This article presents the pressing need for corporates to establish an anti-bribery/anti-corruption policy in today's global business environment. Corruption poses a significant threat to a country's socio-political well-being and economic health, fostering monopolistic practices, unfair competition, and unethical market behavior. To effectively address and combat corruption, corporates must prioritize transparency, enforce stringent anti-corruption measures, and foster a culture of ethical conduct.

Furthermore, the increasing globalization of business has led to the enactment of anti-bribery policies and legislation with extraterritorial reach. It is imperative for companies to ensure compliance not only with their home country's laws but also with the legal frameworks of the countries where they operate. With regulatory burdens and legal consequences on the rise, implementing a robust anti-bribery/anti-corruption policy becomes indispensable to safeguard corporate reputation, protect stakeholder interests, and contribute to the overall development and prosperity of the country.

Introduction

According to Charles Caleb Colton, an English cleric, writer, and collector, "Corruption is like a ball of snow, once it's set a rolling, it must increase."

This analogy holds true for snowballing corruption, which poses a significant threat not only to the socio-political well-being of a country but also to its economic health. In India, corporations have unfortunately become enablers of corruption, leading to detrimental consequences in the market.

The implications of corporate corruption are manifold and severe. It can give rise to monopolistic practices, disrupt fair competition, and discourage ethical market behaviour. Hence, it is crucial to address and combat corruption within the corporate sector because it seriously undermines the market integrity and economic vitality of the country.

Bribery and corruption within corporate settings manifest in various forms, such as cash or gifts offered to individuals, their family members, or associates, inflated commissions, sham agreements, unauthorized allowances, non-monetary favors, and veiled political or charitable donations. These illicit actions can be carried out directly or through intermediaries.

Facilitation payments, often indistinguishable from bribes, have earned several aliases, including speed money, grease money, kickbacks, or goodwill money. While facilitation payments involve unofficial payments made to public officials to secure or expedite routine or necessary actions, kickbacks are payments made in exchange for business favors or advantages.

In this context, corporates are expected to create a fair and prosperous business environment by ensuring transparency, enforcing rigorous anti-corruption measures, and promoting a culture of ethical conduct. In addition, to ensure long-term growth, corporates must make integrity, accountability, and responsible business behaviour their top priority. By doing so, they can effectively mitigate the detrimental impacts of corruption and actively contribute to the development and prosperity of the country.

The Problem

In the era of globalization and economic liberalization, businesses are increasingly engaging in complex cross-border transactions with foreign government entities for obtaining approvals, etc. Consequently, governments worldwide have taken proactive measures by enacting anti-bribery policies and anti-corruption legislation having extraterritorial applicability.

Notable examples include the US Foreign Corrupt Practices Act, 1977 ('FCPA') which primarily addresses public bribery offences; and the United Kingdom Bribery Act, 2010 which covers commercial bribery and bribery of public officials. The UK Bribery Act holds extraterritorial jurisdiction thereby enabling UK authorities to prosecute acts of bribery regardless of the location of the offense. As a result, corporations must ensure compliance not only with the anti-corruption laws of their home country but also with the laws of the countries where they conduct business.

In India, corporate criminal liability is recognized, and the Supreme Court, in the case of Iridium India Telecom Ltd v. Motorola Incorporated & Ors.[(2011) 1 SCC 74], established the principle of attributing mens rea (guilty mind) to a company based on the "alter ego" concept. According to this principle, the state of mind of directors and managers, who represent the company's directing mind and will, can be imputed to the company. The court held that for corporate criminal liability to be established, it must be demonstrated that the degree of control exerted by individuals, or a body of persons is significant enough for the corporation to be deemed to act and think through them.

This legal test provided a defence for corporates against liabilities arising from the actions of rogue employees. Companies could argue that such employees do not represent the directing mind and will of the company, thus preventing the imputation of mens rea to the company. However, this defence plea is no longer available to the corporates.

Knocked Down Defences

In India, the primary legislation addressing corruption is the Prevention of Corruption Act, 1988 ('PCA') which applies to both Indian and foreign companies operating in India through subsidiaries or associated entities. The Prevention of Corruption (Amendment) Act of 2018, which came into effect on 26.07.2018, aligned the Indian anti-corruption legal framework with the international practices laid down by the United Nations Convention Against Corruption. The amendment act introduced the concept of corporate liability, covering all categories of corporate organizations in India and those carrying out business within the country. Consequently, corporates can no longer rely on the defence that instances of bribery and corruption are individual offences unless they can demonstrate that they had adequate compliance measures and safeguards in place to prevent their associated persons from engaging in such conduct.

