Unlike other alternatives to fossil fuels, solar power is a type of renewable energy that is encouraged by the Government.

The development of alternative sources of energy first began with the National Master Plan for Power Development in 2011 when the Prime Minister issued Decision 1208/QD-TTg. With the implementation of Decision 11, solar energy has gradually become a priority among power sources.

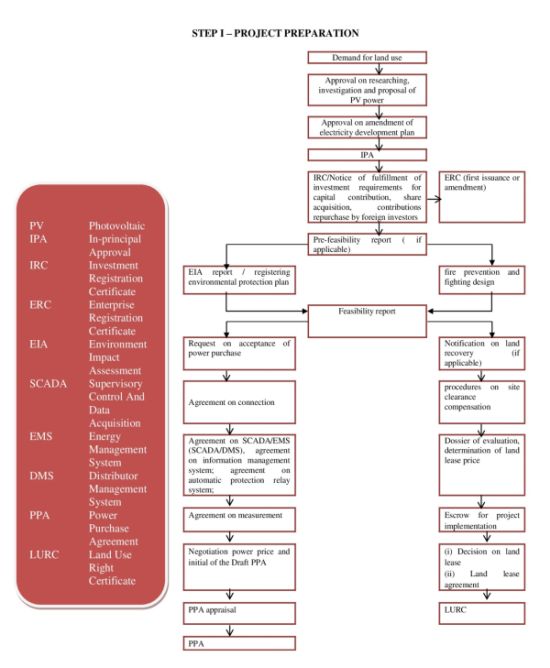

Decision 11 provides regulations for solar power projects, including rooftop projects and grid-connected projects. Rooftop projects are solar power projects that have their solar panels mounted on the rooftop or integrated into the construction of a building. Rooftop projects are connected directly to the buyer's power grid. Grid-connected projects are those solar power projects, other than rooftop projects, connected to either the national power grid or the buyer's power grid. Under Decision 11, only grid-connected projects must conform to the National Development Plan for Solar Power or to the Provincial Development Plan for Solar Power. The Ministry of Industry and Trade (the "MOIT") develops the National Development Plan, and the Prime Minister approves it. On the other hand, the provincial-level People's Committee establishes the Provincial Solar Power Development Plan, and the MOIT approves it. This is one of the first steps to prepare and implement a Solar Power project. The detailed procedure is described in a flowchart presented at the end of this article.

Decision 11 provides an important incentive to encourage the development of solar power projects. Decision 11 mandates that Vietnam Electricity (EVN) and its authorized subsidiaries must buy all the electricity produced by every Vietnamese solar power project. Furthermore, Decision 11 also puts forth some important provisions regarding the price of electricity. Decision 11 fixes the purchasing price at US$ 00.0935/kWh, equivalent to VND 2.086/kWh for grid-connected projects. This price was set according to the exchange rate between VND and USD announced by the State Bank of Vietnam on the 10th of April 2017. The MOIT will determine the price to sell electricity for each power purchase agreement based on the present exchange rate. With respect to rooftop projects, projects must be implemented using net-metering with two-way electricity meters. In a trading cycle, if the amount of electricity generated from rooftop projects is greater than the consumed amount, the surplus will be carried forward to the next trading cycle. Every year, the MOIT will announce prices for electricity produced by rooftop solar power for the following year based on the exchange rate on the last day of the year.

According to Decision 2256/QD-BCT (dated 12 March 2015) of the MOIT, EVN's average electricity selling price was US$ 00.0714/kWh, equivalent to VND 1.622/kWh. Therefore, the price provided by Decision 11 is significantly higher.

In addition, Decision 11 also states that the MOIT will provide a template for power purchasing agreements. Those agreements will be limited to twenty years, but could be extended.

