So...2021 started much like 2020 ended. We are all still at home, we are still binge watching unchallenging TV (Bridgerton anyone...?), the chance of having a meal at a restaurant still seems pretty remote and, of course, you can hardly move for hearing about SPACs, with S&P Global Market Intelligence reporting that more SPAC listings have already taken place in 2021 than took place in the whole of 2020.

As you are almost certainly aware, a special purpose acquisition company is a public company which raises funds via its listing, typically in order to acquire an existing business. They are by no means new, but as is well documented, have been enjoying a huge resurgence. In the US, SPAC Insider reported $36.2 billion raised in gross proceeds during 2020 (compared to $13.6 billion in 2019 and $10.8 in 2018).

However, when it comes to Channel Islands listings, notwithstanding the introduction of new rules by The International Stock Exchange ("TISE") back in 2017 designed to facilitate the listing of SPACs, there has not been a huge amount of activity. TISE is very much the exchange of choice for technical listings and was ahead of the game in introducing the relevant SPAC framework, with stock exchanges around the world catching up and looking to improve their SPAC appeal (for example, the recently reported rule change at Nasdaq Stockholm to bring it in line with the US and Nasdaq Nordic introducing a new framework, not to mention Rishi Sunak trying to encourage SPAC business into the City in the recent budget).

Notwithstanding the lack of activity to date, anecdotally at least, SPAC interest in TISE seems to be on the rise. We are certainly seeing an increase in the number of enquiries. Add that to the number of deals and ongoing global coverage relating to SPACs, we thought it worth revisiting TISE in this context.

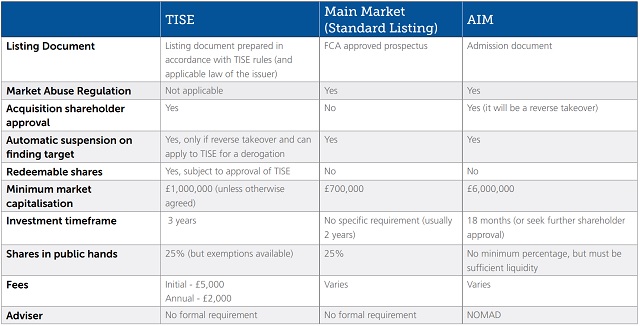

At the end of this article is a table summarising a few of the requirements of LSE and TISE listings. There are of course other factors to consider, but clearly TISE compares favourably. For example, under the TISE listing rules there is no express automatic suspension of a SPAC's shares when a target is identified unless the acquisition would be a reverse takeover, and redeemable shares can be listed on TISE, which is often required for SPACs. In addition, EU Listings Directives (including the Market Abuse Regulation) do not apply and its requirements are considered pragmatic and flexible, though of course are implemented in line with international standards and requirements. Another key advantage is TISE's very competitive and transparent fee regime.

Over in the UK, as set out by Lord Hill in the UK Listing Review (3 March 2021), the LSE is looking to enhance the UK listing rules so that the UK can better compete with the US and European exchanges for the listing of SPACs, with listings in the US more common to date. It is currently anticipated by the UK FCA that certain enhancements will be in place towards the end of 2022, including the removal of the presumption that SPAC shares will be suspended on identifying a target, and replacing it with rules around disclosures to investors and their rights on approving acquisitions and redeeming their investment.

TISE listing rules in respect of SPACs are also under review and in the interim, it is possible to apply to TISE for a derogation from listing rule 3.4.3, which relates to the automatic suspension on a reverse takeover. However, this would be considered by TISE subject to a suitable rationale being provided and would be granted by TISE on a case-by-case basis.

Until the UK listing rules have been enhanced to be more attractive to SPACs, TISE represents a cost-effective, quick and efficient route to the listing of SPACs in a UK time-zone.

As with all trends, only time will tell if this resurgence in SPAC activity is here to stay and whether TISE begins to see an uptick in their listings in the Channel Islands. We certainly hope so as TISE is, independently of SPACs, an internationally recognised exchange, as well as extremely flexible while maintaining international standards of regulation.

Walkers is a full member of TISE, regularly advises on the listing of companies outside of the Channel Islands and would be delighted to answer any queries or discuss the above in more detail. In the meantime, save for SPAC listings going from strength to strength, we hope that 2021 turns out to be a very different year from 2020.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.