OUR INSIGHTS AT A GLANCE

- Various tax measures such as the major reform of the current investment tax credit framework and the adjustment of income tax scales will be applicable as from tax year 2024.

- In the 2023-2028 coalition agreement of the recently elected Luxembourg government, various measures related to income taxes, subscription tax, housing, the modernisation of tax administration and the tax procedure were announced.

- The new double tax treaty between Luxembourg and the UK as well as the new protocol to the double tax treaty between Luxembourg and Germany are on the way to be soon applicable.

Luxembourg Income Tax Measures

- Investment tax credit regime to be modernised as from 2024

On 19 December 2023, the law introducing a major reform of the current investment tax credit ("ITC") framework was passed and will be applicable with effect as from tax year 2024. The law not only implements the investment tax credit modifications agreed upon in the tripartite agreement of 28 September 2022, but also completely reforms the current regime.

First, it increases the rates of the global investment tax credit. Further, it replaces the current additional investment tax credit by an additional tax credit for investments and operating expenses linked to the digital transformation and the ecological and energy transition and introduces a new system to certify the nature and reality of such investments and operating expenses.

The reform of the ITC regime is a positive initiative to accelerate the digital transformation as well as the ecological and energy transition of Luxembourg businesses and strengthen their competitiveness. However, since the new procedure of certification (which is only applicable to benefit from the new additional ITC) seems heavy, it remains to be seen how it will work in practice, given the related additional administrative burden for both taxpayers and the administration.

Read more about this new law in our previous Alert: Luxembourg Parliament adopts law modernising investment tax credit regime as from 2024

- Individual taxation and tax brackets

Given the difficult economic situation and the polycrisis context, the coalition agreement for the period 2023-2028 dated 16 November 2023 (hereafter referred to as the "Coalition Agreement") provides for a set of tax measures in order to strengthen the purchasing power of households.

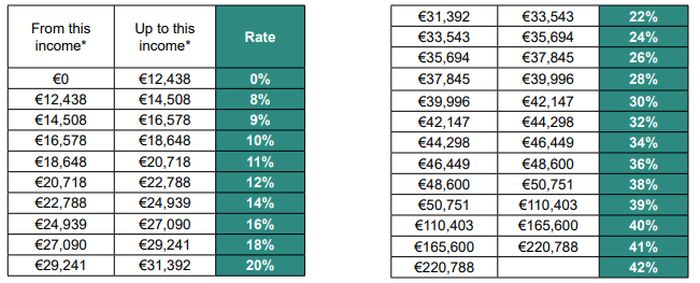

To that aim, on 20 December 2023, a tax law was passed in order to adjust the income tax scale by 4 index brackets as from 1 January 2024. The tax relief provided for by the new law is in line with the Tripartite Agreement dated 3 March 2023, which had already provided for an adjustment of the tax scale by 2.5 index brackets implemented by a law dated 5 July 2023, which 1.5 additional brackets have now been added to. The law also reviews the tax scale for class 1A - which applies to single parents, widows and widowers - to ease the tax burden on single earners.

In practice, the law provides for an adaptation of tax brackets of 10.38% compared to the rate applicable since 2017.

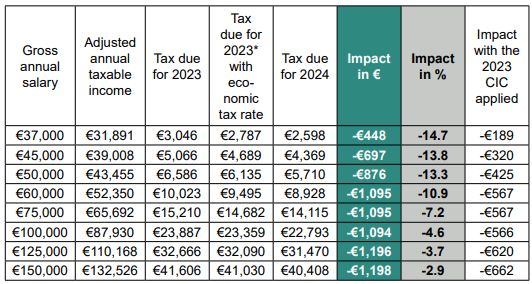

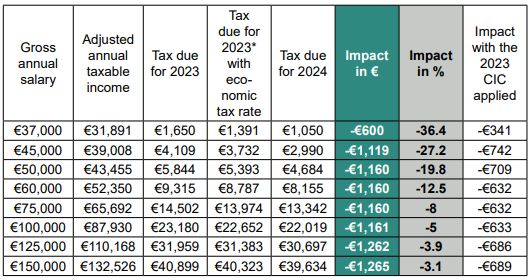

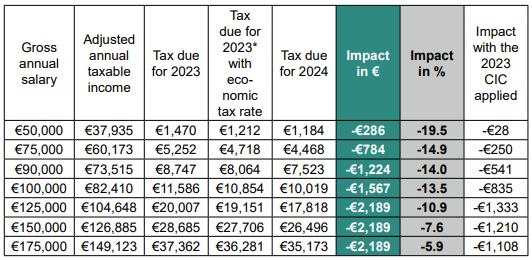

According to the Luxembourg government, taking into consideration the economic tax credit (crédit d'impôt conjoncture or "CIC") applicable in 2023, the law involves the following tax reductions:

Class 1:

*adjusted taxable income

Employed taxpayers in tax class 1

Annual salary:

*not including the employment fund

Employed taxpayers in tax class 1A

Annual salary:

*not including the employment fund

Collective taxpayers in tax class 2 - each earning a salary (split 2/3 and 1/3)

Annual salary:

*not including the employment fund

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.