MAS Publishes Thematic Inspection Findings on Enterprise-Wide Risk Assessment on AML/CFT

The Monetary Authority of Singapore ("MAS") has published an information paper on 3 August 2020, which sets out its findings from a series of thematic inspections on enterprise-wide risk assessment ("EWRA") on money laundering and terrorism financing. The information paper highlights inspection observations and MAS' supervisory expectations of effective EWRA frameworks and processes that financial institutions should benchmark themselves against. While the information paper is premised on the inspection of selected banks, the learning points are also relevant to other classes of financial institutions. Financial institutions are therefore encouraged to reference and to incorporate (with the appropriate calibrations) the key takeaways outlined in the information paper, when enhancing their EWRA framework and processes.

Introduction

Most classes of financial institutions in Singapore are subject to anti-money laundering and countering the financing of terrorism ("AML/CFT") regulations. The obligation to implement effective policies, procedures, and controls to deal with money laundering and terrorism financing ("ML/TF") risks are set out in binding Notices on AML/CFT issued by MAS pursuant to section 27B of the MAS Act. The specific AML/CFT measures are customised to take into account the specific financial activities normally carried on by each class of financial institution. In the case of banks, the relevant AML/CFT Notice is MAS Notice 626 (last revised on 30 November 2015). Banks are required to establish frameworks and processes to conduct the EWRA in accordance with the requirements set out in MAS Notice 626 and its corresponding Guidelines.

The objective of the thematic inspection by MAS was to assess the robustness of the EWRA of the selected banks, and to benchmark practices among these banks. The scope of the thematic inspection consisted of (1) the bank's management oversight of EWRA, (2) the EWRA framework established by the bank, and (3) the bank's implementation of its EWRA framework and processes.

We have summarised below the six desired outcomes and key observations arising from the MAS thematic inspection.

I. Overall assessment

In general, MAS has found that banks have generally established frameworks and processes to conduct the EWRA in accordance with the requirements set out in MAS Notice 626 and its corresponding Guidelines.

However, the robustness of the EWRA was uneven across the banks inspected by MAS. Some banks have established good practices that the financial industry in general can emulate, while others still have room to enhance their management oversight of the EWRA processes, the robustness of their EWRA methodologies, and the effectiveness of their EWRA implementation.

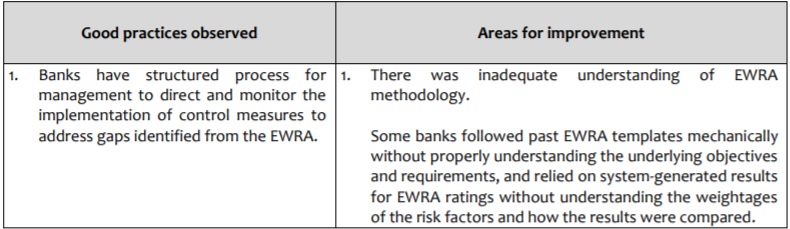

II. Outcome 1: Senior management to maintain active oversight of EWRA frameworks and processes

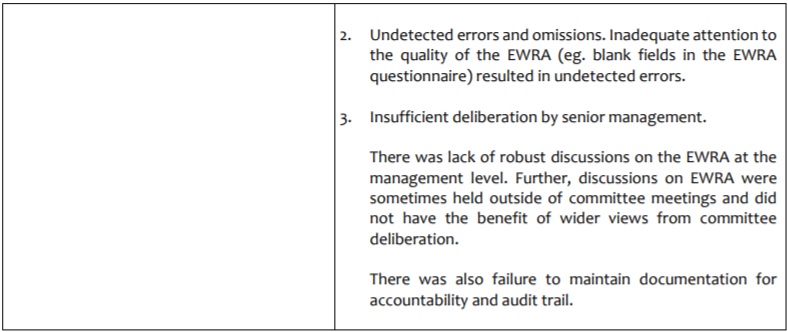

III. Outcome 2: Banks to have systematic frameworks and processes to assess inherent risks, control effectiveness, and residual risks for each business

