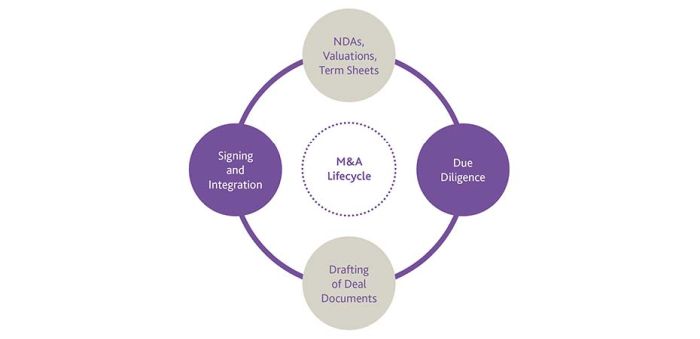

Continuing from our earlier article on the mergers and acquisitions (M&A) lifecycle, we will be looking at the process of due diligence which occurs once term sheets have been signed and non-disclosure agreements (NDAs) are in place. As a key part of the M&A lifecycle, a thorough due diligence process is likely to benefit both sides of a transaction. Through this process, buyers will become aware of any perceived risks in relation to their acquisition and can seek to either encourage the seller to remedy the issue or otherwise mitigate the risk through protections included in the transaction documentation. Sellers, on the other hand, can use this process to ensure full disclosure to buyers about the entity they are acquiring as a tool to reduce any potential liabilities post-transaction.

The due diligence to be carried out is often sector-target company ("Target") and purchaser-dependent, focusing on those areas where issues may arise. Generally, this is likely to include financial and legal due diligence, alongside possible other areas such as tax, commercial, technical, regulatory and/or environmental due diligence, depending on the nature of the Target (and its assets) and the buyer's concerns.

The scope of the legal due diligence will then likely be determined between the buyer and their lawyers. In particular, the following is likely to be considered:

- Corporate – Are filings, licences and registers complete, accurate and up-to-date? It is not unusual to find that shareholder and ultimate beneficial ownership registers have not been kept up to date, which should be rectified pre-completion where possible to avoid the buyer inheriting any liability in this regard. Corporate registries maintained by relevant authorities should be checked to confirm records are accurate, although in certain jurisdictions, including onshore in the UAE, these may not be accessible or available.

- Related Party Contracts – Are there contracts with related parties which may be at an undervalue or diverting profit or assets away from the Target? Are there director loans or similar? The buyer may want to consider whether such arrangements should remain in place following completion.

- Finance – Is there any security over the Target? Is there any indebtedness, including intra-group? Are there any personal guarantees or similar arrangements in relation to debt facilities? These should be considered to identify any repayments required at completion and removal of charges where appropriate. This will also usually be flagged through financial due diligence.

- Commercial – Are the Target's top customer and supplier contracts current or historic (i.e. is there a revenue pipeline and is supply secured)? Specifically in the UAE, are there any agency or distributor arrangements which may be difficult to terminate due to local laws? Do the contracts include balanced provisions to address risk or are there any unusual/overly onerous obligations? Are there any change of control provisions? Where such issues exist, it is not unusual for lawyers to recommend that affected contracts be re-negotiated post-completion. The buyer will also need to consider whether it wishes to seek change in control consents from key customers pre-completion.

- Intellectual Property (IP) – What IP has been registered and what remains unregistered? Has the registered IP been registered in the name of the Target, or does it need assigning from another entity or individual? Does the Target own the IP used in connection with its business, or does it rely on third-party licences? Do employment contracts contain adequate IP provisions (i.e. ensuring all IP is held by the Target)? Depending on the issues raised, pre and post-completion rectification items may be recommended, such as ensuring IP assignment documents are in place.

- Litigation – Has the Target been involved in any litigation in recent years? If so, what is the status? If cases are ongoing, an assessment of risk will need to be made, and protection sought in the transaction documents (if deemed material) to avoid the buyer inheriting any latent liability for something that occurred prior to its control.

- Employment – What contractual arrangements are in place with employees/contractors? Are contractors treated as contractors, or is there a risk of them being reclassified as employees and therefore subject to more statutory rights/obligations? What termination provisions and post-termination restrictions are included? It may be that new employment contracts are recommended, particularly for senior management, prior to completion of a transaction. It will also be important to understand who the key employees are and seek some assurance that they will continue after the change of ownership. If key employees whose details are registered with a relevant authority, such as a General Manager of a UAE entity, will be leaving post-completion, corporate filings and signatory requirements will also need to be considered as part of the due diligence.

- Property – What properties are leased/owned by the Target? Are any leases due to expire, what are the terms of these, and do they contain any unusual obligations? Has the Target breached any covenants? If the lease term is near expiration, the renewal process should be considered (particularly if the premises are critical to the Target), or if not, the position on dilapidations needs to be considered and those charges accounted for.

- Regulatory – What licences/regulatory consents does the Target require to operate in key jurisdictions? Are filings and licences, including any trade licences if the Target is based onshore in the UAE, current and up-to-date? Have any regulatory investigations been undertaken, and what was the outcome of these? It may be that updates are required pre or post-completion to rectify any issues identified.

The above is not intended to be an exhaustive list, but considers some of the key areas that would usually be considered to some extent. These need to be considered across the Target's group of companies, wherever they may be incorporated. There may be significant transactional risks that apply only in certain jurisdictions; therefore, those local matters should be considered, and by local lawyers where appropriate.

As alluded to above, once risks have been identified, the lawyers carrying out the due diligence should go beyond this and consider recommendations to the buyer. These may include recommendations to consider a price-chip in the event of a material issue, to recommend indemnities to protect the buyer (on a pound for pound basis) in the event of any loss, and warranties to ensure the sellers can confirm certain positions in relation to the Target and its group companies. They may also consider rectification items to be undertaken pre or post-completion by the Target and sellers should anticipate such requirements when considering their sale timeline.

The upcoming third part of our M&A lifecycle series will consider the key transaction documents and the role they play in the M&A process.

Gowling WLG is well-placed to assist with all aspects of M&A transactions and is consistently ranked for M&A work across the globe. We are able to deliver both cross-border and domestic corporate transactions as part of structured sale processes or off-market deals.

Read the original article on GowlingWLG.com

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.