Donal O'Donovan (Partner, Dublin), Turlough Galvin (Partner & Co-Head of the Finance and Capital Markets Department, Dublin) and Alan Keating (Partner, New York) at Matheson are often asked by clients and non-Irish law firms about:

- whether Irish law account security is appropriate for lenders to Irish investment funds with an Irish depositary which has appointed sub-custodians who ultimately hold the fund assets in accounts outside of Ireland; and

- in circumstances where Irish law account security is appropriate, what security packages are available and customary in Ireland in respect of depositary accounts held by Irish investment funds.

They have set out a brief (and hopefully helpful) summary of these issues below.

Is Irish law account security appropriate?

A depository appointed in respect of an Irish investment fund for the purpose of (among other things) safekeeping the fund's assets must itself be "located" in Ireland. In practice, however, this does not necessarily mean the underlying fund assets custodied with the depositary will themselves always be located in Ireland.

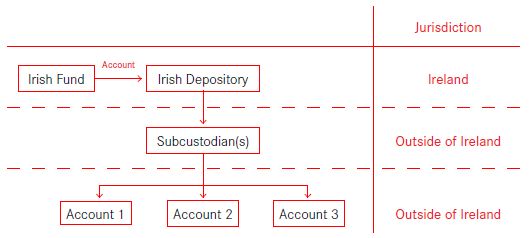

Referring to the below structure by way of illustration and example: an Irish fund would have one or more securities (and possibly also cash) accounts recorded for the benefit of the fund on the books of an Irish depositary (simplified in the illustration below as a single account).

In order to perform its safekeeping functions in respect of the fund assets, the depositary may enter into subcustody arrangements with one or more sub-custodians. Those subcustodians may be located in jurisdictions outside of Ireland, and hold the fund assets sub-custodied with them in accounts outside of Ireland.

As an example, Account 1 above could be a GBP cash account held at a financial institution in London and Account 2 could be a securities account in respect of shares issued by a US company located in New York.

The question therefore arises as to which point in the structure, and therefore over which account, security would customarily be taken.

The typical approach in Ireland is to follow the "place of relevant intermediary approach" ("PRIMA"). Following PRIMA:

- The account(s) over which a secured party would take security are the Irish fund's account(s) with the depositary in Ireland (and therefore Irish law governed account security would generally be appropriate).

- The Irish fund would not be considered to have right, title and interest to the accounts held with the sub-custodians, which precludes it from granting security over those accounts.

- Rather, those sub-custodied accounts are the depositary's accounts (ie, the depositary custodies the fund assets for the benefit of the Irish fund subject to trust or other arrangements with the relevant sub-custodians). On enforcement, a secured party would generally seek to direct the depositary to take specific actions to realise the fund's assets from the sub-custody arrangements, and this key consideration will feed through to the security structure and related documentation (considered further below).

The above analysis would differ if the Irish fund had a direct nexus or account with a sub-custodian, and security in the context of any such direct arrangements should be considered.

What security structures are used in practice?

Where the security granted in a fund financing transaction in Ireland is to include security over the fund's account(s) with the depositary in Ireland, the security structure and related documentation will need to be agreed to, among other things, (i) create the security over the depositary account(s) and any assets held in such account(s) and (ii) govern the rights (eg, the fund's access to assets / withdrawal parameters) of the various parties involved both pre- and post-enforcement.

A key consideration from the secured party's perspective will be to ensure that the depositary will facilitate the secured party's realisation of the underlying fund assets in an enforcement scenario, including where the depositary has custodied those assets (whether cash or investments) to subcustodians.

Below is a brief overview of a number of possible approaches to structuring security packages in respect of depositary accounts located in Ireland that we have seen used:

- Bilateral account charge with notice and tripartite acknowledgement: This approach involves a bilateral account charge between the fund and the secured party which is accompanied by a separate tripartite acknowledgement entered into by the fund, the secured party and the depositary. Pursuant to the account charge itself, the fund grants security over its interest in the depositary account(s) and the assets held in such account(s). The depositary, secured party and the fund then enter into a tripartite acknowledgement which governs matters such as access rights and withdrawal parameters. The depositary can also provide certain undertakings in the acknowledgement, including in respect of facilitating enforcement, in favour of the secured party.

- Bilateral account charge and tripartite account control agreement: Similar to the preceding approach, this approach also involves a bilateral security document. However, in this case the accompanying document is a full account control agreement which is entered into by the fund, the secured party and the depositary. It is this account control agreement that governs the rights between the relevant parties (such as access to the fund's accounts and assets held in them both pre- and post-enforcement) and contains the relevant undertakings from the depositary to the secured party, including to facilitate enforcement.

- Tripartite account charge: In our recent experience, this approach is used less often in the Irish market in the context of fund financing transactions but, when used, involves (i) the fund granting security over its (beneficial) interest in the depositary account(s) and the assets held in them and (ii) the depositary granting a charge over its (legal) interest in those account(s) and assets, in each case in favour of the secured party. The account charge itself also governs matters such as access to the fund's assets and contains the relevant undertakings, including to facilitate enforcement, in favour of the secured party.

In addition to the secured party having security over the depositary account(s) themselves and the assets held in such account(s), it is desirable for the secured party to also obtain a charge or assignment over the depositary agreement, insofar as it applies to the particular assets charged. Under the depositary agreement, the fund has a right to the return of its assets from the depositary and this right would (if secured in favour of the secured party) be able to be invoked by the secured party in an enforcement scenario.

There is of course no "one true approach" and the relevant account security structure and documentation involved will need to be considered on a case-by-case basis depending on the facts of a particular transaction and the relevant arrangements in place.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.