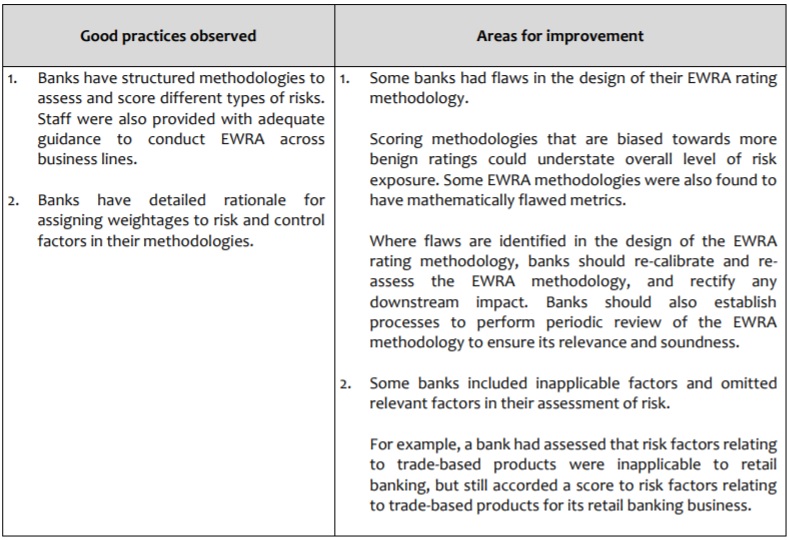

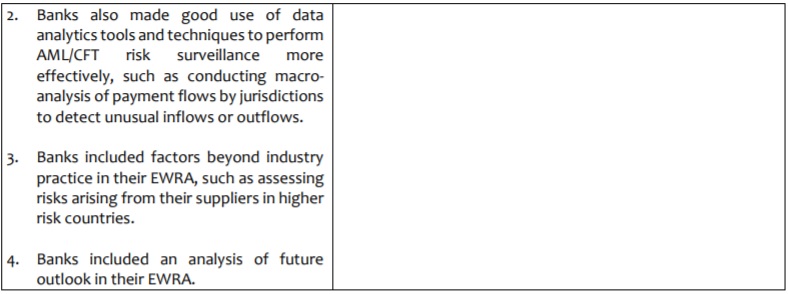

IV. Outcome 3: Banks to perform appropriate qualitative and quantitative analyses in assessing risk

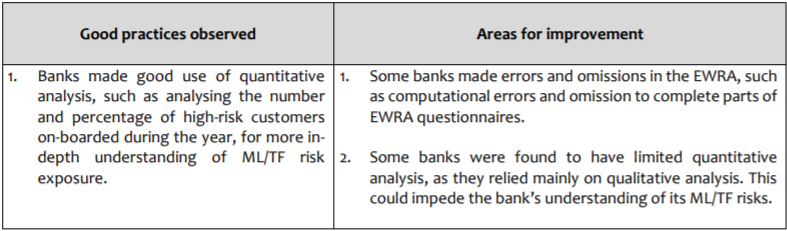

V. Outcome 4: Banks to assess effectiveness of controls, taking into account policies and procedures, control testing results, and office culture

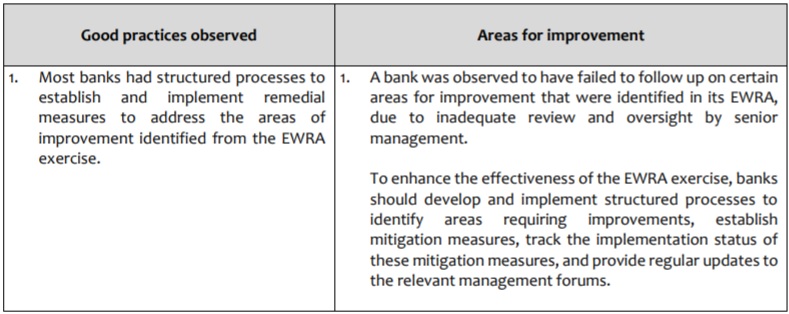

VI. Outcome 5: Banks to have systematic processes to establish and implement control measures

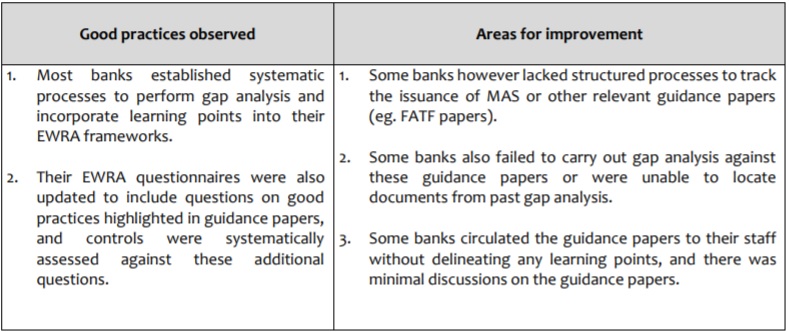

VII. Outcome 6: Banks to have structured processes to perform gap analysis, and incorporate lessons learnt and good industry practices

Conclusion

MAS has emphasised that the EWRA provides financial institutions with an overview of their ML/TF risk exposure and forms the cornerstone of AML/CFT risk management.

While this round of thematic inspection has found that most banks have generally established frameworks and processes to conduct the EWRA, MAS has also observed that there were key areas for improvement. These areas for improvement generally relate to the management oversight of EWRA processes, the robustness of the EWRA methodologies, and the effectiveness of the EWRA implementation.

As these key improvement areas are applicable for the industry in general, financial institutions should therefore take notice and try to incorporate the key takeaways into their own EWRA frameworks.

This update was authored by Kwah Chee Hian (Senior Associate).

Originally published 10 August, 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.