1 Overview of the Nigerian Power Sector

1.1 History

The first utility company, the Nigerian Electricity Supply Company, was established in Nigeria in 1929. However, electricity generation in Nigeria had started over 30 years before the establishment of the first utility back in 1896.

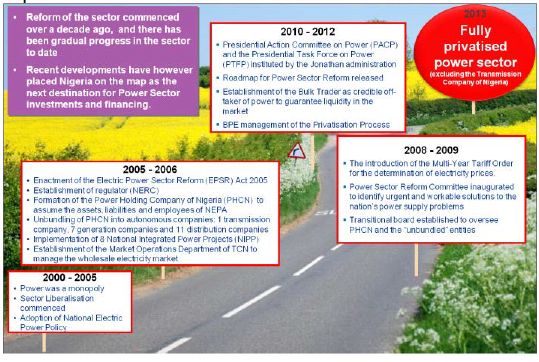

Despite the various efforts of the State-owned utility, (which operated as a monopoly) to manage the sector to provide electricity, it became clear by the late 1990s that the Nigerian electricity system was failing to meet Nigeria's power needs. Hence, the National Electric Power Policy of 2001 kicked off the power sector reform in Nigeria, leading to several other reforms over the last decade.

Since the advent of the democratic regime in Nigeria, there have been significant strides in the reform of the sector. The Evolution of the Nigerian Power Sector is as depicted below:

one of the boldest privatisation initiatives in the global power sector over the last decade, with transaction cost of about $3.0bn.

Over the past decade, the Federal Government has been able to complete the privatisation process. The Federal Government retains the ownership of the transmission assets (management under concession) with the generation and distribution sectors fully privatised. The subsequent segments shed more light on the various Power Sub-Sectors detailing current capacity, trends and key sector statistics to aid the understanding of the sector as a whole.

1.2 Sub-sectors

The Nigerian Power Sector is made up of 3 major sub-sectors as depicted below:

1.2.1 Generation

There are currently 23 grid-connected generating plants in operation in the Nigerian Electricity Supply Industry (NESI) with a total installed capacity of 10,396.0 MW and available capacity of 6,056 MW. Most generation is thermal based, with an installed capacity of 8,457.6 MW (81% of the total) and an available capacity of 4,996 MW (83% of the total). Hydropower from three major plants accounts for 1,938.4 MW of total installed capacity (and an available capacity of 1,060 MW).

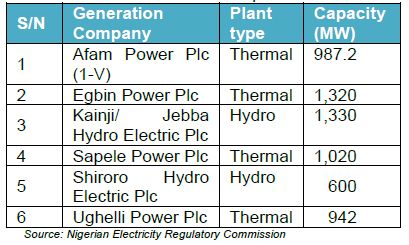

i. Successor Generation Companies (Gencos): There are 6 successor Gencos in Nigeria. Their names and installed capacities are:

ii. Independent Power Producers (IPPs) : IPPs are power plants owned and managed by the private sector. Although there are Independent Power Producers (IPPs) existing in Nigeria prior to the privatisation process, the Nigerian Electricity Regulatory Commission (NERC) has recently issued about 70 licenses to Independent Power Producers in order to improve the power situation in the country. The existing IPPs include Shell – Afam VI (642MW), Agip – Okpai (480MW) and AES Barges (270MW).

iii. National Integrated Power Projects: The National Integrated Power Project ('NIPP') is an integral part of Federal Government's efforts to combat the power shortages in the country. It was conceived in 2004 as a fast-track public sector funded initiative to add significant new generation capacity to Nigeria's electricity supply system along with the electricity transmission and distribution and natural gas supply infrastructure required to deliver the additional capacity to consumers throughout the country. There are 10 National Integrated Power Projects (NIPPs), with combined capacity of 5,455 MW, scheduled for completion (for ongoing projects) and privatization in 2014. The NIPPs are:

The Federal Government has set aside N50 billion in escrow accounts in 3 Nigerian Banks to serve as a buffer for losses that the GENCOS may suffer in the course of power transmission. Draw-downs are only possible where the stipulated conditions are met. The Nigerian Bulk Electricity Trading Plc (NBET) will manage the accounts.

