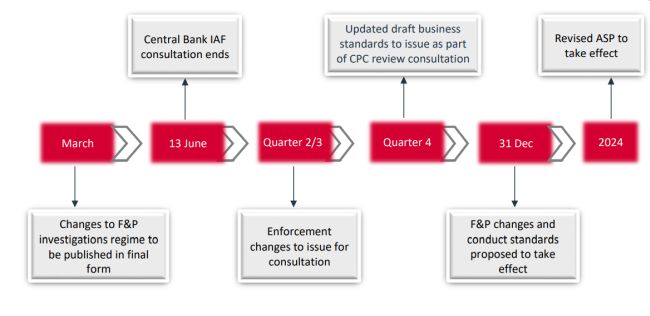

On 13 March 2023, following hot on the heels of facilitative legislation, the Central Bank published its long-promised individual accountability framework (IAF) for industry consultation.

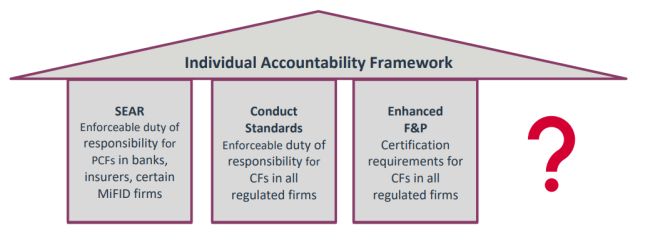

Introduction of the IAF has been a key agenda item for the Central Bank since 2018 and, as the name suggests, it seeks to hold individuals accountable for their responsibilities in regulated firms. The framework includes:

- a senior executive accountability regime (SEAR) for banks, insurers and certain MiFID firms – fund managers are not therefore, in scope of the first wave of SEAR;

- conduct standards for individuals in all regulated firms and firms themselves;

- enhancements to the Fitness & Probity (F&P) regime relevant to all regulated firms; and

- enhanced Central Bank powers of enforcement to ensure individuals' and firms' compliance with the IAF.

What's included in the IAF consultation?

The consultation includes draft Central Bank rules and guidance for three of the four pillars of the proposed framework:

What's still to come?

Enforcement changes – the consultation did not include anticipated changes to the Central Bank's Administrative Sanctions Procedure (ASP) following the removal of the participation hurdle and while no explanation is provided, the Central Bank has confirmed a separate consultation on updates of "all core ASP documents" will issue in mid-2023.

Business standards – these standards will be developed as part of the Central Bank's separate review and consultation on the update of the Consumer Protection Code (CPC)

Changes to F&P Investigations – updates to the Central Bank's F&P investigation regulations and guidance reflecting the IAF Act will issue separately this month

When does the consultation end and what happens next?

Pillar 1: SEAR – Effective 1 July 2024

The IAF imposes an enforceable legal duty on pre-approval controlled function (PCF) holders to take reasonable steps to avoid a firm breaching those legal obligations relating to activities for which the PCF is responsible. The consultation includes draft rules for the scope of this legal duty, PCF responsibilities and firms' documentation of those responsibilities along with draft regulatory guidance for assessing 'reasonable steps' and complying with the draft rules.

Are fund management companies in scope of SEAR?

Initially, SEAR will only apply to banks, insurers and MiFID firms carrying out bank-like activities. Fund managers are therefore, not in scope of SEAR. However, the Central Bank confirms, as per previous indications, that it intends to extend SEAR's application once lessons have been learned from the first wave. As this briefing is for fund managers it does not focus on SEAR however, further details of this pillar of the IAF can be found on our dedicated IAF & SEAR site.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.