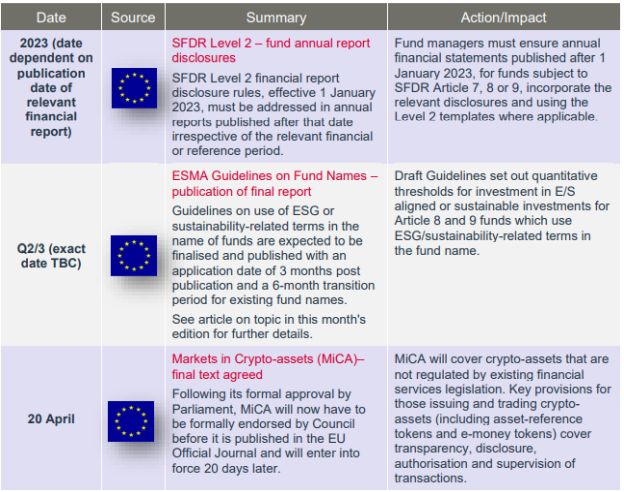

Key Dates & Deadlines: Q2/3 2023

Updates to the Central Bank's Fitness and Probity Enforcement Procedures

The Central Bank (Individual Accountability Framework) Act 2023 (the IAF Act) was signed into law by the President of Ireland on 9 March 2023. Part 3 of the IAF Act, which was commenced by Order of the Minister for Finance on 19 April 2023 (the commencement date), makes changes to the Central Bank's fitness and probity regime under Part 3 of the Central Bank Reform Act 2010 (the 2010 Act).

These amendments to Part 3 of the 2010 Act necessitated a number of changes to the Central Bank's regulations and guidance in relation to fitness and probity enforcement procedures. The updated regulations and guidance, applicable from 20 April 2023, are as follows:

- the Fitness and Probity Investigations, Suspensions and Prohibitions: Guidance (April 2023) replaces the previous guidance; and

- the Central Bank Reform Act 2010 (Procedures Governing the Conduct of Investigations) Regulations 2023 replace the previous regulations.

The Central Bank has issued a guide explaining the changes to Part 3 of the 2010 Act, and how they apply to investigations and related procedures which were ongoing at that time – see Fitness and Probity Investigations, Suspensions and Prohibitions: Guide to Transitional Arrangements Arising from the Central Bank (Individual Accountability Framework) Act 2023 (April 2023). Below is an overview of the changes to Part 3 of the 2010 Act, as set out at Appendix 1 of this guide:

| Change | Summary |

| Investigation of individuals who formerly performed CF roles | The Central Bank can now investigate an individual who formerly performed a controlled function (CF) role provided that they performed the role within the shorter of the following periods: (a) the period since 19 April 2023 (the commencement date of the relevant provision), and (b) the 6 years before the date on which an investigation is commenced. |

| Commencement of investigation | A new statutory procedure has been introduced for giving notice of investigations. |

| Suspension | The limit for the initial duration of suspension notice issued by the Central Bank has increased from 3 months to 6 months. Suspension notices confirmed by the Central Bank may now be appealed to the Irish Financial Services Appeals Tribunal. The period for which the High Court may extend a suspension notice has increased from 3 months to 6 months. The Central Bank may make subsequent applications to the High Court to further extend the suspension notice. |

| Investigation report | The statutory procedure for investigation reports has been changed to provide for the preparation and service of a draft report followed by a final report. |

| Discontinuing an investigation | The Central Bank may discontinue an investigation for reasons to be stated in the notice. |

| Prohibition | Prohibition notices, which previously took effect on service, will now take effect only when confirmed by the High Court or agreed in writing, |

| Varying / revoking prohibition | A procedure has been introduced allowing the Central Bank or the subject to apply to the High Court for an order varying or revoking a prohibition notice that was previously confirmed by the Court. |

| Regime extended to certain holding companies | The fitness and probity regime will (upon the Central Bank issuing regulations) apply to individuals performing certain CF roles in holding companies of certain regulated firms. |

| Enhanced independence requirements | Certain requirements have been introduced to ensure the independence of an investigation and associated decision-making procedures. |

The Central Bank has also notified relevant industry bodies of these changes – see Industry Letter of 21 April 2023.

The amendments to Part 3 of the 2010 Act are part of a suite of changes that are being introduced in order to give effect to the individual accountability framework (the IAF). The Central Bank has opened a three-month consultation (which closes on 13 June 2023) on certain aspects of the IAF. Further information is available at www.centralbank.ie/IAF.

ESAs Consult on SFDR Level 2 Revisions

On 12 April 2023, the ESAs published proposed amendments to the SFDR Delegated Regulation (Level 2) for industry consultation. The consultation is open until 4 July 2023.

The proposed amendments, summarised below, fall into two categories:

- Commission-mandated amendments to the PAI indicators and new disclosure rules for decarbonisation targets; and

Click here to continue reading . . .

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.