I. Introduction

The Department for Promotion of Industry and Internal Trade ("DPIIT") on 18 September 2019 released Press Note 4 of 20191 ("Press Note 4").2 Press Note 4 has introduced (rather than clarified) a cap on foreign direct investment ("FDI") in the digital media sector.

This introduction by Press Note 4 resulted in chaos among the market players more so because of lack of clarity on its scope and compliance timeline. The confusion prompted the DPIIT to release a clarification dated 16 October 20203 ("DPIIT Clarification"). Subsequently, on 16 November 2020, the Ministry of Information and Broadcasting ("MIB") released another set of clarification4 ("MIB Clarification", collectively with DPIIT Clarification referred to as "Government Clarifications") as discussed in Chapter III below.

II. Understanding 'digital media' and 'news & current affairs'

The fine print of Press Note 4 reads 'uploading/ streaming of news & current affairs through digital media'. However, neither Press Note 4, nor the Government Clarifications have defined the term 'digital media', and this has contributed greatly to the debate surrounding the scope and applicability of the imposed FDI cap.

Section 2(k) of the draft Registration of Press and Periodicals Bill, 20195 ("Bill") defines the term 'news on digital media' as news in digitized format that can be transmitted over the internet, computer or mobile networks and includes text, audio, video and graphics. The draft Bill, though does not define the term 'print media', it does define the term 'publication' under Section 2(s) as anything which is printed on paper and is meant for public distribution including periodicals, newspapers & books. This brings us to a rough distinction between digital and print media as the latter involving everything printed on paper and the former comprising only digitized versions.

Subsequently, the term 'news & current affairs' has also not been subjected to any clarifications. This lack of clarity raises questions as to the applicability of Press Note 4 on various entities such as OTT platforms streaming documentaries and docuseries on certain recent events.

The DPIIT Clarification clarified that Press Note 4 shall apply to the following key stakeholders that are registered or located in India:

- digital media entity streaming/uploading news and current affairs on websites, apps or other platforms;

- news agency which gathers, writes and distributes/transmits news, directly or indirectly, to digital media entities and/or news aggregators; and

- news aggregators, being an entity, which using software or web application, aggregates news content from various sources, such as news websites, blogs, podcasts, video blogs, user submitted links etc. in one location.

(collectively (a), (b) and (c) above referred to as the "Covered Entities")

It is worth noting that the DPIIT Clarification appears to have broadened the FDI cap eligibility compared to the one envisaged by the actual entry inserted by Press Note 4 (see above). Resultantly, not just news aggregators which are merely disseminators of information, even news agencies that permit transmission (directly or indirectly) to such news aggregators also get covered.

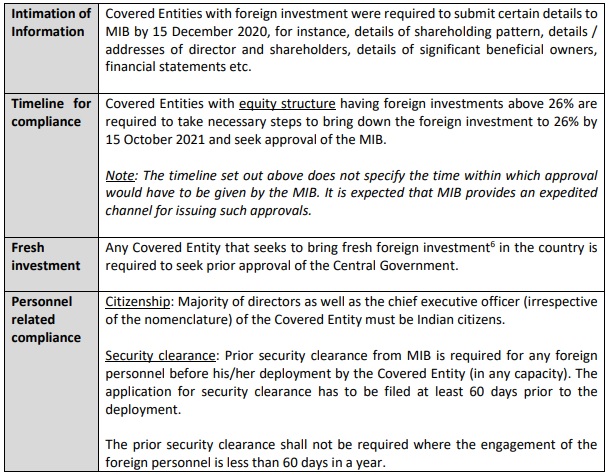

III. Regulatory compliances

As per the Government Clarifications, all the Covered Entities must comply with the following:

III. Key analysis

Applicability of Press Note 4

The inclusion of the Covered Entities under the 26% FDI cap has remained marred with concerns around what the future holds for such entities in terms of regulation by MIB.

Analysis: Consider two scenarios: (a) where a foreign entity licenses an Indian entity (with no foreign investment or with foreign investment below 26%) the task of streaming and/or uploading the content on its platform; and (b) a vice versa situation where an entity while being located within India caters to the digital news markets abroad by uploading/streaming content outside India having no connection whatsoever with the Indian consumer base.

