On 9 March and together with its long-promised amendment to the General Block Exemption Regulation ('GBER') the European Commission (EC) also endorsed its new Crisis Framework aimed at speeding up investment and financing for clean or green tech production in Europe.

The new Temporary Crisis and Transition Framework (TCTF) aims to foster support measures in sectors which are deemed key for the transition to a net-zero economy, in line with its recently adopted Green Deal Industrial Plan (GDIP). This is essentially a key plank in Europe's response to the USA's Inflation Reduction Act. The TCTF extends the possibility for Member States to support measures needed for the transition towards a net-zero industry. It aims to make schemes to support renewable energy, energy storage and decarbonisation of industrial production processes easier to design and to be more effective. Where there is a real risk of investments being diverted away from Europe, Member States may provide the amount of support the beneficiary could receive for an equivalent investment in that alternative location ('matching aid'). The new 'GBER' retains the three overarching objectives as its predecessors: reduction of the number and administrative cost of ex ante notifications of planned aid to the EC, simplification of the implementation procedures for state aid measures and increased legal certainty. Notification thresholds have been raised for many types of aid, but can the new GBER really serve the urgent goals of the new GDIP?

I. THE GBER

Although the amendments to the new - 110 page long - General Block Exemption Regulation are extensive, the focus is essentially on three policy areas: the greening and digitisation of the economy and security concerns, with support for actions such as decarbonisation, investment in renewable hydrogen, investment networks and co-funding of projects supported by the European Defence Fund. There are only a few sectoral exceptions - including aid for providers of services of general economic interest, aid for operators of land transport and aid for rescue and restructuring of failing or bankrupt companies. The first two categories fall within the scope of other block exemption instruments. As aid for rescue and restructuring is one of the most distortive types of aid for the internal market, it is always notifiable to the EC for prior clearance.

The main amendments to the new GBER can be summarised as follows:

- The definition of "firm in difficulty" is revised.

- The notification threshold for regional aid has been increased.

- The definition of innovation clusters has been expanded to include Digital Innovation Hubs.

- There is a new category for innovation including 'testing and experimentation infrastructure.'

- For environmental aid, the concept of the "funding gap" is explained in greater detail.

- Energy infrastructure now covers electricity, gas, hydrogen and CO2.

- The notification threshold for research projects is increased (e.g., it was Euro 15M for experimental research, and is now Euro 25M); for research infrastructure this is increased from Euro20M, to Euro 35M per project).

- The notification threshold for innovation clusters is now Euro 10M.

- For heat projects it was 20M and will be 50M.

- For risk capital, tax measures for private investors are included.

- The nominal aid ceiling for tech start-ups will be increased to ?1 million.

- In article 25 GBER (the most used article in innovation policy), aid intensities go up by 5 percentage points and there is also a new 25% point bonus if there has been a call and at least 3 countries participate.

- A new article (25a) is added for testing and experimental research infrastructure, with an aid intensity from 25% to 60%.

- Article 27 (innovation clusters) has been amended, so that support can now also be provided not only to the operator, but also to a consortium.

- A new article 25e is added on defence research.

- Article 36 (the general environmental article) is now focused on decarbonisation (climate). and includes aid for carbon capture projects.

- Article 38 also provides more options for storage.

- In Article 41 (investment support for renewable energy) hydrogen is now included.

- Article 46 (heat projects) - the funding gap method (with 100% extension) has been extended to heat production.

- Article 47 (waste) is based on a circular economy approach and may also cover the company's own waste.

- Aid for environmental studies goes up from a maximum 50% to 60%.

Can the new GBER really serve the goals Green Deal Industrial Plan? If we look at investment in the chips sector or in electric cars support measures will still require a customized individual assessment by the EC. Even if EC pursues a policy of 'open strategic autonomy', it has not broadened the state aid framework to allow its member states more leeway to do so.

