In this update, we discuss the new regulation issued by the Ministry of Energy and Mineral Resources on the use of renewable energy for electricity supply and whether it fulfils the expectation of independent power producers.

The Indonesian government has once again promised to boost the proliferation of renewable energy industry in Indonesia by enacting the Ministry of Energy and Mineral Resources Regulation ("MEMR") No. 4 of 2020 on Use of Renewable Energy for Electricity Supply ("New Regulation"). The New Regulation amends MEMR Regulation No. 50 of 2017 as amended by MEMR Regulation No. 53 of 2018 ("Previous Regulation"), which was viewed by many as inadequate.

Status Quo

Contrary to the expectation of many independent power producers ("IPP") and rumours that the Government will re-introduce the feed-in tariff scheme for renewable energy, the New Regulation still benchmark the pricing of renewable energy against PT Perusahaan Listrik Negara's ("PLN") average electricity generation basic cost (biaya pokok penyediaan or "Generating BPP"). Benchmarking the electricity tariffs to the Generating BPPs is seen as a major hurdle in attracting investors' appetite in developing renewable power generation projects as Indonesia's low Generating BPP is derived from Indonesia's reliance on coal-fired power plants.

In other words, the pricing of renewable energy must compete against fossil fuel-based electricity generating plant, which price is even depressed on a global scale.

What's Changed?

- Unlike the Previous Regulation, the New Regulation provided more clarity to the procurement process for renewable energy by PLN by way of direct selection or direct appointment depending on the type of renewable energy. The direct selection process, involves the selection of invited IPPs, must be concluded within 180 days. Whereas direct appointment involves the appointment of one specific IPP and must be concluded within 90 days.

- PLN must now operate all renewable power plants continuously or on a must-run basis. Previously, PLN's obligation to continuously operate renewable power plants is only applicable for renewable power plant that have capacity of less than 10MW. It is likely that this obligation would not apply to renewable energy plant that is intermittent in nature (e.g. solar photovoltaic).

- Under the Previous Regulation, PLN may purchase electricity from renewable energy only if the price contributes to the general reduction of the local Generating BPP. Under the New Regulation, this is no longer the case.

- The New Regulation replaces the

build, own, operate and transfer

("BOOT") scheme for renewable

energy-based electricity with a build, own and operate

("BOO") scheme. PLN by default must

therefore adopt this BOO scheme whereby an IPP will own all project

assets and does not have to transfer such project to PLN at the end

of the term. The New Regulation even provides the ability of

renewable energy project that has entered into a power purchase

agreement with PLN under the BOOT scheme to be converted into BOO.

However, due to the lack of imperative provisions or process under

the New Regulation, it is safe to assume that the conversion of

existing PPA to BOO will be subject to negotiation with PLN.

This replacement supposed to be a relief and addressed the bankability concern of certain renewable energy producers such as biomass or biofuel-based power generation plants, which are mostly developed in integration of a large plantation complex. However, a power purchase agreement ("PPA") between the IPP and PLN can only be valid for a maximum of 30 years. Thus, this new development would only be beneficial for the IPPs if the New Regulation also accommodates the possibility for the IPPs to sell electricity directly to the consumers.

- For hydro power plant (which utilises multi-purpose dam or irrigation system) and municipal waste power plant, the Government may direct PLN to purchase the electricity from such sources, albeit the pricing remains subject to PLN's agreement and also the Generating BPP.

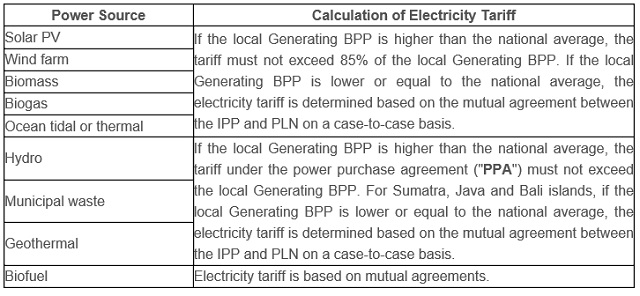

The electricity tariffs for renewable power generation projects under the Previous Regulation, which has not changed by the New Regulation are as follows:

Conclusion

Despite hopes that the New Regulation will finally give the push demanded by the renewable energy industry, it seems that now is still not the time for the renewable energy industry to take centre stage. Within the context of promoting renewable power generation projects in Indonesia, it seems that the New Regulation is still not enough to attract investors considering that it fails to address the main concern of many IPPs on electricity tariffs. Coupled with the plummeting price of fossil fuels (oil, gas, and coals), the government would need to do more to promote renewable power generation projects in Indonesia and to achieve the 23% renewable energy mix by 2025.

But there are news that the Government is also in the process of preparing a new regulation on tariff, which we hope would finally be the push needed for the renewable energy industry.

Originally published 28 April, 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.