technology transfer, all of which concern international investors.

How else will the AfCFTA benefit investors?

WP: It changes the game dramatically. It allows you to invest almost anywhere on the continent, knowing that the goods or services the business you invest in supplies can be traded freely across 1.2 billion people in 54 countries. It opens up the continent in a way that it hasn't been before.

The ability to scale your investment, to sell goods and services to the greatest number of people, has been limited in large part by the population of each African country. Investments tended flow to larger countries with bigger populations. With the introduction of AfCFTA, there'll be more mobility of investment, and that will benefit everyone.

NI: The AfCFTA is still very much in its development stages, but some of the obstacles they are looking to address would include poor infrastructure, trade logistics, overly bureaucratic or onerous regulatory requirements, regional conflict, and complex and corrupt customs procedures.

What are the key U.S. trade policies on Africa currently?

NI: Since 2018 we've seen the announcement and the start of the implementation of the BUILD Act - Better Utilization of Investments Leading to Development. It's not specifically targeted at African countries, but it is expected to significantly benefit them. Its main achievement thus far is the termination of OPIC and the establishment of a new institution called the U.S. International Development Finance Corporation, also known as DFC. The goal of the DFC is to incentivize private investment as an alternative to state directed investment. It aims to support U.S. businesses competing for investment opportunities in lower income countries.

Prosper Africa is an initiative to support open markets for American businesses in Africa. It aims to create within the Commerce Department a concierge service for U.S. businesses that are looking to invest in Africa, instead of running around trying to get information from the 15 or so agencies that have assisting with investment in Africa as part of their portfolio.

How do investment opportunities and barriers vary across different African countries?

WP: For one thing, there are huge linguistic differences across the continent. Both the local languages and European languages are driven in large part by their history of colonization. A lot of West Africa speaks French, for example, with the exception of Nigeria, Ghana, Liberia, Sierra Leone, and the Gambia. Culturally, Ghana feels a lot more similar to Nigeria, which is two countries away, than Ivory Coast, which is right next door.

South Africa, the most industrialized country on the continent, is more similar to lower-middle income Southern European countries than to a lot of other African countries. Even within that country it's almost two economies running side by side because you've got a sophisticated, industrialized Western economy sitting on top of a huge amount of income disparity and an informal workforce. Investors who are interested in Africa should take the time to understand the regional differences. Even within countries, there are markets within markets.

What is your advice to people or businesses considering investing in Africa?

NI: If you're going into Africa, you have to go in with the right mindset. Number one, you need to recognize that Africa is not homogeneous. Each country is unique and has its own unique challenges. Some African countries, you could close your eyes and you could be in any country in Europe. But most African countries are still very much developing. There should be a healthy suspension of expectation that things are going to run as they do in more developed economies.

WP: First and foremost, you need to choose a company and a market that you think is going to give you a decent return. You need somewhere where there is rule of law, and where your chances of enforcing your contracts are high. The ability of a currency to track the U.S. dollar or the euro, is very important. Investment in the Francophone West African region is attractive for a lot of people because that currency is pegged to the euro.

Most importantly, look for business owners who are talented and hungry and honest, and are willing to take risks in a sensible way to grow a business.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.