On 29th November 2023, President Bola Ahmed Tinubu, GCFR presented the 2024 Federal budget proposals to a joint session of the National Assembly. The 2024 budget themed "Budget of Renewed Hope" is the first full year budget to be proposed by the current administration. The budget is geared toward making significant strides in cementing macro-economic stability, reducing deficit, increasing capital spending and allocation to reflect the eight priority areas of the administration.

We have summarised the key highlights of the budget proposal below:

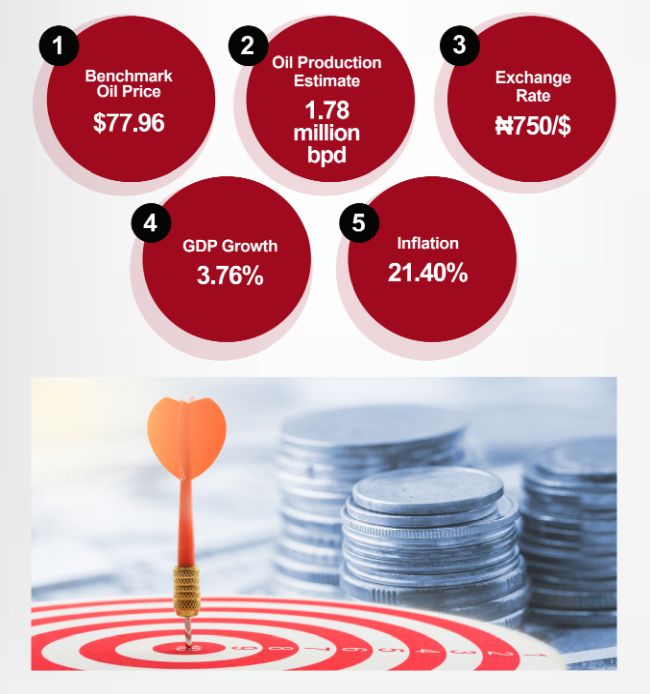

Key Parameters & Assumption Underpinning the 2023 Budget

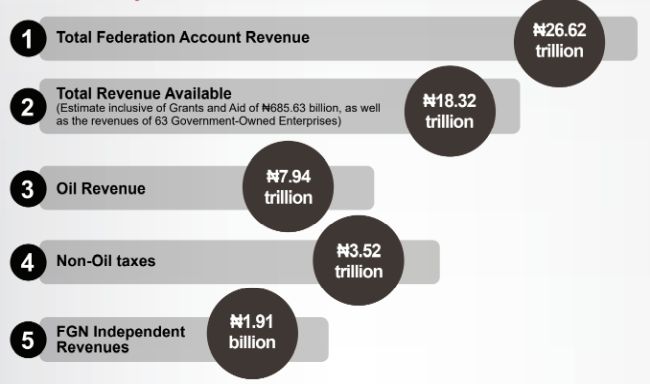

Revenue Projection

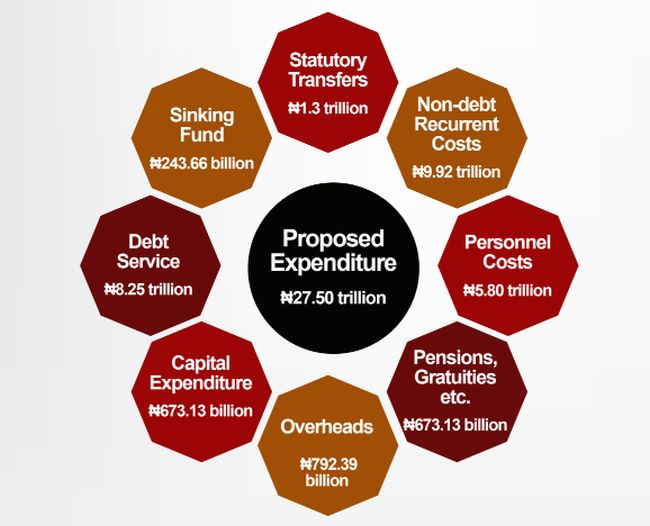

Planned 2024 Expenditure

Budget Deficit

It is proposed that the total fiscal operations of the Federal Government will result in a deficit of ₦9.18 trillion. This represents 3.88% of estimated GDP, which is slightly above the 3% threshold set by the Fiscal Responsibility Act 2007.

The deficit is expected to be funded as shown below:

Other Key Highlights of the 2022 Budget Speech

- Focus on the Education Sector

In 2024, the Government intends to implement a more sustainable model of funding tertiary education to address long standing issues in the education sector. To this end, the proposed Student Loan Scheme is scheduled to become operational by January 2024. In this regard, ₦2.18 trillion was allocated to the education sector, specifically ₦1.23 trillion is provisioned for the Federal Ministry of Education and its agencies, ₦251.47 billion for Universal Basic Education Commission (UBEC) and ₦700 billion for transfer to the Tertiary Education Trust Fund (TETFUND) for infrastructure projects in Tertiary institutions. - Social Development

Social investment programs are currently being reviewed by the current administration to enhance their implementation and effectiveness. Specifically, it is proposed that the National Social Safety Net project will be expanded to provide targeted cash transfers to poor and vulnerable households. In addition, the Government promises to make sufficient effort to progress existing beneficiaries toward productive activities and employment. - Innovations in Infrastructure Financing

In 2024, the Government intends to strengthen the framework for concessions and public private partnerships (PPPs). To this end, provisions have been made to leverage private capital for big-ticket infrastructure projects in energy, transportation and other sectors. This will be key to ensure the diversification of the energy mix of Nigeria, enhancing efficiency, and fostering the development of renewable sources. By allocating resources to support innovative and environmentally conscious initiatives, the Federal Government intends to demonstrate commitment to a greener future for Nigeria for positioning as a regional leader in the global movement towards clean and sustainable energy. - Debt Service

A major provision of ₦8.25 trillion and ₦243 billion was made for Debt Service and Sinking Fund to retire maturing bonds issued to local contractors/creditors, respectively. This is a significant amount in the budget, although the debt service is attributable to legacy borrowings. - Finance Bill 2024

The budget speech did not confirm if a Finance Bill would be proposed for 2024, however, the President highlighted that the current tax and fiscal laws are being reviewed to increase the ratio of revenue to GDP to 18 percent. In this regard, the Presidential Fiscal Policy and Tax Reforms Committee has stated that an Emergency Economic Intervention Bill is being proposed. In the absence of a Finance Bill, this Bill may propose the changes to tax and fiscal laws that will support the implementation of the budget and government's revenue generation plans.

Conclusion

The draft budget was prepared against the backdrop of continuing global and domestic challenges and it is obvious that revenue generation remains the major fiscal constraint to full implementation of the budget. If the revenue projections are met and surpassed, it is likely to boost the budget performance, reduce the deficit and minimize the plans for additional borrowing.

We will continue to monitor developments on the budget and provide more details in subsequent publications.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.