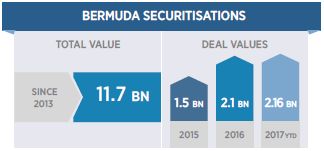

Welcome to the inaugural edition of Conyers' Bermuda Securitisations Bulletin.

Bermuda has long been established as one of the largest and most developed offshore jurisdictions for asset-backed securitisation ("ABS") transactions, most notably in the aircraft and aircraft engines sectors, but also significantly in respect of shipping container leases, insurance securitisations through catastrophe bonds or transformation transactions, and other asset classes. Historically, a great deal of aviation-based equity and debt has been raised through Bermuda and we have seen this trend expand in the last decade into a variety of other assets, making Bermuda the automatic choice for ABS deals with an offshore component.

This Bulletin features a recap of recent securitisation transactions involving Bermuda companies, as well as describing other market developments which we hope will be of interest to our legal colleagues, clients and Bermuda market followers.

BERMUDA SECURITISATIONS

In a typical Bermuda securitisation transaction, a special purpose vehicle ("SPV") is incorporated which is often owned by a Bermuda purpose trust. The SPV purchases an asset or assets which have some form of regular cash flow, and issues loan notes or preference shares to investors in the capital markets to finance the purchase. The repayment of principal and interest on the notes is then secured by the purchased asset(s) and the accompanying cash flow.

Aviation

Bermuda has been domicile to the most significant aircraft ABS transactions of the last decade, from GE Capital Aviation Services' 2011 launch of Rotor Engines Securitization Ltd., which marked the return of pooled aviation securitised sales after a four year hiatus, to award-winning deals such as 2013's AABS Limited, Castlelake's 2014 Aircraft Securitization Trust, Labrador Aviation Finance Limited in 2016 and Elix Aviation Capital's Prop 2017-1 Limited earlier this year.

- Advised Elix Aviation Capital ("Elix"), as servicer, and Prop 2017-1 Limited, as borrower, on Elix's US$411 million debut asset-backed securities deal, backed by a fleet of 63 aircraft on lease to 17 airlines with an initial total value of approximately US$545.1 million.

- Advised Labrador Aviation Finance Limited, on its US$928 million acquisition financing of 20 commercial passenger aircraft and related notes issuance and listing on the Irish Stock Exchange, backed by leases to 16 airlines in 15 countries. GE Capital Aviation Services Limited (GECAS) acts as the servicer for the transaction. This transaction was named the 2017 Editor's Deal of the Year at the 2017 Aviation 100 Global Leaders Awards, presented by Airline Economics, as well as Editor's Deal of the Year 2016 by AirFinance Journal.

- Advised CIT Group Inc. on its aircraft securitisation structure, CIT Aviation Finance III Limited, involving an issue of US$640 million in Class A-1 notes backed by payments on a portfolio of 28 aircraft.

- Advised Goldman Sachs, in connection with Aldus Aviation's ("Aldus") US$540 million asset-backed secured Term Loans for ATLAS 2014-1 Limited and ATLAS 2014-1 LLC, to fund the acquisition of 30 Embraer aircraft from Aldus and the secondary market.

- Advised Castlelake, L.P., as sponsor and servicer, and Castlelake Aircraft Securitization Trust 2016-1 (CLAS 2016-1), as borrower, in the funding of US$916 million in Class A, B and C asset-backed loans, backed by a fleet of 52 aircraft and one aircraft engine, leased to 20 lessees across 17 countries, with an initial total value of approximately US$1.2 billion. Conyers also advised Castlelake in connection with their prior 2015 US$713 million and 2014 US$515.6 million aircraft securitisations.

- Advised AABS Limited on its US$650 million leasing asset-backed securitisation secured against 26 narrow body aircraft including the entry into Series A and Series B loans backed by aircraft leases to airlines, acquired from affiliates of GECAS.

- Advised Turbine Engines Securitization Ltd. on a US$362.5 million asset-backed securitisation in respect of a pool of 32 aircraft engines. The transaction was backed by leases to 15 airlines in eight countries.

