At a glance:

2023 budget - no major reforms

- Clarification of the reverse hybrid rules

- Deadline for filing tax returns extended to 31 December

- Increased flexibility for the "profit-sharing bonus" regime

- Minimum salary for eligibility for the inpatriate regime reduced

- Clarification of, and new exclusion in, the so-called Luxembourg "RELIBI Law"

- Tax credit for individuals (single parents and minimum wage earners)

- Real estate measures

- VAT measures for energy transition

Housing supply reform - existng tax revised and two new taxes levied to tackle real estate speculation

- The revised real estate tax

- The new unbuilt land tax

- The new unoccupied residential real estate tax

Temporary vat rate cuts - 1% reduction of certain vat rates during the 2023 financial year

2023 budget

The Luxembourg government has filed the bill for the 2023 budget (the "Budget Bill"). As expected, the Budget Bill contains no major tax reforms due to the current economic situation. The proposed tax measures only comprise certain tax reductions and clarifications.

Source: Bill no. 8080_ (Part I) filed on 12 October 2022 with the Luxembourg Parliament.

The main tax measures in the Budget Bill are the following:

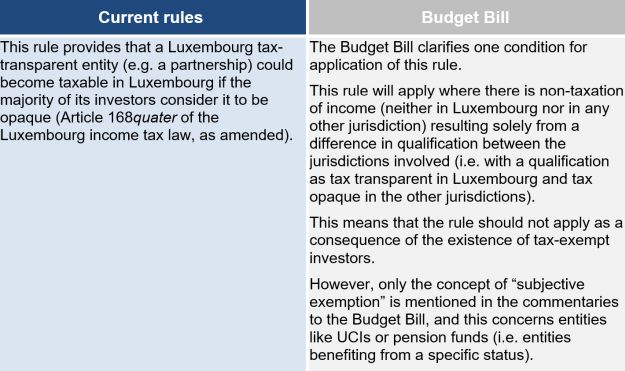

1. Reverse hybrid rules

If adopted, this clarification could already apply to the 2022 tax year.

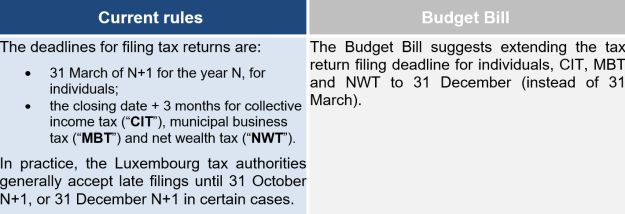

2. Deadline for filing tax returns extended

If adopted, this measure would be applicable from the 2022 tax year for individuals, CIT and MBT, and from the 2023 tax year for NWT.

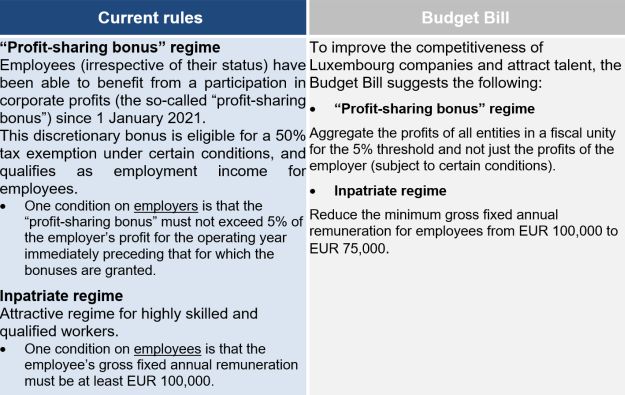

3. More flexibility for the "profit-sharing bonus" regime and the inpatriate regime

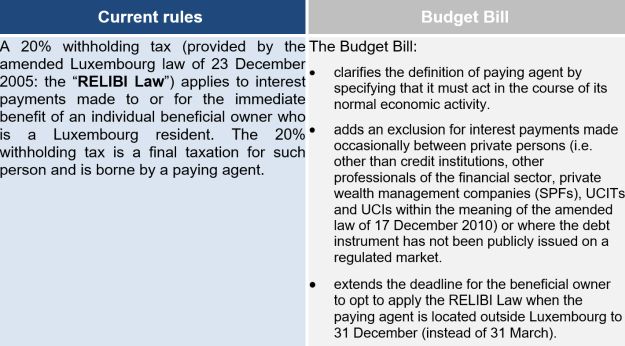

4. The Luxembourg RELIBI Law

Next steps

The Budget Bill will now follow the normal legislative process through Parliament and is expected to be approved before the end of December. The Budget Bill should enter into force on 1 January 2023 (with applicability from the 2022 tax year for certain clarifications).

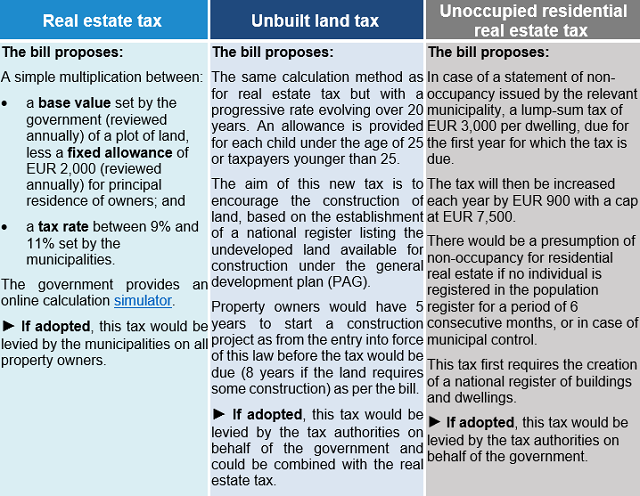

Luxembourg's real estate tax rules

The Luxembourg government also filed a bill revising the calculation of the existing real estate tax. In addition, the bill creates two new taxes: one on unbuilt land and one on unoccupied residential real estate.

Access to the online calculation simulator provided by the government here_

Source: Bill no. 8082_ filed on 10 October 2022 with the Luxembourg Parliament.

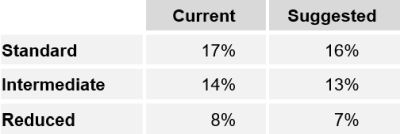

Temporary VAT rate cuts

The government also filed a draft bill proposing a 1% reduction of certain VAT for the period from 1 January 2023 to 31 December 2023.

This bill is part of the government's package of measures to mitigate the effects of energy and consumer prices on households and businesses.

Source: Bill no. 8083_ filed on 12 October 2022 with the Luxembourg Parliament.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.