The South African financial services regulatory environment is in flux! It is experiencing significant regulatory change, which is becoming increasingly burdensome to financial institutions operating in the South African financial services sector. While the intentions behind the new wave of regulations may be sound, the implications to market participants are significant and challenging.

The source of this burgeoning South African financial services regulatory landscape is primarily rooted in the recent global financial crisis. Since the beginning , governments, politicians and regulators around the world have been calling for additional and stricter regulatory oversight, and South Africa is no exception. This has seen the introduction of laws and regulations that have impacted on the activities of South African financial institutions and the manner in which they conduct business. While the need to protect the taxpayer from ever having to bail out the banks again is laudable, we need to ask the question, has regulation gone too far, especially in the South African context of no bank bailouts during the financial crisis?

The financial services industry needs regulation that serves the economy in which it operates however this does not necessarily mean "just" more. Increased regulation has both a negative and positive impact, it will increase compliance costs, increase the need for additional staff to monitor compliance which in turn can reduce the availability of resources for innovation, change and can impact the way investors see their opportunity of return. For customers this may mean reduced credit offering, trade finance and risk management services. Similarly we cannot discount the benefits of regulation. The objective of the regulation reforms is to enhance stability, consumer protection, access to financial services, coordination between regulators and comprehensiveness whereby businesses operating in the financial services sector are licensed and registered.

All stakeholders, local and international, have a key role to play in striking a balance between the cost of regulation and that of economic growth. After all, operating in the financial services industry does not mean a zero-risk business, failures may occur from time to time.

Increased regulation could be viewed as looking ahead to prevent the possibility of another financial crisis or alternatively viewed as filling the voids exposed by the last one.

The Life cycle of regulation

The principle objective of government and regulators has been first and foremost to make the financial system safe and to ensure public/customer confidence. The perception of the financial environment has been negative since 2008. The rate at which regulatory reform has flowed from the financial crisis has been significant but at what cost?

Certain costs associated with the implementation of regulation have increased, reducing the availability of lending and services to customers. For example, in order for the banks to raise additional capital and liquidity, their lending margins have been impacted, which in turn creates lower loan to value rates and thus impacting lending in the wider economy.

Looking specifically at the reforms in South Africa there are a number of new, amended and proposed regulations such as;

- The Financial Services Board (FSB) is in the process of developing a new risk-based solvency regime for South African short-term and long-term insurers, known as the Solvency Assessment and Management regime (SAM). This will align the South African insurance industry with international standards

- The FSB is formulating a high level TCF (treating customers fairly) regulatory framework

- Proposals have been discussed to reform the retirement industry, with a focus on governance, preservation, annuitsation and harmonisation of retirement funds

- The FSB Intermediary Remuneration Review where the objectives of the review are to ensure that the definition of intermediary services and related remuneration structures in the insurance sector promote appropriate, affordable and fair advice, services to potential and existing policyholders and support a sustainable business model for financial advice.

- New Binder Regulations and Directive 159.A.i. means that all insurers will need to re-contract with all brokers who are mandated in any way, irrespective of whether they perform binder functions, or simply outsource administration functions, should their existing agreements not meet certain requirements.

- Proposed regulation of hedge funds. The proposal is to regulate and supervise certain hedge fund structures under the existing Collective Investment Scheme Control Act, 2002 (CISCA) with the creation of a new and separate category for hedge funds as a collective investment scheme.

- Amendments to regulation 28 of the Pension Fund Act where trustees will be guided in the investment of funds and an investment strategy specific to the fund and the appointment of investment managers who will implement the strategy, and places an onus on the trustees to monitor performance and regularly review the strategy

Proposed amendment to the National Credit Act (2005) to amend certain definitions, tighten measures related to debt counselors, allow debt counselors to voluntarily cancel their registration, tighten requirements that credit providers must adhere to in respect of marriages in community of property and provide for the registration and accreditation of Alternative Dispute resolution structures

Update the Financial Services Laws General Amendment Bill which incorporates all the above and

The introduction of a Twin Peaks model.

Although we see a number of Acts and Standards relating to the financial sector being passed or amended, the most note worthy of these is the implementation of Basel III this year. This third instalment of the Basel Accords was developed in direct response to the deficiencies in financial regulation exposed by the global financial crisis. Basel III was intended to further strengthen banks capital requirements by increasing bank liquidity and decreasing bank leverage.

All the above are being introduced in an attempt to control and better regulate the financial sector. A culture of non compliance may have existed in the past and the financial crises merely exposed this culture. It is this "non compliance" that the government is trying to address.

Financial regulation is beginning to encourage banks to change their approach to transparency, market integrity and consumer protection as proposed in the structural separation known as "Twin Peaks".