Shipping and Containers

In the shipping container lease sector, both of Marine Money's Securitization Deals of the Year for 2013 used structures domiciled in Bermuda: Global Container Assets' issuance of Fixed Rate Secured Container Equipment Notes; and Buss Capital's note offering, which was lauded as a "groundbreaking transaction" by Marine Money. In 2014, Textainer Group Holdings Limited, the world's largest lessor of intermodal containers, completed a US$1.2 billion warehouse securitisation facility through a Bermuda SPV.

- Advised Buss Capital on its US$280 million securitisation of a portfolio of no less than 200,000 containers. This transaction was named one of Marine Money's Securitization Deals of the Year 2013.

- Advised Global Container Assets 2013 in connection with its US$280 million note offering and previously in connection with its issuance of US$144 million Fixed Rate Secured Container Equipment Notes, Class A-1 and US$135.25 million Fixed Rate Secured Container Equipment Notes, Class A-2.

- Advised CAI International, Inc. (NYSE: CAP) ("CAI"), in connection with the issuance by CAL Funding II Limited (an indirect, wholly-owned subsidiary of CAI) of asset-backed notes totalling US$400 million.

- Advised Textainer Group Holdings Limited (NYSE: TGH), the world's largest lessor of intermodal containers based on fleet size, on its US$1.2 billion warehouse securitisation facility and the subsequent refinancing of the facility.

- Advised Alpha Bank, a leader in the Greek market, on an innovative securitisation raising in excess of US$500 million. The transaction, arranged and financed by Citibank, financed a portfolio of shipping loans.

- Advised CAI International, Inc. (NYSE: CAP) ("CAI"), in connection with the issuance by CAL Funding III Limited (an indirect, wholly-owned subsidiary of CAI) of asset-backed notes totalling US$253.07 million.

- Advised Textainer Group Holdings Limited (NYSE:TGH) in connection with the issuance of US$500 million of Fixed Rate Asset Backed Notes by its subsidiary Textainer Marine Containers V Limited.

Insurance

Bermuda is the principal offshore jurisdiction for a range of insurance-linked securities issuances, which use a Bermuda special purpose insurer as the issuer. The issuance of catastrophe bonds or similar insurance-related bond issuances are particularly common in Bermuda. Bellemeade Re Ltd. in 2015 was the first securitisation of mortgage insurance portfolio risks since the mid-2000s.

- Advised Bellemeade Re Ltd. on the completion of the first securitisation of mortgage insurance portfolio risks since the mid-2000s. Bellemeade Re Ltd. issued US$298.88 million Series 2015-1 Mortgage Insurance- Linked Notes, listed on the Bermuda Stock Exchange.

- Advised Oaktown Re Ltd. In connection with the completion of its first securitisation of mortgage insurance portfolio risks. It issued US$211.32 million Series 2017-1 Mortgage Insurance-Linked Notes comprised of US$98.61 million Class M-1 Series 2017-1 Mortgage Insurance-Linked Notes due 25 April 2027, US$98.61 million Class M-2 Series 2017-1 Mortgage Insurance-Linked Notes due 25 April 2027 and US$14.08 million Class B-1 Series 2017-1 Mortgage Insurance-Linked Notes due 25 April 2027.

- Advised Eden Re II Ltd. on its Munich Re sidecar issuance of US$75.57 million Series 2016-1 Class A Notes and US$284.42 million Series 2016-1 Class B Notes due 23 April 2016.

- Advised Pelican IV Re Ltd. on the launch of its Note Program pursuant to which it issued US$100 million Series 2017-1 Class A Principal At-Risk Variable Rate Notes due 5 May 2020.

- Advised Kilimanjaro Re Ltd. pursuant to its Note Program, Kilimanjaro Re Ltd. issued US$300 million Series 2015-1 Class D Principal At-Risk Variable Rate Notes due 6 December 2019 and US$325 million Series 2015-1 Class E Principal At-Risk Variable Rate Notes due 6 December 2019.

