2016 YEAR IN REVIEW

2016 was another dynamic year for Conyers' Bermuda corporate practice. We were fortunate to advise on the jurisdiction's most significant, and in many cases, headline-grabbing, transactions.

Our work is also evidence of Bermuda's continued ability to attract blue-chip clients who are more focused than ever on Bermuda's long and enviable track record as a well-regulated and reputable jurisdiction. These attributes are the foundation of the continuing trend of the migration of large corporate groups to the jurisdiction. The year was also marked by significant legislative change, with the introduction of Bermuda Limited Liability Companies, through the passing of the Limited Liability Company Act, 2016.

2016 By The Numbers

GENERAL CORPORATE OVERVIEW

There was increased activity throughout our Bermuda corporate practice last year. We continued to dominate the Bermuda public companies space acting as issuer's counsel on all of the Bermuda company IPOs on the NYSE. The market capitalization of Bermuda companies listed on the principal US exchanges is approaching US$250 billion. We have assisted a wide range of companies (including public companies, insurance companies and companies wishing to start-up operations on the ground in Bermuda) with their redomestications to Bermuda. The jurisdiction continues to maintain its position as one of the world's leading centres of insurance capital. Our insurance practice helped the jurisdiction achieve a record number of new ILS listings on the Bermuda Stock Exchange and also advised on all of the Class 4 insurance company launches (raising over US$1.2 billion in capital) in 2016. There were also significant legislative and structural developments involving our shipping and aircraft groups, as both the Department of Maritime Administration and the Bermuda Department of Civil Aviation were restructured to operate as quangos. There were more ship registrations on the Bermuda Ship Registry in 2016 than ever before. Our funds group also had an active year, which was highlighted by some key global players in the investment funds space domiciling new structures in Bermuda.

Practice Highlights

Capital Markets/Public Companies

Bermuda remains a premier jurisdiction for raising capital on the NYSE and Nasdaq. In 2016, approximately US$9 billion was raised on those exchanges by Bermuda companies – more than any other offshore jurisdiction.

Six new Bermuda companies were listed on the NYSE and Nasdaq last year. This included three IPOs: Butterfield, Myovant and Athene, and three migrations: TAL/Triton, Nordic American Offshore and XL Group plc.

Conyers has built and maintained Bermuda's leading capital markets practice. We continue to act as issuer's counsel on more Bermuda company IPOs on the principal US exchanges than all other Bermuda firms combined. Last year we acted in this capacity on all three IPOs completed, details of which are set out below.

BUTTERFIELD BANK COMPLETED IPO ON NYSE

We advised Bank of N.T. Butterfield & Son Limited on its US$287.5 million IPO on the NYSE. Butterfield is Bermuda's largest independent bank and a specialist provider of financial services.

This in-demand listing saw the underwriters exercise their option in full prior to closing and is a demonstration of investor confidence in Bermuda's public companies sector.

US$1.1 BILLION ATHENE HOLDING LTD. IPO

We advised Athene Holding Ltd. ("Athene") on its US$1.1 billion IPO on the NYSE, with its shares finishing more than 10% higher than its IPO price. The offering consisted of 27,000,000 shares that were sold by existing shareholders for US$40 each, which was the midpoint of the estimated IPO price range.

The offering valued the company at US$7.4 billion and was the third largest IPO in the US in 2016, according to Bloomberg.

Athene is a leading retirement services company that issues, reinsures and acquires retirement savings products for the growing number of individuals and institutions seeking to fund retirement needs.

MYOVANT SCIENCES - THE LARGEST NYSE BIOTECH IPO IN 2016

We also advised Myovant Sciences Ltd. on a highly successful underwritten IPO on the NYSE of 14,500,000 of its shares, for a total fundraising of US$218 million. Roivant Sciences Ltd., the parent company (who is also the parent company of Axovant Sciences Ltd. whose IPO we advised on in 2016), remains the majority shareholder. This was the biggest New York IPO in the biotechnology sector in 2016 and is the latest biotechnology IPO to use a Bermuda company as the listing vehicle.