Other incentives to be clarified

Decision 11 also encourages the development of solar power projects by providing attractive incentives. Those incentives are related to: capital mobilization; import duties; the corporate income tax ("CIT"); and land acquisition and rent. However, most of these incentives are too general and should be clarified. This lack of clarity can be seen when examining each incentive individually.

First, regarding capital mobilization, Decision 11 merely states that organizations and individuals involved in the development of solar power projects may raise domestic and foreign capital to carry out solar power projects in accordance with effective law.

Second, regarding import duties, Decision 11 provides that with respect to goods imported as fixed assets, solar power projects are exempted from import duties. Besides that, with respect to other materials, components, and semi-finished products that cannot be manufactured domestically, the import duty incentives for solar power projects must be determined in accordance with the present provisions in the Law on Import and Export Duties.

Third, regarding CIT, Decision 11 provides that the CIT exemptions and reductions granted to solar power projects shall be the same as those granted to projects eligible for investment incentives in accordance with effective regulations.

Fourth, regarding land incentives, grid-connected solar power projects, transmission lines, and substations shall be eligible for exemptions from, or reductions on, land levies, land rents, and water surface rents. Those exemptions or reductions shall be in accordance with current regulations on investment incentives. Depending on plans approved by the competent authorities, the People's Committees of the provinces shall facilitate land arrangements for investors to execute solar power projects. Provision of compensation and site clearance shall be carried out in accordance with effective land regulations.

Therefore, because most of Decision 11's incentives refer to other laws and specific incentives are not mentioned, the above-mentioned solar power project incentives remain unclear.

In addition, Decision 11 produces a conflict in the use of terms used by previous laws and regulations dealing with investment incentives. In fact, while Decision 2068/QD-TTg approving the development strategy of renewable energy stated that renewable energy includes solar energy, and Decree 118/2015/ND-CP on Guidelines for some articles of the Law on Investment ("Decree 118") classifies solar power projects as a business line eligible for special investment incentives (rather than a business line eligible for investment incentives), Decision 11 considers solar energy projects as a business line eligible only for investment incentives. Thus, Decision 11 may limit the chances for solar energy projects to benefit from the incentives applied to business lines eligible for special investment incentives. For example, under Decree 118, if the solar power project is treated as a business line eligible for investment incentives, the investor is entitled to only a 25% reduction of the security deposit required for project implementation. However, if the solar power project is treated as a business line eligible for special investment incentives, the investor may be entitled to a 50% reduction of the security deposit required for project implementation.

The MOIT has drafted a circular related to the development of solar power projects. However, the draft circular does not clarify the incentives, including investment incentives.

Conclusion

Decision 11 is an innovative move by the Vietnamese Government to help it meet its international obligations under the 2015 United Nations Climate Change Conference. Vietnam's issuance of this decision demonstrates Vietnam's intention to develop its economy without compromising environmental protection. However, while Decision 11 is a big step in the right direction, some of its important provisions, especially regarding investment incentives, need to be further clarified (or even modified) in order to remove any sources of confusion or disincentives. Otherwise, Decision 11 might only be a symbolic gesture without real effect.

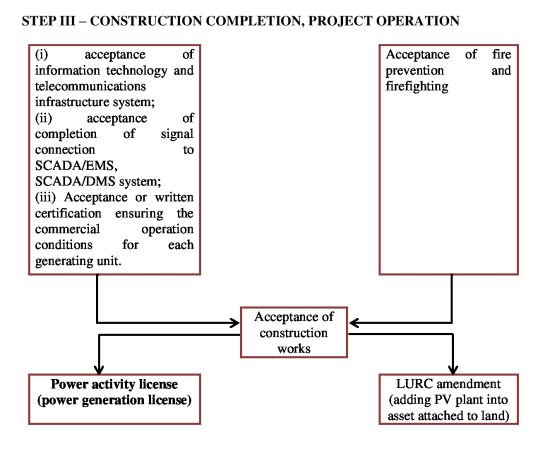

Process flowchart for the implementation of a solar power project

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.