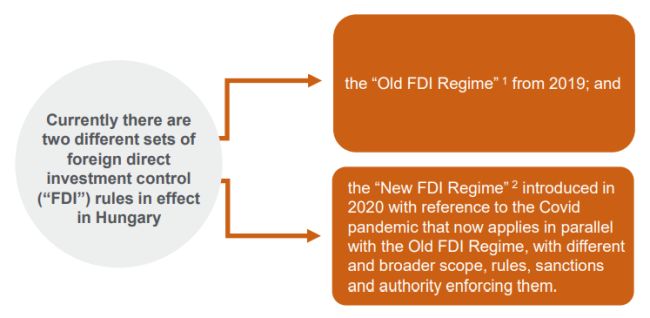

On 23 December 2022, the Hungarian government adopted a new decree3 (the "New FDI Government Decree") amending certain rules of the New FDI Regime set forth in Act LVIII of 2020 and in some other laws. 4 The New FDI Government Decree is applicable during the emergency situation declared in Hungary relating to the war in Ukraine, i.e., until approximately the end of May 2023, although the Hungarian government may prolong the emergency situation if its conditions remain. From the legal perspective, this means that the previous rules of the New FDI Regime remain in effect, but as long as the New FDI Government Decree is in force, its provisions prevail over the general rules and must be applied to transactions covered by the New FDI Regime. The New FDI Government Decree did not change the Old FDI Regime, but it is important to note that until 1 June 2023, investors from the EU, the EEA and from the Swiss Confederation also qualify as foreign investors under the Old FDI Regime. The New FDI Government Decree introduces the following main changes to Hungary's New FDI Regime, in addition to several technical clarifications and modifications.

01 Definition of state interest

The New FDI Government Decree creates a more uniform system of definitions by incorporating the definition of state interest—with unchanged content—from Act XCIX of 2021, so that all applicable rules of the New FDI Regime are included in the same law. State interest is defined as public interest related to the security and operability of networks, equipment and to the continuity of supply, or related to a fundamental economic strategic interest from a national economic perspective and which is not regulated by sectoral EU or national law.

This definition is important because upon receipt of the FDI notification, the minister shall immediately examine whether the notifier's acquisition will harm or threaten the state interest, public safety, and public order of Hungary, or the possibility of their occurrence.

02 Activities that make a company 'strategic'

It remains unchanged under the New FDI Government Decree that transactions involving a socalled "strategic company" must be notified to the authorities. The list of the types of entities that may qualify as a "strategic company"—similar to the definition of state interest—has been unified by adding universities and colleges operating in the form of a legal entity. These can qualify as "strategic" if they are engaged in activities the NACE (in Hungarian TEÁOR) code of which are included in Annex No. 1 to the New FDI Government Decree.

The New FDI Government Decree adds the following new activities to the already extensive list of strategic activities that qualify a company as strategic company:

- Financial service activities, except insurance and pension funding; and

- Insurance, reinsurance and pension funding, except compulsory social security.

03 Notifiable transactions

A transaction must be notified if certain types of foreign investors intend to acquire interest in a Hungarian strategic company by entering into certain transactions. The New FDI Government Decree sets out three foreign investor categories (the "Foreign Investor"):

- a legal entity or other organisation registered in the EU, the EEA or in the Swiss Confederation if a non-EEA person has majority influence in such entity; or

- a citizen of or a legal entity or other organisation registered in a country outside the EU, the EEA or in the Swiss Confederation; or

- a citizen of or a legal entity or other organisation registered in another EU/ EEA country and in the Swiss Confederation.

A transaction must be notified if a Foreign Investor defined in point b (i.e., a purely third-country investor) acquires

- a stake as a result of which its shareholding, directly or indirectly, is at least 5% (instead of the previous 10%) in a strategic company, or at least 3% if the strategic company is a public limited company, provided that the total value of the investment reaches or exceeds HUF 350 million; or

- a 10%, 20% or 50% stake (or a bond or beneficial interest) in a strategic company (instead of the previous 15%), regardless of the value of the transaction.

A transaction must be notified if a Foreign Investor defined in points a) or c) acquires directly or indirectly majority influence in a strategic company by acquiring shares, a bond or usufructuary right, provided that the total value of the investment reaches or exceeds HUF 350 million..

A transaction must also be notified if a Foreign Investor either defined according to points a) or b) (i.e., investors other than purely EU/EEA/Swiss Confederation based investors) acquires the title to, or the operating rights (e.g., acquiring strategic assets as part of asset deals or by way of a lease agreement or exercising a call option right) of, infrastructure assets, equipment or tools that are essential for the conduct of the strategic company's activities.

04 Eemption rule for intra-group transactions in 04 Hungary

Hungary's New FDI Regime provides for an exemption from the notification obligation for transactions that are implemented in respect of a foreign entity and in relation to companies that are related parties within the meaning of the Hungarian Accounting Act. The New FDI Governmental Decree attempts to clarify the wording of the intra-group exemption, but it remains unclear whether the exemption granted to intra-group restructurings applies to transactions directly or indirectly over strategic Hungarian companies. Based on a conservative interpretation of the New FDI Governmental Decree, the intra-group exemption may apply only to upstream transactions, i.e., transactions where the share transfer involving related parties occurs in respect of a foreign entity (e.g., at the level of the mother company of a strategic Hungarian company).

This would mean that intra-group restructurings entered into by and between related parties at the level of a strategic Hungarian company (i.e., the shareholder of the Hungarian company changes) may not be exempt from the notification obligation under the New FDI Regime. It is worth noting that the New FDI Governmental Decree maintains the foreign-to-foreign exemption rule of the New FDI Regime, meaning that third-party upstream transactions executed above the level of a strategic Hungarian company are exempt from the notification obligation.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.