Migrations to Bermuda

Another notable trend that we have observed in 2016 involves the choice of companies to migrate or concentrate in Bermuda. As can be seen from the representative transactions set out below, this trend manifested itself across a broad range of companies.

MARKIT COMPLETES US$13 BILLION MERGER WITH IHS

We provided advice to Markit Ltd. on its US$13 billion merger with IHS Inc.

Markit Ltd. became the holding company for the combined groups and was renamed IHS Markit Ltd. (Nasdaq: INFO). The merger creates a global leader in critical information, analytics and solutions for major industries and markets that drive economies worldwide.

The transaction featured a merger under Delaware law with IHS becoming a subsidiary of IHS Markit Ltd. Former IHS shareholders now own approximately 57% and former Markit shareholders own approximately 43%. The parties chose for the combined group to have a Bermuda holding company, which resulted in the largest capital markets transaction involving a Bermuda company in 2016.

SELLAS LIFE SCIENCES GROUP'S CONTINUANCE TO BERMUDA

In October, we advised SELLAS Life Sciences Group on the continuation of the company from Zug, Switzerland to Bermuda. SELLAS is a late-stage biopharmaceutical firm focused on the development of novel products that treat a variety of cancers, using the body's own defences. The company has a close working relationship with the Memorial Sloan-Kettering Cancer Center in New York to progress research and trials for treatment on various types of cancer. SELLAS chose Bermuda for its potential to attract biotech and 'big pharma' businesses, and for the jurisdiction's ability to facilitate a quick, streamlined process for the company to redomicile. Other reasons that were cited were Bermuda's close proximity to the US, Bermuda's strong legal system, political stability and infrastructure, as well as its quality workforce.

SAGICOR MOVES HOLDING COMPANY TO BERMUDA FROM BARBADOS

In July, Sagicor Financial moved its holding company to Bermuda from Barbados.

Sagicor Financial Corporation is a Caribbean-based multinational financial services firm which has been in operation for over 175 years. The company operates in 22 countries in the Caribbean, the US and Latin America, and is currently listed on the London Stock Exchange, Barbados Stock Exchange and Trinidad Stock Exchange.

The shareholders of the company approved the discontinuance of the company from Barbados to Bermuda. Taking into consideration Bermuda's historically strong and stable infrastructure and credit ratings, a continuance to Bermuda was deemed to be in the best interests of the company. It is expected that the company's continuance will provide the potential for an improved credit rating and better access to capital to fund future development, as well as other business opportunities.

Other significant transactions and legislative developments

ENDO'S US$1.2 BILLION DEBT LISTING – SECOND LARGEST EVER APPROVED BY THE BSX

We advised Endo International on the listing of its US$1.2 billion aggregate principal amount of 6% senior notes, due February 2025 on the Bermuda Stock Exchange ("BSX"). The listing is believed to be the second largest ever approved by the BSX.

Endo International is a global specialty pharmaceutical company that develops, manufactures, markets and distributes quality branded pharmaceutical and generic pharmaceutical products, as well as over-the-counter medications, through its operating companies. Endo International is headquartered in Dublin, Ireland with its US headquarters in Malvern, PA and had global sales of US$3.7 billion last year.

The BSX is the only offshore exchange to be a member of the World Federation of Exchanges which has, in recent years, helped Bermuda become a viable alternative to Luxembourg and Dublin as a listing jurisdiction. The BSX expects more listings of this type in 2017.

PACIFIC EXPLORATION & PRODUCTION CORPORATION'S RESTRUCTURING - THE LARGEST IN COLOMBIAN HISTORY

We advised on the restructuring of Pacific Exploration & Production Corporation ("Pacific Exploration"), which was the largest restructuring in Colombian history, involving bankruptcy proceedings in Colombia, Canada and the United States. Pacific Exploration is a Canadian oil and gas company with principal operations in Latin America. The transaction, completed in November, reduced Pacific Exploration's overall debt from US$5.4 billion to US$250 million.

