OTHER TAX CHANGES FOR BUSINESSES AND INDIVIDUALS

Enhanced Tax Deduction for Donations

Current

Donors are eligible for a 250% tax deduction for qualifying donations made to Institutions of a Public Character ("IPCs") and other qualifying recipients (such as approved museums, prescribed educational institutions) from 1 January 2009 to 31 December 2015.

Proposed

The tax deduction rate for qualifying donations made to IPCs and other qualifying recipients in 2015 will be increased from the current 250% to 300%.

The tax deduction will revert to 250% for qualifying donations made from 1 January 2016 to 31 December 2018 to IPCs and other qualifying recipients.

Tax Concession on Royalties and Other Payments from Approved Intellectual Property or Innovation under Section 10(16) of Income Tax Act

Current

Section 10(16) of the Income Tax Act provides a tax concession to:

- An individual who is the inventor, author, proprietor, designer or creator of an approved intellectual property or innovation; or

- Any company in which such an individual beneficially owns all the issued shares.

The income derived by such an individual or company from royalties or other payments received as consideration for the assignment of or the rights in the approved intellectual property or innovation shall be deemed to be:

- the amount of royalties or other payments remaining after deductions and capital allowances (if any); or

- an amount equal to 10% of the gross amount of royalties or other payments, whichever is less.

Proposed

The Section 10(16) concession will be withdrawn from YA 2017.

GOODS AND SERVICES TAX ("GST")

Extending and Enhancing the GST Remission for Listed REITs, and Listed Registered Business Trusts ("RBTs") in the Infrastructure Business, Ship Leasing and Aircraft Leasing Sectors

Current

GST remission is granted to listed REITs, and listed RBTs in the infrastructure business, ship leasing and aircraft leasing sectors, to allow them to claim GST on their business expenses regardless of whether they hold underlying assets directly or indirectly through multi-tiered structures such as special purpose vehicles ("SPVs") or sub-trusts. The GST remission is scheduled to lapse after 31 March 2015.

REITs and RBTs qualifying under the GST remission are however not allowed to claim GST on costs to set up SPVs that do not hold qualifying assets of the REITs or RBTs, directly or indirectly. The GST on the business expenses of such SPVs is also not claimable. Qualifying assets are assets that are used to make taxable supplies or out-of-scope supplies that would have been taxable supplies if made in Singapore.

Proposed

The existing GST remission will be extended till 31 March 2020. In addition, REITs and RBTs qualifying under the current GST remission will be allowed to claim GST on business expenses incurred to set up SPVs that are used solely to raise funds for the REITs or RBTs, and which do not hold qualifying assets of the REITs or RBTs, directly or indirectly. These REITs and RBTs will also be allowed to claim GST on the business expenses of such SPVs. The enhancement to the GST remission will take effect for GST incurred from 1 April 2015 to 31 March 2020.

IRAS will release further details by March 2015.

Simplifying Pre-registration GST Claim Rules for GST-registered Businesses

Current

Generally, GST-registered businesses can only claim pre-registration GST on the portion of goods and services used or to be used to make taxable supplies after GST registration.

Where goods and services are used to make supplies straddling GST registration (i.e. supplies before and after GST registration), or where goods are partially consumed before GST registration, businesses are required to apportion the pre-registration GST on these goods and services and can only claim the portion attributable to taxable supplies made after GST registration.

Proposed

A newly GST-registered business will be allowed to claim pre-registration GST in full on the following goods and services that are acquired within six months before the GST registration date of the business:

- Goods held by the business at the point of GST registration; and

- Property rental, utilities and services, which are not directly attributable to any supply made by the business before GST registration.

This is provided the use of these goods and services after GST registration is for the making of taxable supplies and not exempt supplies. For other purchases of goods and services prior to GST registration, including those acquired more than six months before the GST registration date of the business, existing pre-registration GST claim rules will apply.

This will take effect for businesses that are GST-registered from 1 July 2015. IRAS will release further details of the change by June 2015.

WAGE CREDIT SCHEME

Extension of the Wage Credit Scheme ("WCS")

The WCS will be extended for 2016 and 2017, with the Government co-funding at 20% of the wage increases given to Singaporean employees earning a gross monthly wage of $4,000 and below.

