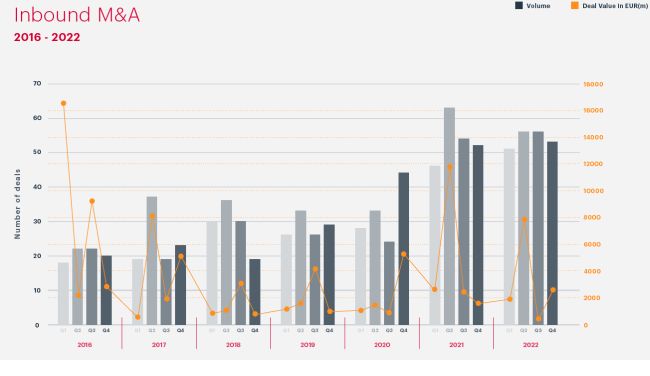

Overseas investors remain committed to Ireland: foreign acquirers conducted 216 transactions in the country in 2022 – one more than in 2021, but the total value of inbound deals fell by almost a third to €12.5bn. All but three of the 20 largest deals of the year were inbound cross-border transactions.

Interest in Irish business is truly global. Close to home, the country represents an obvious opportunity for UK acquirers, accounting for 72 deals last year, more than any other country. But buyers also came from across the Atlantic as well as across the Irish channel, with US acquirers pursuing 60 transactions. In value terms, Japanese buyers led the way, driving €7bn worth of M&A deals, with the US in second place, with €2.2bn.

This international focus partly reflects Ireland's strengths – a good selection of high-quality companies spread across multiple sectors, a highly educated and talented workforce, and a well- performing economy with strong public finances.

The stable political backdrop in the country is also supportive; the appointment of Leo Varadkar as Prime Minister in December, replacing Micheál Martin, was a well-choreographed move by the coalition government. On policy, it remains welcoming to overseas investors; plans to introduce more scrutiny of foreign takeovers in key industries, for example, were delayed while feedback from the market was considered.

Equally, however, Ireland itself is not always the main attraction – many acquirers see the country as a gateway to the rest of the European Union. Despite its continuing growth, the Irish economy is small compared to the likes of France and Germany but offers s an accommodating environment for investors keen to target the whole bloc.

It's also worth saying that M&A transactions in Ireland are by no means limited to overseas buyers. Last year saw 84 deals that involved purely domestic players, down only marginally from 2021's total of 92. Those included the €1.1bn Hibernia REIT acquisition by Benedict Real Estate

Please click here or on the image to download our full report.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.