The above scenarios while currently remain unregulated, in a significant move the Government has amended the Government of India (Allocation of Business) Rules, 1961 ("AOB Rules") and has placed digital and online media7 within the purview of the MIB.8 The AOB Rules read with Para 1.1. of Annexure 6 of the consolidated FDI policy of 2020 now authorizes MIB to regulate digital media and OTT platforms (both with and without foreign investment).

It is worth noting that while the Government Clarifications do not expressly mention search engines and social media apps, yet category (a) of the Covered Entities is broad enough to include such platforms and search engines even though such platforms are not dedicated to the purpose of streaming or uploading of news and current affairs. A clarification in this regard will be helpful.

Digital Media Entity

The term 'digital media entity' has been explained as entities that perform the function of streaming/uploading news and current affairs on websites, apps or other platforms.

Analysis: In its present form the above definition is quite vague and unclear. The classification here would be of significance, since news channels are subject to a separate FDI cap of 49%. If such news channels happen to upload/stream news on their websites or transmit such news to a news aggregator, then such news channels run the risk of being re-characterized as a digital media entity and be subjected to 26% FDI cap. While this may not be the intent of the DPIIT Clarification, yet it appears to be the consequence of it.

News Agencies

As per the guidelines 'news agencies' that distribute/transmit news to news aggregators shall need to comply with Press Note 4.

Analysis: This might adversely impact the revenue streams of news aggregators in a situation where news agencies with more than 26% FDI may need to renege on contracts and restrict transmission of news to news aggregators in order to protect their financing sources.

News Aggregators

The DPIIT Clarification defines news aggregators as entities which aggregate news content from various sources (such as news websites, blogs, podcasts, video blogs, user submitted links etc.) using software or web applications, in one location.

Analysis: Significantly, while under Press Note 4, the entry reads as 'uploading / streaming of news & current affairs through digital media', the definition of news aggregators only uses the term 'news' and not 'current affairs'.

While the terms have not been defined under Press Note 4, in its recommendations for 'Issues relating to up-linking and down-linking of TV channels in India', the Telecom Regulatory Authority of India as well as the MIB has subscribed to the definition of the term 'News' as provided by Merriam Webster Dictionary, i.e., 'a report of recent events'.9 The term 'Current Affairs' has also not been defined.

However, the United Kingdom Office of Communications has defined the term 'current affairs programming' as 'a programme which contains explanation and analysis of current events and ideas, including material dealing with political or industrial controversy or with public policy. Also included are investigative programmes with contemporary significance'.10 While clear guidelines are not present at the moment, it does appear that even those news aggregators providing current affairs on their applications or websites might fall within the purview of Press Note 4, given that the distinction between the terms 'news' and 'current affairs' is quite narrow and the content under both sectors might frequently overlap.

Equity Structure

While Para 2(i) of the MIB clarification uses the terminology 'foreign investment' for entities with less than 26% foreign investment, Para 2(ii) uses the term 'equity structure'. The reason for this differential use of language is not clear.

Although the term 'equity structure' has not been statutorily defined, it is primarily a capital structure that contains no potentially dilutive securities.

Annexure 6 of the FDI Policy carries detailed guidelines on the Broadcasting Sector. Para 1.2 thereunder delineates the scope of the term FDI to include several modes of seeking financing. The modes specified, however, do not include Compulsorily Convertible Debentures ("CCD") which do not squarely fall within the category of equity instruments since these are more in the form of hybrid instruments. CCDs are converted into equity at a later point in time. Going by the usage of the term 'equity structure' in Para 2(ii), this might result in a conclusion that foreign investors investing through CCDs will be excluded from the 26% FDI cap.

Interplay between Press Note 4 and Consumer E-Commerce Rules, 2020

Under Rule 2(1)(a) of the Consumer E-Commerce Rules, 2020, ("E-Commerce Rules") the Rules have been made applicable to 'all goods and services bought or sold over digital or electronic network including digital products'. From a literal reading of the scope it appears that the Rules would be applicable to digital media entities as provision of news and/or current affairs for a fee might be held to fall within the purview of the term 'services'. If the Rules are held to be applicable, digital media entities would have to comply with all the requisites towards ensuring a safe digital experience for its consumers.

