1. Status of online shopping platforms in Vietnam in 2020

1.1 Status of online shopping platforms

Vietnam is truly a land of opportunity for domestic and foreign e-commerce companies1 because of its digitally savvy young population, high Internet penetration rate (ranked 14th in the world2 ) and rising smartphone penetration rates.

According to surveys carried out by the Vietnam E-Commerce Association ("VECOM"), the growth rate of ecommerce reached over 32% in 20193 . 2019's scale of e-commercial retail sales and consumer services was around 11.5 billion USD4 . The Southeast Asia E-commerce Report in 2019 by Google, Temasek and Bain&Company also predicts that the Compound Annual Growth Rate from 2015 to 2025 will reach 29%. By that time, the scale of Vietnam's e-commerce will reach USD$43 billion, ranking the third in ASEAN5 .

Over the last four years, approximately US$1 billion in funding has been invested into Vietnam's e-commerce sector, reaching a record high in 2019. The period 2018-2019 also witnessed the emergence of Vietnam-origin ecommerce players, such as Tiki, Thegioididong and Sendo, which are among the most successful e-commerce platforms in the region6 . In 2019, Shopee raised to become the market leader with monthly traffic of over 40.7 million, dramatically increasing by 71% compared to its performance in 20187 .

E-commerce has become much more popular, and a frequent shopping channel of a large number of customers, especially the 9X generation clients in Ha Noi and Ho Chi Minh City8 . Despite accounting for only 18% of the population, in 2019, Ha Noi and Ho Chi Minh City contributed more than 70% of the total e-commerce transactions of the whole country9 .

B2C E-commerce in Vietnam is classified into four different types10:

- E-commerce website

- E-commerce trading floor

- Online auction website

- Online promotion website

E-commerce trading floor ("E-commerce platforms") carries the majority of E-commerce activities in Vietnam with the four major players: Shopee, Tiki, Lazada and Sendo.

Vietnamese consumers are shopping online through two other means: social media platforms and mobile apps. While social media platforms are quite popular among Vietnamese consumers, mobile commerce is still an emerging trend11. The most popular social media platforms in Vietnam are Facebook, Zalo, Tiktok and Instagram. Facebook is also one of the popular channels for online shopping, especially for small retailers due to lower requirements of technical capacity12. However, E-commerce platforms are still the most popular online shopping channel among Vietnamese consumers (91 percent) compared to 43 percent who shop on social networks13.

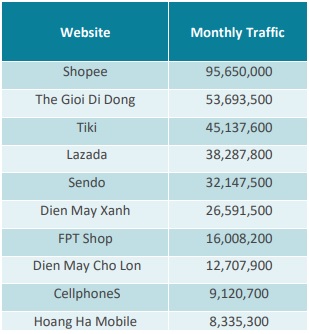

Top 10 most e-commerce websites in first six months of 202014

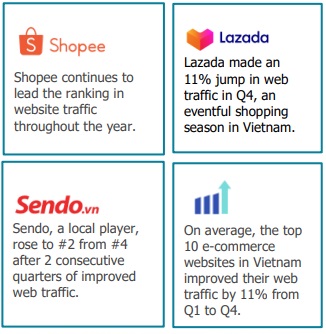

Remarkable statistics of e-commerce platforms in 20191

Footnotes

1 https://www.retailnews.asia/e-commerce-boom-in-vietnam-the-rising-tiger/

2 Based on statistics of Internet World Stats (Data as of Q1 2020) https://www.internetworldstats.com/top20.htm

3 REPORT ON VIETNAM E-BUSINESS INDEX 2020 by VECOM

4 Idem

5 Idem

6 Vietnam's Booming E-Commerce Market by Dang Hoang Linh , published on ISEAS Perspective 2020, No. 4 https://www.ssi.com.vn/index.php/en/individual-customer/economic/news/518713

7 https://e27.co/ecommerce-wars-in-vietnam-intensify-heres-all-you-need-to-know-20200312/

8 REPORT ON VIETNAM E-BUSINESS INDEX 2020 by VECOM

9 REPORT ON VIETNAM E-BUSINESS INDEX 2020 by VECOM

10 Article 3, Degree 52/2013/NĐ-CP on E-commerce ("Degree 52")

11 http://www.ukabc.org.uk/wp-content/uploads/2018/09/EVBN-Report-E-commerce-Final-Update-180622.pdf

12 https://e27.co/ecommerce-wars-in-vietnam-intensify-heres-all-you-need-to-know-20200312/

14 Statistics from The Map of E-commerce in Vietnam by Iprice Group https://iprice.vn/insights/mapofecommerce/en/

To read the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.