1.2.2 Transmission

The Transmission Company of Nigeria (TCN) is a successor company of PHCN, following the unbundling of the sector, and is currently being managed by a Management Contractor, Manitoba Hydro International (Canada). Manitoba is responsible for revamping TCN to achieve technical and financial adequacy in addition to providing stable transmission of power without system failure. Currently, the transmission capacity of the Nigerian Electricity Transmission system is made up of about 5,523.8 km of 330 KV lines and 6,801.49 km of 132 KV lines.

The TCN is made up of two major departments: System Operator and Market Operator. The Market Operations (MO) is a department under TCN charged with the responsibility of administering the wholesale electricity market, promoting efficiency and where possible, competition. The system operator is focused on system planning, administration and grid discipline.

Furthermore, one of the major areas of focus of Manitoba Hydro International is to reorganise TCN and ensure that the Market Operator and the System Operator become autonomous.

The responsibilities of the System Operator include:

i. Implementing and enforcing Grid Code, and draft/implementation of operating procedures as may be required for the proper functioning of the System Operator Controlled Grid;

ii. System planning;

iii. Implementing and supervising open access to the System Operator Controlled Grid;

iv. Providing demand forecasts;

v. Planning operation and maintenance outages;

vi. Undertaking dispatch and generation scheduling;

vii. Scheduling energy allocated to each Load Participant in the event that available Generation is not sufficient to satisfy all Loads;

viii. Ensuring Reliability and availability of Ancillary Services;

ix. Undertaking real time operation and SCADA/EMS system;

x. Administering system constraints (congestion), emergencies and system partial or total recovery; and

xi. Coordinating regional Interconnectors.

The responsibilities of the Market Operator include:

i. Market Administration

a. Guarantee an efficient, transparent and non-discriminatory market administration service to all Participants;

b. Facilitate the development of a sustainable competitive Market; and

c. Adapt to regional Markets or regional electricity trading agreements.

ii. Implementation of the Market Rules

a. Implementing the Market Rules, draft and implement any and all requisite Market Procedures;

b. Review the efficiency and adequacy of Market Rules and Market Procedures and propose such amendments as may be required to ensure their efficacy and adequacy;

c. Admit and register Participants;

d. Organise and maintain a Participants' Register;

e. Centralise the information required for market administration, organise and maintain the related data bases;

f. Verify that each Connection Point, where a Participant injects or extracts energy, has proper commercial metering related to physical exchange - injection and consumption of energy, provision of Ancillary Services and other necessary commercial transactions and;

g. Calculate and recover Ancillary Service and Must-Run Generation costs, when necessary;

h. Centralise and process commercial metering data;

i. Administer the Market settlement process and Market payment system;

j. Calculate and settle payments in respect of ancillary services and other costs of operating the system and administering the Market;

k. Calculate and settle payments in respect of transmission charges;

l. During the Transitional Stage:

− Receive contract information and maintain Contract Register;

− Prepare the Generation Adequacy Report; and

− Calculate Contracted Imbalance Quantities in aggregate, by contract and by Participant, using Metered Quantities adjusted as necessary for losses in each month;

m. During the Medium Term Market:

− Calculate Contracted Imbalance Quantities, Uninstructed Imbalance Quantities and Instructed Imbalance Quantities in aggregate and by Participant - adjusted as necessary for losses in each and every Dispatch Period;

− Determine the System Marginal Price for each and every Dispatch Period; and

− Issue Invoices and arrange recovery and payment of charges for Imbalance Energy and Ancillary Service and the System Operation and Market Administration Charge from, and to, the Participants.

n. Manage Market billing including issuance of invoices, settlement and payment system in accordance to these Rules;

o. Recover the Transmission Usage Charge from the Participants and remit it to Transmission Service Provider (TSP) and other Transmitter(s), if any; and

p. Supervise Participants compliance with, and enforce the Market Rules and Grid Code.