The PCA defines a commercial organization to include a body corporate, partnership firms or any other association of persons, incorporated or formed outside India that carries on business in India. Section 8 of the PCA deals with the offence of bribing a public servant and provides for the punishment of imprisonment for up to 7 years or with a fine, or both. However, when such an offence is committed by a commercial organization, it is punishable only with a fine under Section 9 of the PCA except if the offence has been committed with the consent or connivance of any director, manager, secretary or other officer of the organization. In such instances, all individuals involved can be held guilty and may face imprisonment of 3 to 7 years along with a fine. The accused persons can defend themselves by proving the undue advantage only if they report the matter to the authorities under the PCA within 7 days of the offence being committed.

Even though the PCA applies to the whole of India and to Indians residing outside India, its extraterritorial reach is limited as it does not cover bribes made to foreign officials. To fill this void, India's Institute of Company Secretaries released the Corporate Anti-Bribery Code, 2017 which covers the bribery of foreign public officials and provides a voluntary structure that companies can adopt. In addition to the PCA, the Indian Penal Code of 1860, the Prevention of Money Laundering Act of 2002, the Central Vigilance Commission Act of 2003, and the state-level Lokayukta acts also attack offences related to corruption and bribery.

Regulatory Burden: Companies Act & Indian Corporates

The Companies Act, 2013 ('Act of 2013'), adds to the challenges faced by corporates in India. The Act of 2013 lays down stringent provisions related to fraud, which encompasses any act, omission, concealment of facts, or abuse of position committed with the intent to deceive, gain undue advantage, or harm the interests of the company, its shareholders, creditors, or any other person. Notably, the offence of corporate fraud does not require a wrongful gain or loss to occur. Acts of private bribery and the concealment of such acts are punishable with imprisonment ranging from 6 months to 10 years, along with a fine based on the amount involved in the fraud. However, for fraud falling below a de minimums limit (Rs. 1 million or 1% of the company's turnover, whichever is lower, and not involving public interest), the punishment is imprisonment of up to 5 years, a fine of up to Rs. 5 million, or both.

Under the Act of 2013, directors have a legal obligation to provide specific confirmations in their directors' responsibility statements. They are also required to disclose any fraud reported by auditors, excluding those that must be reported to the central government. Auditors, cost accountants, and company secretaries are all required to report any suspected fraud to the central government during the course of their respective duties. Listed companies and certain types of unlisted companies are also mandated to establish a vigilance mechanism to report concerns and safeguard whistle-blowers. All companies are required to have a disclosure mechanism for fraud in the auditor's report. Additionally, listed companies must disclose incidents of fraud to the stock exchanges in specific instances.

The establishment of the Serious Fraud Investigation Office ('SFIO') under the Act of 2013 serves as a powerful tool in combating white-collar crime and fraud. Empowered by the Act of 2013, the central government has the authority to direct the SFIO to investigate a company's affairs under specific circumstances. The SFIO is equipped with extensive powers to conduct inspections, unearth documents, and execute search and seizure operations including the power to arrest during its investigations. With these measures in place, the SFIO stands as a formidable force against corporate malfeasance.

Identifying the Red Flags

To effectively detect and mitigate potential risks while ensuring compliance with anti-corruption measures, organizations must be adept at identifying specific transactions or indicators that raise 'red flags', warranting meticulous scrutiny. By promptly recognizing and addressing these red flags, corporates can actively prevent instances of bribery and corruption. Employing a vigilant and proactive approach, companies not only safeguard their reputation but also protect stakeholder's interests, fostering a culture characterized by transparency and unwavering integrity.

- Contract involving a third-party consultant: The risk of undue influence and potential corruption is increased in a contract requiring the involvement of a third-party consultant who is a government official or has close ties to one.

- Unqualified or resource-limited business partner: Engaging with a business partner who lacks the required qualifications or resources to fulfil the services offered may indicate the use of sham contracts for bribery or corruption purposes.

- Promises of guaranteed success without explanation: If a party promises guaranteed success or obtains government approvals without providing a legitimate explanation of how these goals will be achieved, it raises suspicions of potential bribery or corruption.

- Unusual payment patterns or financial arrangements: High commissions, multiple offshore bank accounts, or other unusual payment patterns indicate the presence of illicit activities such as money laundering.