CONYERS ADVISED ON BERMUDA LLC ACT AND THE FORMATION OF THE FIRST BERMUDA LLCs

Bermuda's Limited Liability Company Act, 2016 (the "Bermuda LLC Act") came into force on 1 October 2016 and provides for the formation and operation of limited liability companies ("LLCs"). A Bermuda LLC, like its Delaware counterpart, is a hybrid entity combining characteristics of a limited partnership and a corporation. The central provisions of the Bermuda LLC Act were closely modelled on the corresponding Delaware provisions, so that Bermuda LLCs will look, feel and operate much like Delaware LLCs.

Partners from Conyers' corporate group played a key role in the drafting of the Bermuda LLC Act. Following the introduction of the Bermuda LLC Act in October, Conyers has advised on the formation of a majority of Bermuda LLCs.

INSURANCE

Despite a relatively flat insurance and reinsurance market globally, 2016 remained an active year for the sector in Bermuda.

Regulations

One of the year's highlights was the confirmation of Bermuda's long-anticipated full equivalence under Solvency II, which, together with the Island's NAIC Qualified Jurisdiction status (confirmed in January 2015), cements its reputation as a regulatory leader. There has been a surge in interest from existing and start-up commercial insurers and insurance groups to form or expand substantive operations on the Island as a result of these regulatory endorsements. Last year, the Bermuda Monetary Authority registered 42 new insurance companies.

Commercial Insurers

On the commercial front, Conyers advised on the formation of the year's two new Class 4 insurers, Harrington Re and KaylaRe (see highlighted transactions). Together, these major reinsurance start-ups raised over US$1.2 billion in new capital. As referenced in our capital markets review, we also advised Athene on its recent IPO. The Athene transaction demonstrates the continued growth of the jurisdiction's long-term insurance market. This trend was further highlighted by the funding of Somerset Re with US$375 million of new capital.

Insurance-Linked Securities

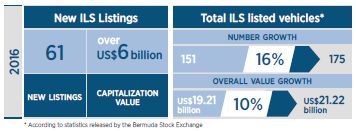

The Insurance-Linked Securities ("ILS") market continues to be active. 2016 saw a record number of new Bermuda ILS listings (61 in total), with a capitalization value of over US$6 billion. According to statistics released by the Bermuda Stock Exchange, the total number of ILS listed vehicles grew 16% from 151 to 175 and the overall value of these securities grew by 10% from US$19.21 billion to US$21.22 billion.

This continued expansion of interest in such structures from investors outside the "traditional" US and European markets, is evidence of the growing importance of ILS as a risk management tool and as a diversified asset class for investors. The fact that these structures continue to be formed in Bermuda is confirmation of the jurisdiction's dominance in this innovative insurance sector.

Captive Insurance

Bermuda's market foundation, captive insurance, also showed significant activity, with the formation of 13 new captive insurers. When viewed in light of the continued soft market for commercial insurance, this is particularly significant, as it demonstrates how the Bermuda market is capable of offering a comprehensive set of risk management solutions. Also significant is the fact that new captive formations derived, not only from Bermuda's traditional market in the US, but also from the emerging Latin American market.

Conyers advises on all Class 4 registrations in 2016HARRINGTON REConyers advised on the establishment and capitalization of Harrington Re Ltd. ("Harrington Re") and its parent company, Harrington Reinsurance Holdings Limited ("Harrington Holdings") and the registration of Harrington Re as a Class 4 insurer. Harrington Re, a multi-line Bermuda reinsurer, launched an initial capitalization of approximately US$600 million. The majority of funds were raised through the private placement of shares of Harrington Holdings, which totalled approximately US$550 million. KAYLARE We also advised on the establishment and capitalization of KaylaRe Ltd., a Bermuda-based, Class 4 reinsurer offering a diversified range of specialty reinsurance to the global insurance market. KaylaRe launched with initial capital of US$620 million, backed by a US$300 million investment from Enstar Group Limited; US$270 million from funds managed by Hillhouse Capital Management, Ltd., a leading global investment manager with over US$25 billion in assets under management and US$50 million from funds managed by Stone Point Capital LLC, a financial services-focused private equity firm with aggregate committed capital of approximately US$13 billion. |