- Advised Sanders Re Ltd. on the issuance of Notes under its Principal At-Risk Variable Rate Note Program, including US$375 million Series 2017-1, Class A Principal At-Risk Variable Rate Notes. The issuance provided Allstate Insurance Company and certain affiliates with fully-collateralised reinsurance protection against covered exposures. The Notes are listed on the Bermuda Stock Exchange and are due 6 December 2021.

- Advised Akibare Re Ltd. on the launch of its Note Program pursuant to which it issued US$200 million Series 2016-1 Class A Principal At-Risk Variable Rate Notes due April 7 2020.

Structuring of a Bermuda Securitisation Transaction

SECURITISATION AND STRUCTURED FINANCE: THE BERMUDA MODEL

Although the asset classes are diverse, Bermuda securitisation structures are usually established with similar essential features and for similar reasons. By using a Bermuda SPV, funding and leasing arrangements may obtain certain tax, regulatory and capital restriction relief through a reliable and trusted jurisdiction. As a host jurisdiction for an ABS transaction, Bermuda offers tax neutrality ensuring there are no additional taxes in Bermuda that will impact the transaction. The involvement of a Bermuda SPV can act as a counterbalance to operator jurisdictions where such stability is less evident. Investors, lenders, rating agencies and various service providers are familiar with Bermuda's legal system and have demonstrated a continued commitment to participate in Bermuda structures with limited additional due diligence necessary on their part.

Bermuda securitisation structures accommodate the bankruptcy remoteness, true-sale, non-consolidation, off-balance sheet ownership, credit enhancement and certainty of security interest priority features common to most ABS transactions. However, there are additional benefits Bermuda confers. In lease transactions, for example, Bermuda law provides additional comfort to the lessees because, unlike the laws of many jurisdictions, which empower liquidators or their equivalent to disclaim unilaterally onerous property (such as a lease), Bermuda law only allows such a disclaimer with the leave of the Bermuda Supreme Court. This allows any interested party leasing the asset, the ability to be heard before such a step is taken.

|

Bermuda has been the venue for all of GECAS' securitisation

transactions since Rotor Engines Securitization Ltd., notably the

US$650 million Bulk Sale conducted through AABS Limited, which

scooped Airline Economics' Americas Deal of the Year

Award 2013 and Global Transport Finance's 2013

Aircraft Lessor Finance Deal of the Year, as well as Labrador

Aviation Finance Limited which won Air Finance

Journal's Editor's Deal of the Year and Airline

Economics Editor's deal of the Year for 2016. Issuers are able to list securities on the Bermuda Stock Exchange ("BSX"), which is not bound by, or subject to, any EU directives or regulations, including the EU Market Abuse Regime. The BSX is a member of the World Federation of Exchanges and was awarded Acquisition International's (AI) Excellence Award 2016 for Most Outstanding Offshore Stock Exchange. |

Many ABS transactions involve an SPV that is directly owned by a parent, but often a transaction will require an "orphan" SPV, meaning that it is not part of the originator's corporate group. By selling the asset to the orphan SPV, the asset is removed from the originator's balance sheet. When an orphan structure is established in Bermuda, the SPV is incorporated with all the shares issued to a trustee (also offshore) pursuant to a purpose trust. A Bermuda purpose trust is of particular benefit in an ABS transaction, structured in this manner, as the purposes of the trust and the duties of the trustees can be clearly linked to the contemplated transactions. In other jurisdictions a charitable trust is usually established where the duties of the trustees of the charitable trust are to maximise the benefits for the charity or charitable purposes and, depending on the circumstances, a conflict of interest may arise. Additionally, a charitable trust created primarily to facilitate a particular structure or transaction, so that the benefits to the charity are not maximised, may be exposed to a substance over form argument that the trustees are really acting in the interests and for the benefit of those who actually benefit from the structure rather than the stated beneficiaries.

Bermuda offers flexible structures that are ideally suited for today's innovative ABS transactions. In addition to an attractive infrastructure, Bermuda provides a statutory framework which facilitates structured finance transactions and benefits from an unrivalled reputation among investors, lenders, rating agencies and service providers. For these reasons Bermuda is the offshore jurisdiction of choice for ABS transactions.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.