This co-funding will apply to wage increases given in 2016 and 2017, over the employee's wage level in the preceding year. In addition, if wage increases given in 2015 are sustained in 2016 and 2017, employers will continue to receive co-funding, at the new rate of 20%. Employers do not need to apply for Wage Credit. They will receive their yearly payout automatically, at the end of March 2015, 2016, 2017 and 2018.

The table below shows a summary of the changes to the WCS under the extension:

CENTRAL PROVIDENT FUND

Changes to Central Provident Funds ("CPF")

- Higher CPF Salary

Ceiling

The CPF salary ceiling will be raised from $5,000 to $6,000 for all age groups and will take effect from 1 January 2016. The existing limits on tax reliefs for CPF will be raised accordingly. - Raising CPF Contribution

Rates for Older Workers

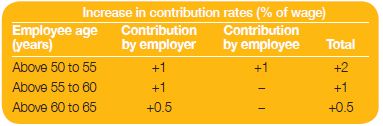

The CPF contribution rates for workers aged above 50 to 65 years will be increased from 1 January 2016 as shown below.

The increase in employer contribution rates will go to the Special Account. The increase in employee contribution rates will go to the Ordinary Account. The existing limits on tax deduction for employers' statutory CPF contributions and tax relief for employees' CPF contributions will be raised accordingly.

EMPLOYMENT CREDIT

Extension and Enhancement of the Temporary Employment Credit ("TEC")

The TEC will be enhanced by:

- increasing the TEC to 1% of wages in 2015 (an extra 0.5% in addition to the original TEC)

- extending the TEC by two years in order to help employers adjust to cost increases associated with the increase in the CPF Salary Ceiling and the CPF contribution rates for older employees. The changes will take effect in January 2016. There will be an additional TEC of 1% of wages in 2016 and 0.5% of wages in 2017.

Employers of workers earning above the CPF ceiling will receive TEC that corresponds to the CPF contributions payable at the CPF salary ceiling.

Enhancement of the Special Employment Credit ("SEC")

To promote voluntary re-employment of older Singaporean workers, the Government is providing employers with an additional SEC of up to 3% of wages for workers aged 65 and above in 2015. This is on top of the 8.5% wage offset that employers will receive in 2015.

For employers who hire such Singaporean employees, the SEC payout will be 11.5% of wages for salaries up to $3,000 per month and for employees with salaries between $3,000 and $4,000, the SEC payout will reduce linearly from 11.5% of wages (or $345) to $0. This means that the maximum SEC an employer can receive per month for a Singaporean employee aged 65 and above is $345.

The SEC will be paid in September 2015 for work done from January to June 2015 and March 2016 for work done from July to December 2015.

The table below provides the monthly SEC amounts for wages paid in 2015 for employers who hire Singaporeans aged 65 years and above.

VEHICLE/ROAD TAX

Refining the Carbon Emissions-based Vehicle Scheme ("CEVS")

Current

The current CEVS will expire on 30 June 2015.

Proposed

The CEVS will be extended by two years, from 1 July 2015 to 30 June 2017, with two refinements:

- Update the surcharge and rebate bands to reflect improvements in vehicle engine technology; and

- Increase the highest rebate and surcharge and surcharge quantum from $20,000 to $30,000.

Updating Petrol Duty Rates

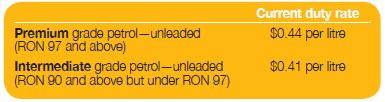

Current

The current petrol duty rates introduced in 2003 are:

Proposed

The petrol duty rates will be updated as follows:

Providing a One-Year Road Tax Rebate for Petrol Vehicles

Current

Road tax payable is based on the engine capacities for cars and motorcycles and based on maximum laden weight for commercial vehicles. Road tax for taxis is $1,050 per year.

Proposed

A one-year road tax rebate will be provided for petrol vehicles:

- 20% for petrol cars;

- 60% for petrol motorcycles; and

- 100% for petrol commercial vehicles and taxis.

The rebate will be effective from 1 August 2015 to 31 July 2016.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.