TRANSPORTATION

Shipping

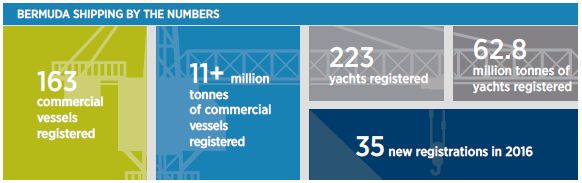

2016 was a watershed year for the Bermuda Ship Registry as the former Department of Maritime Administration changed its status and was renamed the Bermuda Shipping and Maritime Authority. It now operates as a quasi-autonomous non-governmental organisation or quango. The move to a quango has been in the works for many years and will provide a level of independence to Bermuda's ship registry and maritime authority. There were 35 new vessel registrations in 2016, (two more than the previous record of 33 set in 2015) the majority of which were handled by our shipping practice. Our shipping team also advised on the following ship finance transactions in 2016:

Highlighted Transactions

US$189 MILLION REFINANCING OF SEVEN CONCORDIA MARITIME P-MAX VESSELS

Conyers advised Svenska Handelsbanken AB (publ), in connection with a US$189 million refinancing of seven of Concordia Maritime's P-MAX vessels. The facility has a final maturity period of five years and can be used to finance up to 67.5% of the ships' fair market value. The transaction involved Conyers arranging for the discharge of existing security registered against the vessels and their owning companies, as well as registration of new security registered against such vessels and owning companies.

AVANCE GAS HOLDING LTD AMENDS US$450 MILLION AND US$200 MILLION FACILITIES

In October, we advised the agents in connection with an amendment to each of the US$450 million and US$200 million facilities for Avance Gas Holding Ltd. The amendment provides that, for a 2.5 year period, commencing on 1 January 2017, amortization payments on both facilities will be reduced by 50%, deferring a total of US$55 million of amortization payments over the period.

The agreement with the banks is conditional upon Avance Gas Holding Ltd raising a minimum of US$55 million of new equity.

| Conyers'

Norway Practice BW OFFSHORE LIMITED RESTRUCTURES TO IMPLEMENT NEW LONG-TERM FINANCIAL PLATFORM Our leading Norwegian ship finance and shipping capital markets practice continued to strengthen in 2016. This was evidenced by our advice to BW Offshore Limited (the "Company"), a Bermuda company listed on the Oslo Børs. We worked on a restructuring to implement a new long-term financial platform for the Company comprising:

|

Aviation

Bermuda's Aviation sector experienced interesting developments last year. The Bermuda Department of Civil Aviation became an independent quango and changed its name to the Bermuda Civil Aviation Authority. Our team was an integral part of Bermuda passing the domestic legislation necessary to enable the United Kingdom to extend the Cape Town Convention to Bermuda (anticipated to occur in the first half of 2017). In addition to the usual aircraft financings and registrations, we advised on special purpose structures, joint ventures and aircraft asset-backed securitizations.

AZERBAIJANI AIRLINE FINANCINGS

Throughout the year we advised on a number of transactions involving aircraft operated by Azerbaijani Airlines. We worked on two transactions that each terminated the bridge financing and lease and Ex-IM Bank financing of: two Boeing 747-83QF aircraft and one General Electric model GEnx-2B67 spare engine (February) and two Boeing 787-8 aircraft and one GEnx-1B spare engine (May).

AIRCASTLE COMPLETES JOINT VENTURE WITH IBJ LEASING COMPANY, LIMITED

In February, we advised Aircastle in connection with its aircraft leasing joint venture with IBJ Leasing Company, Limited, a Japanese general leasing company, which is part of Mizuho Financial Group.

The joint venture, to be serviced by Aircastle, will target investments in newer narrow-body aircraft, leased to premier airlines. It is expected the joint venture will purchase its first two aircraft from Aircastle and that future aircraft investments will be acquired directly. Aircastle will own 25% of the joint venture.