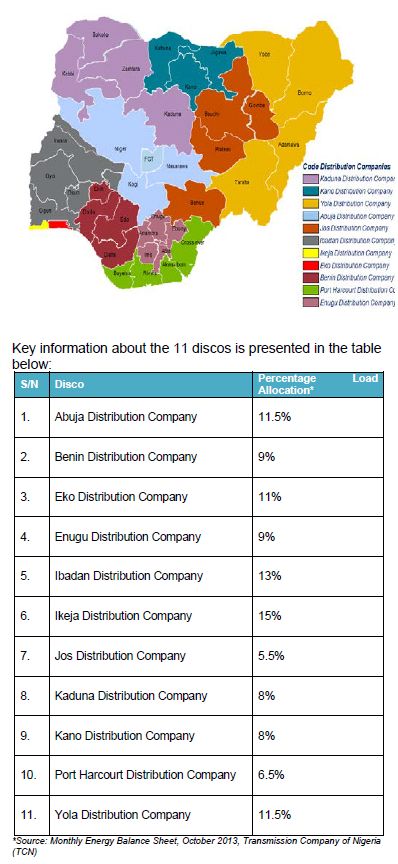

1.2.3 Distribution

There are 11 electricity distribution companies (discos) in Nigeria. The coverage areas of the 11 companies are indicated in the map below:

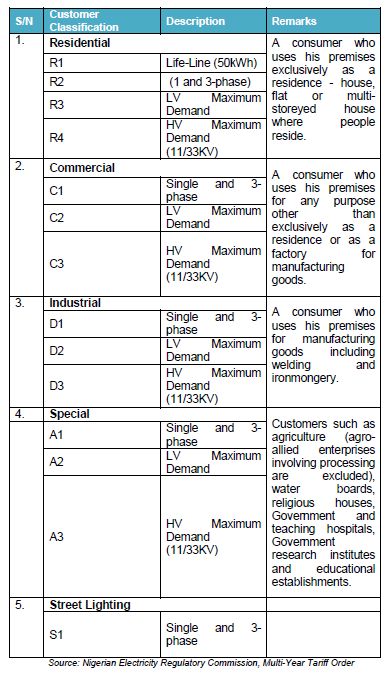

Tariff Class Descriptions: The customers across the various Discos are classified into 5 groups as indicated in the table below:

1.3 Types of Licences

The players in the Nigerian electricity market are often referred to as market participants. In order to carry on business as a market participant, it is imperative that such entity(ies) obtain the appropriate licence from the Nigerian Electricity Regulatory Commission (NERC). Appendix I contains information on the licence application requirements. A summary of the applicable licences along the electricity value chain is provided below:

1.3.1 Electricity Generation Licence

A generation licence authorises the licensee to construct, own, operate and maintain a generation station for purposes of generation and supply of electricity in accordance with the Electric Power Sector Reform Act, 2005. Subject to this Act, the holder of a generation licence may sell power or ancillary services to any of the classes of persons specified in the licence. An electricity generation licence is needed for any power generation activity beyond 1MW.

1.3.3 Transmission Licence

A transmission licence authorises the licencee to carry on grid construction, operation, and maintenance of transmission system within Nigeria, or that connect Nigeria with a neighbouring jurisdiction limited to, the following activities as may be specified in the licence:

1.3.4 System Operation Licence

A system operation licence authorises the licensee to carry on system operation, including, but not to:

1.3.2 Distribution Licence

A distribution licence authorises the licensee to construct, operate and maintain distribution systems and facilities, including, but not limited to, the following activities as may be specified in the licence:

- the connection of customers for the purpose of receiving a supply of electricity;

- the installation, maintenance and reading of meters, billing and collection; and

- such other distribution service

A distribution licensee may also have the obligation to provide electricity to its distribution customers, pursuant to the terms of a trading licence issued by the Commission to the distribution licensee.

- generation scheduling, commitment and dispatch;

- transmission scheduling and generation outage co-ordination;

- transmission congestion management;

- international transmission co-ordination;

- procurement and scheduling of ancillary services and system planning for long term capacity;

- administration of the wholesale electricity market, including the activity of administration of settlement payments, in accordance with the market rules; and

- such other activities as may be required for reliable and efficient system operation

1.3.5 Trading Licence

A trading license authorizes the licencee to engage in the purchasing, selling, and trading of electricity. The Commission (NERC) determines the terms and conditions of trading licences as may be appropriate in the circumstances. The Commission may also issue temporary bulk purchase and resale licence, giving the licensee, the ability to purchase electrical power and ancillary services from independent power producers and successor generation companies for the purpose of re-sale to one or more other licensees, or to an eligible customer. A licensed trading entity in Nigeria is the NBET.

To read this article in full please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.