- Counterparty's refusal to accept certain clauses: Caution is required when a counterparty refuses to accept an anti-bribery or an anti-money laundering clause in a given contract suggesting the mala fide intentions of the said party.

- Negative findings from due diligence: Evidence uncovered during pre-acquisition or counterparty due diligence, indicating a history of bribery, law violations, or unconventional transactions should be regarded as a red flag.

- Excessive or dubious payments: Excessive or questionable pay-outs to the counterparty or its affiliates may imply the presence of inducement or corruption.

- Lack of transparency in fee splitting: Resistance or failure to disclose parentage or undisclosed principals, associates, or subcontractors involved in fee splitting raised concerns about potential corrupt practices.

- Refusal to grant access to books and records: If a party refuses to grant access to its books and records when requested under a proposed contract, it raises suspicions of non-compliance and possible hidden fraudulent activities.

The Solution

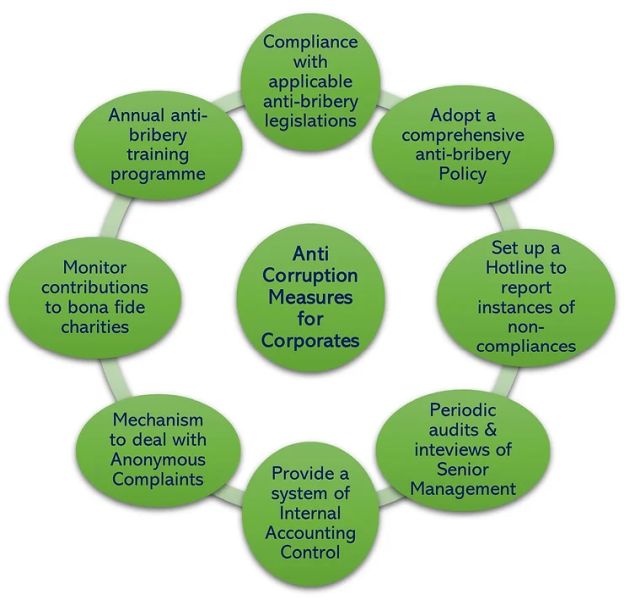

In order to navigate the extensive scope and intricacies of national and international anti-corruption legislation, corporates must take proactive measures to avoid significant reputational and financial consequences.

- Adopting a comprehensive anti-bribery policy: Corporates should adopt an all-encompassing anti-bribery policy that clearly communicates expectations and standards for employees at all levels of the organization. This policy should emphasize zero tolerance for bribery and corruption, outlining the consequences of non-compliance and reinforcing the importance of ethical conduct.

- Setting up a confidential Hotline: Creating a secure and confidential channel for reporting instances of non-compliance, such as a hotline or a similar dedicated reporting system. This would empower employees to come forward with concerns or suspicions without fear of retaliation and facilitate timely investigation and remedial action.

- Conducting regular audits and interviews: Regular audits and interviews with senior management can help identify potential risks and vulnerabilities within the organization. By assessing internal controls, financial transactions, and operational processes, companies can proactively identify areas of concern and take corrective actions to mitigate risks.

- Establishing internal accounting controls: Creating a robust system of internal accounting controls is essential for ensuring transparency and accountability in financial transactions. This includes mechanisms to monitor and track expenses, approvals, and disbursements, reducing the likelihood of illicit activities going undetected.

- Creating a mechanism for anonymous complaints: Providing a mechanism to address anonymous bona fide complaints encourages employees and other stakeholders to raise concerns without fear of reprisal. This fosters an environment of trust and transparency, where potential instances of bribery or corruption can be reported to the organization by even third parties.

- Monitoring charitable contributions: Vigilance in monitoring contributions to bona fide charitable organizations is crucial to prevent illicit funds from being disguised as donations. By implementing controls and due diligence processes, companies can ensure that donations for charitable purposes align with ethical standards and legal requirements.

- Conducting anti-bribery training programs: Comprehensive anti-bribery training programs should be conducted for employees at all levels whether annually or bi-annually. Such programs equip employees with the necessary knowledge and skills to identify and prevent bribery and corruption risks.

By adopting these proactive measures, corporates demonstrate their commitment to ethical business practices, strengthen their internal controls and contribute to creating a level playing field in the business environment, fostering trust among stakeholders and promoting a sustainable and responsible business culture.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.