Since our first ESG assignment, well over 10 years ago, a lot has changed. One constant, however, is the opening statement of prospective clients. "What we don't want, is a box-ticking exercise; we want to see ESG as a value driver. Can you give us examples of where ESG really created value?"

Of course we can!

In the thousands of company scans we conducted over the past years, we have found many ESG related risks and opportunities that belong at the top of the agendas of senior management, and we have helped our clients create value from these findings by reducing risks, reaping cost saving potential, or rethinking propositions and business models.

But value creation is not the only driver of ESG. By creating monetary value, an entrepreneur can turn a public need into a solution. This public need is what drives ESG.

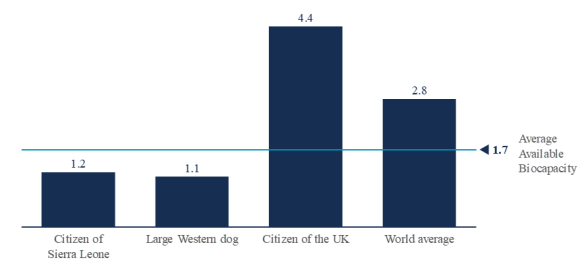

So, what is that need? There is relatively broad consensus that the way we live, produce and consume supersedes the carrying capacity of the Earth. Also, the Earth's resources are not distributed evenly. The Global Footprint Network, for example, estimates that the global land capacity available per citizen is 1.7 hectares. An American citizen on average uses 8.1 hectares, a British 4.4, and a citizen from Sierra Leone 1.2, which is comparable to a Labradoodle in Chelsea.

Figure 1: Average Ecological Footprint, 2019 (global hectares per capita)

Source: Global Footprint Network

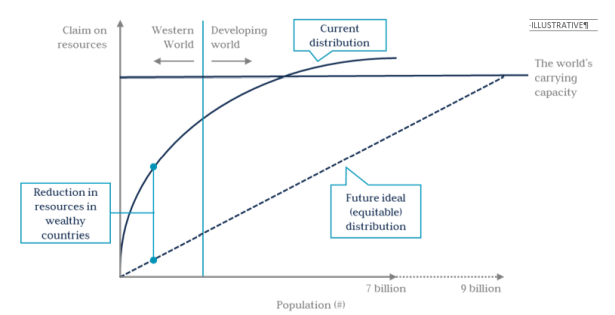

What we are seeing, is a system under stress, but the challenge is bigger than just reducing this stress. Let's take greenhouse gas emissions as an example. Reducing them already is an enormous challenge. Despite all the activism in the form of carbon markets, investments in renewables, divestments from fossil fuels, governmental policies, subsidies and consumer awareness, global emissions are still on the rise. In wealthy countries, emissions per capita are well above the global average (hence the concave shape of the curve in figure 2, below), moreover, cumulative emissions are well above the Earth's carrying capacity. The global population is set to grow from 7 to 9 billion people by 2040, and this growth will happen primarily in South-East Asia, Africa and South America, where the wealth (and thus the consumption) of the medium income groups is also expected to rise quickly. Today, these groups consume a disproportionally small part of the global resource pie (and related emissions), but their appetite will rise faster than in the Western hemisphere. What does this mean for an average investment in Europe?

No one knows of course, but we observe in our daily practice that for (Western) investors it can be a sobering exercise to calculate what the combination of factors mentioned above may have in store for them. It may very well be that Western demand for certain resources will have to be cut by 60-80% in about 20 years.

Figure 2: Current vs. equitable distribution of resources

Source: MJ Hudson Spring

We are seeing this already. The closure of coal-fired power stations, the ban on single-use plastics, the potential replacement of concrete and steel in building applications with wood, are just a few examples. Businesses such as oil & gas and mining companies are afraid of losing their licence to grow. The public does not want to touch businesses that put excessive strain on the planet and people, and they are increasingly demanding more action.

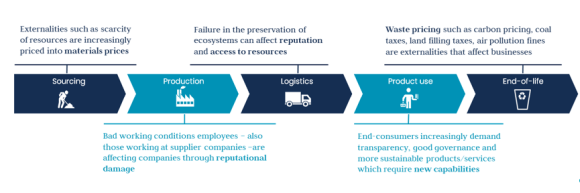

The question is, how this systemic long-term reality will hit your investments. How will certain things that we used to label as 'externalities' (such as scarcity of a particular resource), become internalised over time?

FIGURE 3: example externalities in the value chain that could affect business

Source: MJ Hudson Spring

In Europe, a lot of new legislation is under way. For instance, the national climate action plans that result from the Paris agreement will have to find their way into national laws. Also, the current discussions on sustainability taxonomy or on circularity can be expected to become part of legislation.

Some legislation that already exists, has not yet been fully absorbed. We often see business practices that are not in line with General Data Protection Regulation (GDPR) standards, and the market still seems to be in learning mode. The implementation of the Energy Efficiency Directive (EED) is another example where the market needs to catch up with swift legislative measures, which are requiring companies to improve energy efficiency by 32.5% by 2030.

So, good ESG means anticipating new legislation really well. Often it happens that mid-market companies are surprised by the speed of change, even on issues that have been around for decades. Take for example the Dutch agriculture sector protests over legislation limiting nitrogen emissions, or the U-turn the Spanish government took on the solar power tariff deficit.

But there is more than legislation. Public trends may be embraced by powerful institutions. For example, the gender diversity discussion: some countries have formally agreed upon hard targets, but even when they don't, the pressure to broaden the composition of teams is unescapable. And let's not forget consumer demand:

- 40% of Europeans and Americans say their next car will likely be electric

- 90% of Europeans want government to enforce renewable energy

- 14% of the British observe a vegetarian or vegan diet

- 42% of consumers will step away from brands that do not align with their beliefs

Sources: Ipsos Mori, European Commission, Huffington post, Accenture

In short, the context for every business is changing. Societal challenges are substantial, and the progress businesses have made so far (for instance with carbon emissions) is limited. The game has only just begun.

The challenge to the planet is an entrepreneurial goldmine, but entrepreneurs and investors will have to anticipate and respond to that challenge. They are expected to use a combination of innovation and entrepreneurship to satisfy society's new demands. Several companies have already succeeded in doing so. Take Tesla which has successfully anticipated the need for electric vehicles; the modular, glue-free tiles from Interface and the Cradle to Cradle carpet from DESSO, that ride the current trend in circularity.

So, although value creation is extremely important, understanding and accepting the nature of the challenge is a prerequisite.

In a different paper we will share how fund managers can pick the right investments, but also how they can assist their portfolio companies in making a change.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.