Are the revised procedures to avoid notification simpler to apply and faster to implement at national level? Certainly a few minor headaches have been addressed, but the main structure of the GBER remains intact, including its complicated definitions, conditions and procedures. Time will tell but a first reading suggests that the amendments are largely incremental. As with past versions of this complex block exemption regulation, it will be necessary for the Commission to provide more guidance both to Member States and undertakings.

It should also be emphasized that the block exemption forms an exception to the main rule that all state aid measures must be notified to and cleared by the EC. As such the GBER is strictly interpreted. The Court of Justice of the European Union (CJEU) has held that not only must national state aid measures conform with the specific proof visions of the GBER, but they must also comply with all of the procedural provisions, even if they appear to be merely formalistic requirements such as publication.

II. THE TEMPORARY CRISIS AND TRANSITION FRAMEWORK

The new Framework both prolongs the previous version of the framework, first introduced on23 March 2022 to enable Member States to support the economy in the context of Russia's war against Ukraine and subsequently amended on 20 July 2022 and 28 October 2022 in a very short time frame. Measures linked to the immediate crisis situation remain applicable until 31 December 2023.

This latest framework:

- Prolongs the possibility for Member States to further support measures needed for the transition towards a net-zero industry, and especially schemes for accelerating the rollout of renewable energy and energy storage, and schemes for the decarbonisation of industrial production processes, which Member States may now set up until 31 December 2025.

- Amends the scope of such measures to make schemes to support renewable energy, energy storage and decarbonisation of industrial production processes even easier to design and more effective by:

-

- (i) simplifying the conditions for the granting of aid to small projects and less mature technologies, such as renewable hydrogen, by lifting the need for a competitive bidding process, subject to certain safeguards; (ii) expanding the possibilities of support for the deployment of all types of renewable energy sources; (iii) expanding the possibilities of support for the decarbonisation of industrial processes switching to hydrogen-derived fuels; and (iv) providing for higher aid ceilings and simplified aid calculations.

- Introduces new measures, applicable until 31 December 2025, to further accelerate investments in key sectors for the transition towards a net-zero economy, enabling investment support for the manufacturing of strategic equipment, namely batteries, solar panels, wind turbines, heat-pumps, electrolysers and carbon capture usage and storage as well as for production of key components and for production and recycling of related critical raw materials.

- Member States may:

-

- Design simple and effective schemes, providing support capped at a certain percentage of the investment costs and nominal amounts, depending on the location of the investment and the size of the beneficiary. Small and medium-sized enterprises ('SMEs') as well as companies located in disadvantaged regions are eligible for higher support, to ensure that cohesion objectives are duly taken into account.

- Member States may grant even higher percentages of the investment costs if the aid is provided via tax advantages, loans or guarantees.

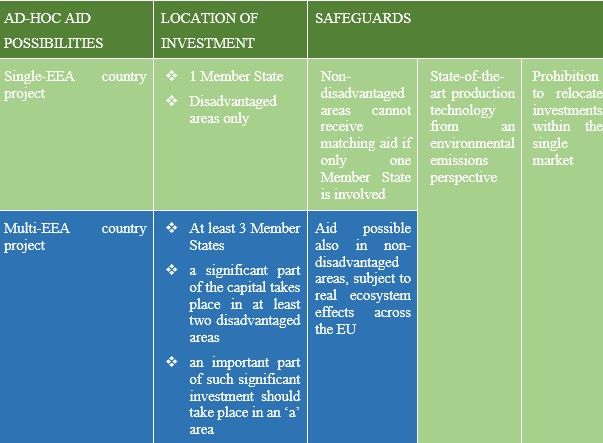

- National authorities must nevertheless verify the concrete risks of the productive investment not taking place within the European Economic Area ('EEA') and that there is no risk of provoking relocation within the single market.

- In exceptional cases, Member States may provide 'matching aid' - that is either the amount of support the beneficiary could receive for an equivalent investment in that alternative location or the amount needed to incentivise the company to locate the investment in the EEA (the so-called 'funding gap') whichever is the lowest. This option is subject to a number of safeguards and detailed in the table below.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.