TWIN PEAKS

Background

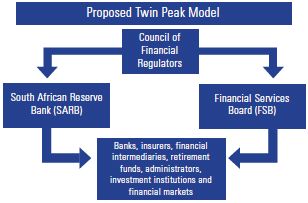

In 2007 a formal review of the South Africa financial regulatory system was undertaken and as a result it was proposed that South Africa move towards a "Twin Peaks" model of financial regulation.

In the 2012 budget speech the Minister of Finance (Pravin Gordhan) said:

"As announced last year, we intend to shift towards a twin peaks system for financial regulation, where we separate prudential from market conduct supervision of the financial sector. Consultations will continue this year, with a view to tabling legislation in early 2013."

The move to a "Twin Peaks" model is an effort to address the shortcomings in the current regulatory structure and cause the least amount of disruption to the financial industry and the current regulators. The "Twin Peaks" model is seen as giving transparency, market integrity and consumer protection sufficient priority.

Flowing from this the two regulators will namely be the "Prudential regulator" and the "Market conduct regulator". The prudential regulator will form part of the South Africa Reserve Bank (SARB). It will enhance financial stability by promoting safety and soundness of regulated institutions.

The market conduct regulator will form part of a restructured Financial Services Board (FSB). It will protect consumers of financial services and promote confidence.

The twin peaks model aims at achieving 2 broad objectives. This first being to create a more stable financial system and the second, to strengthen South Africa's approach to market conduct regulation. Through the twin peaks model, South Africa is aiming to improve consumer confidence thereby increasing employment, development and economic growth, ultimately creating a more sustainable financial sector.

Both the SARB and the FSB will base their regulatory framework on the same comprehensive set of principles however each of these regulators will place varying degrees of significance onto each principle.

This model differs significantly to the current financial regulatory framework in which the responsibility of prudential regulation and market conduct regulation is shared by both the South African Reserve Bank; the Financial Services Board as well as the National Credit Regulator and the National Consumer Commission.

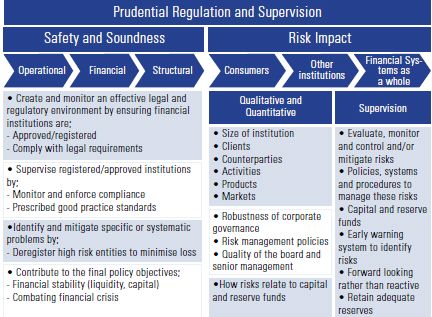

Prudential regulation and supervision

Under the Twin Peaks model, the prudential regulation and supervision will focus on the "big picture" applied to financial institutions such as banks, securities firms and insurance companies with the objective to maintain and enhance the safety and soundness of such financial institutions. This will ensure that they are financially sound and capable of meeting their obligations to customers. The prudential regulation in South Africa will be the responsibility of the South African Reserve Bank (SARB).

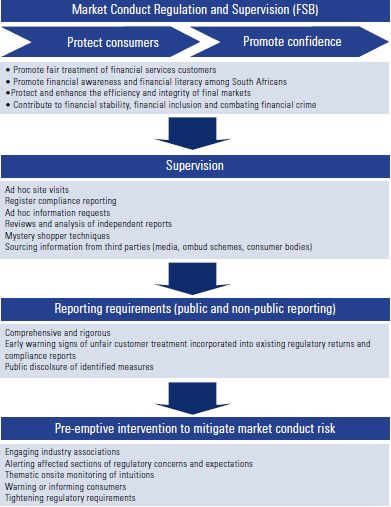

Market conduct regulation and supervision

Market conduct will focus on regulating and supervising the market conduct of banks, insurers, financial intermediaries, retirement funds and administrators, investment institutions and financial markets.

It will ensure consumers are not vulnerable or exploited and will complement the prudential regulation and supervision. The Financial Services Board (FSB) will take the responsibility for market conduct regulation in order to promote and maintain confidence in the South African financial system.

Conclusion

The enhanced "Twin Peaks" model which follows that of the UK is the first of many right steps in planning for the future which incorporates the new, amended and proposed regulations referred to earlier regulated by the FSB and SARB. The wave of new, proposed and amended acts will prevent institutions working in parallel and realigning their goals and objectives so as not to duplicate work effort but at the same time reach a common purpose.

In the medium term in order to implement future planning to prevent the next financial crisis, further costs are likely to be incurred but will be beneficial in the long term.

Politicians must recognise the role financial institutions play in economic growth, similarly financial institutions must deliver higher standards of governance, improved customer treatment, increased risk management and regulators being accountable for multiple reforms while there are many unfinished parts of current regulation.

Regulations need to be comprehensive and rigorous enough to ensure that the financial sector does not once again blemish its reputation. It is important to find a balance between cost and benefit, between those regulations necessary to make a safer financial system and ultimately an improved economy.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.