LABRADOR AVIATION FINANCE ISSUES US$709 MILLION ABS NOTES

We acted for the Issuer, Labrador Aviation Finance Limited, in relation to a pool of 20 passenger aircraft with a value of US$928 million and the issuance of US$709 million fixed-rate asset-backed notes in Series A and B, listed on the Irish Stock Exchange. GE Capital Aviation Services Limited acted as the servicer for the transaction in relation to a fleet of ten A320 family, seven B737-800, one A330-300, one A350-900 and one B777-300ER. The transaction featured a dynamic structure that facilitates acceleration of principal payments on the notes in specified circumstances and has the benefit of credit enhancement and liquidity. The transaction was backed by leases to 16 airlines in 15 countries and was Conyers' largest Bermuda asset-backed securitization transaction to close in 2016.

FUNDS

Bermuda's investment funds sector experienced several new developments that continued to promote the jurisdiction as a key market for asset management.

Key Global Players Choose Bermuda

From a client perspective, 2016 saw Bermuda's efforts to reinvigorate its asset management industry yield significant results, as a number of large global players in the investment funds space determined to domicile their new structures in Bermuda. The "Class A Exempt Fund" regime, with its speed-to-market and same-day regulatory approval, proved highly attractive and for some investment groups was the determining factor in domiciling their new investment funds to the jurisdiction. Also attractive is the flexibility of Bermuda's Segregated Accounts Companies Act, which permits one or more classes of shares to effectively invest in other classes of the same Company with the result that a "Master Feeder" structure can be achieved in a single legal entity with significant cost savings. In addition, the introduction of LLC legislation in Bermuda was also welcomed, as it provides asset managers with a simple and effective structure to organise their Bermuda-domiciled asset management operations.

Highlighted Transactions

SCHRODER INVESTMENT MANAGEMENT NORTH AMERICAN INC.

We assisted Schroder Investment Management North America Inc. ("SIMNA") in the establishment of a "Class A Exempt Fund", domiciled in Bermuda. The fund will follow a relative value government bond investment strategy. SIMNA is part of the larger Schroder Group with a history spanning over 200 years and which operates from 37 offices in 27 countries. It currently manages US$487 billion on behalf of institutional and retail investors, financial institutions and high net worth clients from around the world.

ILS ORION FUND LTD.

We also acted on the structuring and launch of ILS Orion Fund Ltd., an investment fund domiciled in Bermuda and established as a "Class A Exempt Fund". The fund is managed by Pioneer Investment Management, Inc. ("Pioneer") and will invest primarily in insurance-linked securities. Pioneer is an indirect, wholly-owned subsidiary of UniCredit S.p.A, one of the leading banking groups in Italy. As of December 2015, assets under management by Pioneer and its affiliates were approximately US$243 billion, including over US$67 billion in assets managed by Pioneer itself. Pioneer is registered with the US Securities and Exchange Commission.

Other Notable Corporate Transactions

MARCH 2016

Conyers advised on Aircastle's increase in its US$675 million Bank Revolving Credit Facility

Conyers advised Aircastle on US$500 million 5.00% senior notes offering

Conyers advised Akibare Re Ltd. on its US$200 million notes offering

Conyers advised Manatee Re Ltd. on its US$95 million notes offering

APRIL 2016

Conyers advised Aircastle Limited in connection with its US$120 million unsecured term loan

JUNE 2016

Conyers advised Bracell Limited in connection with its proposed privatization

Conyers advised Maiden Holdings, Ltd. on its issue of US$110 million in notes

JULY 2016

Conyers advised Tengizchevroil Finance Company International Ltd on its US$1 billion issuance of senior secured bonds

Conyers advised Bacardi on US$500 million notes offering

OCTOBER 2016

Conyers advised Castlelake, L.P., as sponsor and servicer, and Castlelake Aircraft Securitization Trust 2016-1 (CLAS 2016-1), as borrower, on the Bermuda law aspects in the funding of US$916 million in Class A, B and C asset-backed loans

NOVEMBER 2016

Conyers advised Sirius International Group Ltd. on its issuance of US$400 million 4.6% senior notes

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.