The first destination for FDI in the world has nowadays an information exchange network to allow closer scrutiny of FDI into key technologies, infrastructure, inputs or access to sensitive information on the EU market.

Foreign Direct Investment ("FDI") defined

FDI is an investment of any kind by a foreign (third country) investor aiming to establish lasting and direct links between the investor and the company to which the capital is made available. This includes investments which enable effective participation in the management or control of an EU company, but should not include portfolio investments.

The FDI Regulation: a framework for optional national screening regimes

The FDI Regulation does not oblige Member States ("MS") to set up FDI control regimes.

However, if a MS decides to rely on an FDI control regime, the FDI Regulation sets out key requirements that should lead to a more consistent foreign investment screening policy across the Union: transparency, non-discrimination and recourse against national decisions.

In the same vein, the FDI Regulation sets out a non-exhaustive list of criteria that should allow MS and the Commission to consider whether a particular investment on inter alia critical infrastructure and technologies may affect security or public order:

- is the foreign investor controlled by a third country government ?

- has the investor already affected security or public order in a MS?

- Is there a serious risk that the

foreign investor engages in illegal activities?

The FDI Regulation: an information sharing framework for all MS

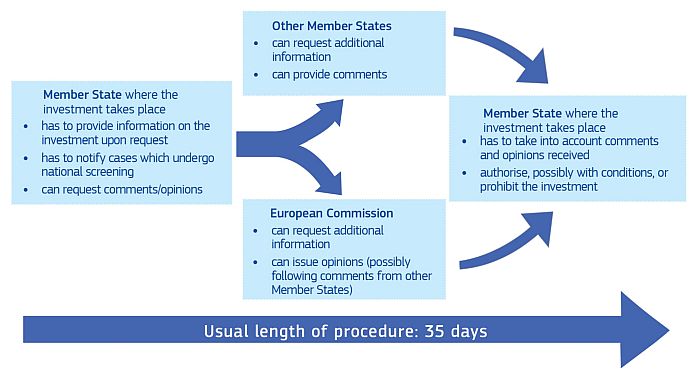

MS relying on FDI control systems must notify cases which undergo official national screening investigations. Every MS must provide information on FDI upon request of another MS or the European Commission.

Such information to be gathered and communicated include the identity of the investor and the target company, the sector in which such company operates, the value of the investment as well as the origin of its funding, and when the transaction is supposed to take place.

Third, every MS is obliged to report to the commission on an annual basis aggregated information on FDI that took place in their territory. MS relying on FDI control systems have to report on the application of their screening mechanisms.

The information sharing framework put in place by the FDI

Regulation may slow down the implementation of an FDI.

(Source: European Commission - See p. 2 of the factsheet of the Commission on the FDI Regulation, accessible here_)

Connection to the ongoing sanitary health crisis

In the wake of the Covid-19 pandemic the Commission has published guidelines aimed at protecting and controlling foreign influence on critical assets such as health, medical research, biotechnology and infrastructure that are essential for the EU's public order.

The Commission also encouraged MS with no screening mechanism, to set up a regime that allows control over foreign influence on assets critical to national and European interests.

Shortly after the publication of the communication, Luxembourg paved the way with primary legislation to establish a domestic legislative screening mechanism.

FDI control in Luxembourg

The proposal of Bill No7578 on May 19, 2020, marks a first step to establish an FDI control regime in Luxembourg. It aims at scrutinizing foreign investors that are in the process of acquiring at least 10% of the shares or voting rights in a company in Luxembourg.

Though not in final form yet, the bill envisages a screening mechanism based on a prior notification obligation and pre-evaluation procedure. While the substantive assessment of the investment will be carried out on basis of criteria set out in the FDI Regulation, procedural non-observation of the law (such as implementation of the transaction without prior approval) can trigger significant administrative fines and unwinding of the transaction.

The expertise and service of Arendt & Medernach

As Luxembourg's leading law firm with a vast European reach and expertise, we can assist in understanding and interpreting EU and national applicable legal frameworks and coordinating EU-wide national FDI filings together with leading partner law firms across the continent. We can also assist with merger control concerns and procedures in the context of FDI as well as in all aspects of national law (including corporate, tax, or labour law). Do not hesitate to get in touch if you have any further questions on these developments or on our service offering.

Originally published by Arendt, October 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.