V. Implications for News Aggregators

The guidelines are set to hit the news aggregator section quite distressingly, both in terms of financing options as well as their ability to aggregate content, whilst also giving global counterparts an unfair advantage. As per news reports, revenue for these aggregator apps was already quite sparce.11 Adding an FDI cap to the situation essentially translates to rendering new entities incapable of building their own businesses in the aggregator market. Moreover, an immensely regulated system would end up discouraging the existing pool of foreign investors.

Additionally, imposing an FDI cap on news agencies, many of whom are involved in distributing/transmitting content to news aggregators, might have the unintended impact of news agencies backing out of agreements with aggregators. The final consequence would be leaving the aggregator sector, cash as well as information strapped, leading to imminent closure.

Given the challenging regulatory regime on digital media, it should not be surprising if news aggregators start externalising their operational structures to ensure availability of funds since otherwise News aggregators may find it difficult to ensure compliance with the 26% cap. Foreign investors may look to sell their stakes to competitors if the promoters fail to acquire the shares. It is also possible that in the rush to comply, the foreign investors may end up selling their stakes at lower valuation thereby resulting in massive erosion of value.

V. Concluding Remarks

The new regulatory regime is going to be challenging to implement for entities that have FDI above 26%. The struggle is not simply associated with cutting down the FDI, but also finding other sources of funding the businesses. Additionally, Press Note 4 comes at a very unfortunate time when businesses are already reeling under the economic downturn due to the Covid-19 pandemic. This might have the unfortunate impact of forcing various entities to shut their India operations.12 However, entities may utilise the timeline to consider externalizing their business structure or looking for alternative sources of funding, such as, debt.

-08 January 2021

Footnotes

1 DEPARTMENT FOR PROMOTION OF INDUSTRY AND INTERNAL TRADE, PRESS NOTE NO. 4 (2019).

2 The contents of Press Note 4 were later included and notified under the Foreign Exchange Management (Non-Debt Instrument) Rules, 2019 on 5 December 2019.

3 DEPARTMENT FOR PROMOTION OF INDUSTRY AND INTERNAL TRADE, CLARIFICATION ON FDI POLICY FOR UPLOADING/STREAMING OF NEWS AND CURRENT AFFAIRS THROUGH DIGITAL MEDIA, (2020).

4 MINISTRY OF INFORMATION AND BROADCASTING, PUBLIC NOTICE, (2020).

5 Currently under public consultation.

6 In this regard, investment means 'to subscribe, acquire, hold or transfer any security or unit issued by a person resident in India.'

7 Digital/Online Media includes: (A) Films and Audio-Visual Programmes made available by online content providers; (B) News and Current Affairs Content on Online Platforms.

8 CABINET SECRETARIAT NOTIFICATION, http://egazette.nic.in/WriteReadData/2020/223032.pdf.

9 TELECOM REGULATORY AUTHORITY OF INDIA, RECOMMENDATIONS ON ISSUES RELATING TO POLICY GUIDELINES FOR UPLINKING AND DOWNLINKING OF TELEVISION CHANNELS IN INDIA, 04 APRIL 2019. (It seems that the MIB as well as the TRAI have not differentiated between news and current affairs as the report states: "A simple definition of news can be provided. MIB has stated that as per Webster Dictionary defines news as "a report of recent events". Hence, any channel that primarily broadcasts news i.e. reports on recent events in the course of its daily broadcast can be classified as a "News and Current Affairs Channel.")

10 Ofcom, 'The Provision of Current Affairs', https://www.ofcom.org.uk/cymru/research-and-data/tvradio-and-on-demand/tv-research/current-affairs.

11 Cyril Sam, 'In India, news aggregator apps are struggling to find a path to sustainability', (January 13, 2020, 11 AM), https://www.niemanlab.org/2020/01/in-india-news-aggregator-apps-arestruggling-to-find-a-path-to-sustainability/.

12 Ayush Tiwari, 'Huffpost India is history, thanks to new FDI norms', (November 25, 2020), https://www.newslaundry.com/2020/11/25/huffpost-india-is-history-thanks-to-new-fdi-norms.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.