The Bermuda insurance and reinsurance sector enjoyed a vibrant 2016, despite markets globally remaining relatively flat.

A.M. Best has reported that the global operating environment remains negative. Factors such as low rates, broader terms and conditions, the unsustainable flow of net favourable loss development and low investment yields are expected to continue to limit risk-adjusted returns over the longer term.

The Bermuda Market

Disruptions in global markets have often led to important industry developments in Bermuda, and 2016 was no exception.

One of the Island's key advantages in this arena is its sophisticated level of sensible yet firm regulation.

The grant of full equivalence with Solvency II by the European Parliament and Council came into force on 26 March 2016 (effective as of 1 January 2016). As a result, Bermuda's commercial reinsurers are considered by all European Member States as applying an equivalent reinsurance regime in accordance with the requirements of Solvency II. This means that Bermuda's commercial reinsurers will not be disadvantaged when competing for, and writing business in, the EU.

Along with the Island's status as an NAIC "Qualified Jurisdiction", Solvency II equivalence has cemented and strengthened Bermuda's position as a leading reinsurance market.

Existing and start-up commercial insurers and insurance groups demonstrated a surge in interest in 2016 to form or expand substantive operations on the Island, partly as a result of these regulatory endorsements.

Legal Updates

Insurance-Linked Securities

Bermuda has in the past acted as an incubator for the development of alternative capital, which is now estimated to comprise approximately 20% of dedicated global reinsurance market capacity. Keen investor and sponsor appetite during 2016 helped the Insurance-Linked Securities ("ILS") market end the year at an all-time high of US$26.8 billion. The average transaction size of new ILS issues in the fourth-quarter of 2016 stood at US$354.4 million, the highest quarterly level in the past 10 years.

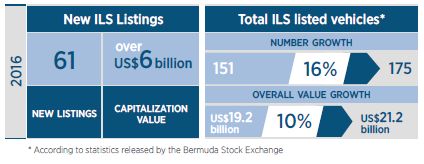

The Bermuda market's robust ILS activity in 2016 offered investors valuable diversification of geographic and peril risk. The Bermuda Stock Exchange reported that the total number of ILS listed vehicles grew in 2016 by 16%, from 151 to 175. The overall value of these securities grew by 10% from US$19.2 billion to US$21.2 billion. Continuing growth in Bermuda's market-leading ILS sector has been fuelled by the increasing global importance of ILS, both as a risk management tool and as a diversified asset class for investors.

Captive Insurance

Captive insurance, Bermuda's market foundation, also reported substantial activity in 2016, with 13 new captive insurers formed during the year. Given the continued soft market for commercial insurance, this demonstrated the Bermuda market's capability of offering a comprehensive set of risk management solutions. Of equal significance is the fact that new captive formations came from one of Bermuda's traditional markets, the US and the emerging Latin American market.

Head Office

New rules concerning commercial insurers maintaining a head office in Bermuda became effective on 1 January 2016. While most of Bermuda's commercial insurers clearly complied with those requirements, there was concern that a number of the "limited purpose reinsurers" would not meet the requirements. During the course of 2016, however, the Bermuda Monetary Authority ("BMA") confirmed that the factors used to determine whether or not a commercial insurer met the head office requirements would be applied in accordance with the proportionality principle, taking into account the nature, scale and complexity of the business. Accordingly, while certain of the limited purpose reinsurers are being required to, among other things, ensure that the key decision making is made in Bermuda, the limited purpose reinsurers are able to satisfy the head office requirements without establishing a full standalone office in Bermuda.

Insurance Manager Code of Conduct

To enhance its oversight of insurance managers, in 2016 the BMA introduced the Insurance Manager's Code of Conduct. Insurance mangers will be required to establish and document an appropriate corporate governance framework and document control policies and procedures to ensure that their business and their clients' business is conducted in a prudent manner. The introduction of the Insurance Manager's Code of Conduct has been seamless to clients and ensures that they continue to benefit from the high quality of insurance management services they require.

Rights of Third Parties

The Contracts (Rights of Third Parties) Act, 2016 (the "Act") became operative in 2016. The Act permits parties to a contract to vary the common law doctrine of "privity of contracts", which provides that only parties to a contract may enforce its provisions. It is important to note, however, that under the new law, for a third party to be entitled to enforce a contract, the contracting parties must expressly identify the third party (by name, as a member of a class or by description) and agree that a third party may enforce the applicable terms of the agreement.

The Act contains a number of express exceptions, including employment agreements of various negotiable instruments, letters of credit and a company's bye-laws. This "opt-in" requirement differs from many other jurisdictions where third parties may automatically obtain rights unless the contracting parties expressly contract out of giving third parties rights.

