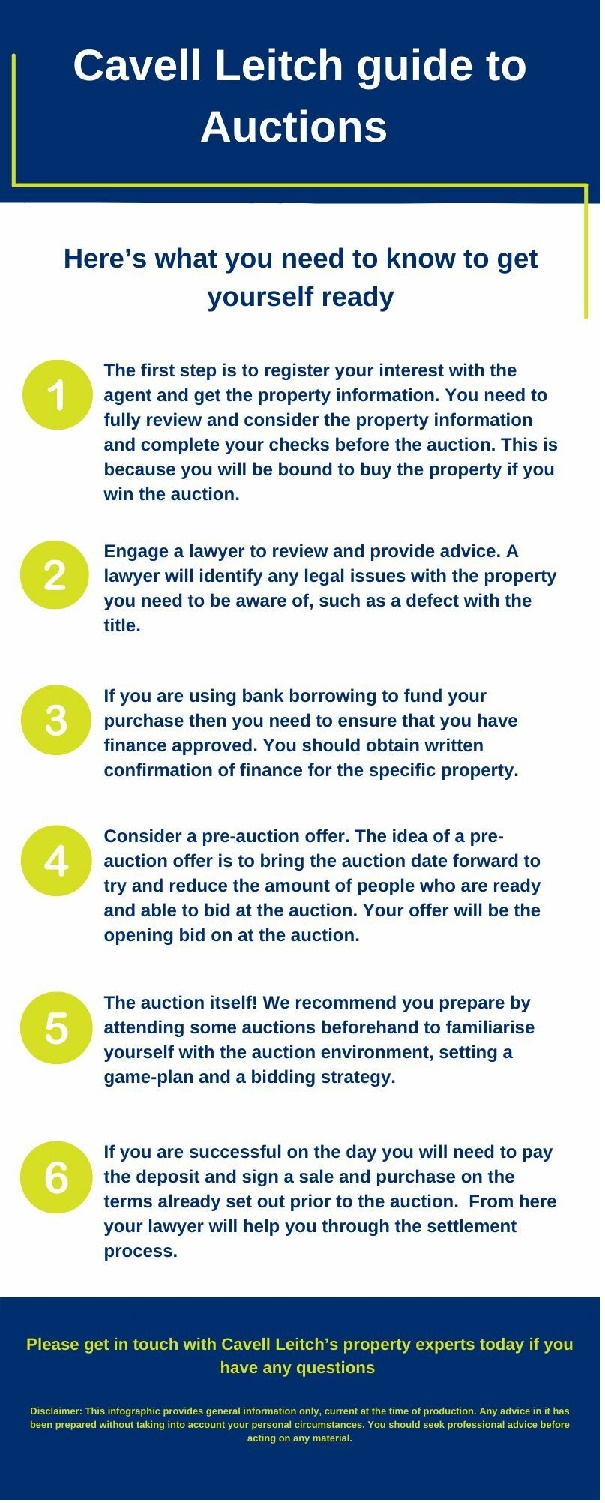

Below is the Cavell Leitch Guide to Auctions, this is a brief summary of the main points discussed below.

The use of auctions to sell properties has seen a substantial rise over the last year. Auctions can be exciting but also intimidating, and because the auction process is different from other methods of purchasing property it is important to understand what is involved. Here's what you need to know to get yourself ready.

If you are the winning bidder at the auction your offer is automatically and completely binding. It is not subject to any conditions or checks. Because of this, you need to ensure that you complete all of your checks and approvals for the property before attending the auction. This is different from a standard offer situation, where your offer will often be subject to conditions (such as finance, insurance, LIM and building report).

Registering your initial interest in a property

The start of the auction process is registering your initial interest in a property, the real estate agent will usually at this point provide you with an auction pack. The auction pack includes documents to help you research the property and identify any issues, most commonly this includes copy of the Title, LIM Report and Auction Agreement, sometimes copies of building reports and more particularly to Christchurch, information about prior earthquake claims and repairs are also included. All of these documents contain important information about the property and should be thoroughly reviewed before making the decision to bid on a property. At this stage you will need to engage a lawyer to review and provide advice. A lawyer will identify any legal issues with the property you need to be aware of, such as a defect with the title.

Finance approval

If you are using bank borrowing to fund your purchase then you need to ensure that you have finance approved. You should obtain written confirmation of finance for the specific property, not just a general bank pre-approval. You need to ensure you give your bank enough notice to approve the property before the auction day. You should also arrange insurance cover as this will be a requirement of any bank lending. The deposit (10% of the purchase price) is payable on the day of the auction, so you need to have enough funds immediately available.

Consider a pre-auction offer

If you get funding approval and complete all your checks early on, then you might want to consider a pre-auction offer. The idea of a pre-auction offer is to bring the auction date forward to try and reduce the amount of people who are ready and able to bid at the auction. Your offer will be the opening bid on at the auction. If you are signing a pre-auction offer you need to have this reviewed first to ensure it does actually require the auction to be moved forward and also binds the vendor if the property isn't sold for a higher price at auction. Most pre-auction offers will not allow you to withdraw your offer unless the property sells for a higher price at auction.

Attending the auction

The auction itself can be an exciting but also intimidating process, we recommend you prepare by attending some auctions beforehand to familiarise yourself with the auction environment, setting a game-plan and a bidding strategy. Because any bid can bind you to purchasing the property it is important to set yourself a maximum budget and to stick within this budget. The vendor will have set a reserve price, if this price has been met the highest bidder will win the auction. If you are the highest bidder and the vendor's reserve price has not been met, the vendor has options to lower their reserve and allow the auction to continue, negotiate with the highest bidder privately, or decide not to sell at the auction (known as the property being passed in). If the vendor accepts the highest bid in negotiation the bidding will re-commence, giving the other bidders another chance at the property.

Successful purchase at auction

If you are successful on the day you will need to pay the deposit and sign a sale and purchase on the terms already set out prior to the auction. The balance of the purchase price will then be paid through your lawyer as a part of the settlement process.

The settlement

From here the property team at Cavell Leitch will then guide you through the settlement process. Our specialist residential property team is one of the largest in the country with the capacity to work around tight auction deadlines, and the knowledge and systems to guarantee you a seamless settlement process.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.