The Act removes uncertainty concerning the enforceability of "cut-through clauses" under Bermuda law. Such provisions, however, will be subject to the normal rules of fraudulent preference, and transactions at an under-value making such provisions unenforceable. Provided the transaction is a bona fide commercial transaction for consideration and a proper purpose between parties that are solvent, there is little danger of the common law rules of privity applying to upset the operation and enforceability of cut-through clauses.

Significant 2016 Transactions

ATHENE HOLDING US$1.1 BILLION IPO

Conyers advised Athene Holding Ltd on its US$1.1 billion IPO on the New York Stock Exchange. The company's shares finished more than 10% higher than its initial public offering price. The offering was the third largest IPO in the United States this year, according to Bloomberg News.

SOMERSET REINSURANCE US$375 MILLION COMMON SHARE CAPITALIZATION

Conyers advised Somerset Reinsurance Ltd. on its US$375 million common share capitalization. This strictly confidential private placement included investments from three strategic investors – Hannover Re, Atlas Merchant Capital LLC and the company's founding shareholder Georg Weiss – as well as a diverse group of high net worth investors.

Somerset Reinsurance, formerly known as Weisshorn Re Ltd., is a Bermuda exempted company registered as a Class E Insurer, which provides customised risk management solutions to the life insurance and annuity sectors, helps clients efficiently deploy capital and improve long-term performance, and funds new business growth.

ARCH CAPITAL GROUP'S ACQUISITION OF UNITED GUARANTY

In December, Conyers advised Arch Capital Group Ltd. in its previously announced acquisition of United Guaranty Corporation from American International Group, Inc. At the closing, Arch Capital Group paid approximately US$3.26 billion, consisting of approximately US$2.16 billion cash consideration and shares of Arch Capital Group's convertible non-voting common-equivalent preference shares.

In connection with funding a portion of the cash consideration, Conyers represented Arch Capital Group in connection with its public offering of US$950 million senior notes, fully and unconditionally guaranteed by Arch Capital Group Ltd., composed of US$500 million aggregate principal amount of 4.011% senior notes due 2026 and US$450 million aggregated principal amount of 5.031% senior notes due 2046.

We also represented Arch Capital Group in connection with its public offering of 18 million depositary shares, each representing a one-thousandth interest in a 5.25% Non-Cumulative Preferred Share, Series E, which generated gross proceeds of US$450 million. Further, we advised in connection with amending and restating Arch Capital Group's US$850 million credit agreement, providing for up to US$350 million of secured letters of credit and US$500 million of unsecured loans and letters of credit.

AURIGEN CAPITAL'S ACQUISITION BY PARTNERRE

Conyers advised Aurigen Capital Limited on its acquisition by PartnerRe. The definitive agreement called for PartnerRe to acquire 100% of the outstanding ordinary shares of Aurigen, a North American life reinsurance company. The cash consideration for the transaction is CA$375 million (about US$286 million).

SIRIUS INTERNATIONAL INSURANCE GROUP SALE TO CM INTERNATIONAL HOLDING PTE LTD.

In April, Conyers acted as counsel for White Mountains Insurance Group, Ltd. in connection with its US$2.6 billion sale of Sirius International Insurance Group to CM International Holding PTE Ltd., the Singapore‑based investment arm of China Minsheng Investment Corp., Ltd. ("CMI"). The sale of Sirius to CMI gives the latter company a foothold in the Bermuda reinsurance market - an example of the expansion of international firms into the Bermuda reinsurance market space, in part to gain risks not correlated with share and bond markets.

NEON UNDERWRITING ESTABLISHMENT OF UNDERWRITING OFFICE

Conyers advised Lloyd's syndicate Neon Underwriting in connection with the formation and insurance licensing of Neon Underwriting's office in Bermuda. The office has been set-up by the Lloyd's specialist insurer in order to help it grow its international footprint, giving it greater access to both the US and Bermuda reinsurance markets. Neon is part of the Great American Insurance Group, the members of whom are subsidiaries of American Financial Group, Inc., a Fortune 500 company whose shares are listed on the New York Stock Exchange.

PREMIA HOLDINGS LTD RAISES US$510 MILLION FOR INITIAL CAPITALIZATION

Conyers advised Premia Holdings Ltd, a property and casualty insurance and reinsurance group focused on providing runoff solutions on its US$510 million initial capital raise. The investors included Kelso & Company and Arch Capital Group Ltd.

The formation of Premia represents one of the largest capital raises ever focused on the P&C runoff market and immediately establishes Bermuda-based Premia as a significant market participant.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.