It gives us immense pleasure to circulate this special edition of DMD Advocates' Newsletter focusing on recent developments in the Insolvency and Bankruptcy law in India.

In this edition, we have covered recent judgements of Indian courts in relation to Insolvency and Bankruptcy Code, 2016. We have also provided a snapshot of cross-border insolvency and its current status in India. A robust cross border insolvency framework is need of the hour, specially in wake of the challenges in reviving Jet Airways and myriad of issues spread across jurisdictions, including, a Dutch court ordering bankruptcy proceedings against Jet Airways.

We are also pleased to announce that Mr. Anay Banhatti has joined DMD Advocates as a partner in our Mumbai office.

We hope you enjoy reading this edition and find it useful in your area of work.

Registered trade union can file a petition on behalf of its members under Section 8 of the Insolvency and Bankruptcy Code, 2016: Supreme Court

A two judge bench of the Supreme Court comprising Justice R. F. Nariman and Justice Vineet Saran, setting aside judgement of National Company Law Appellate Tribunal (NCLAT), has held that a registered trade union can maintain a petition as an operational creditor under Section 8 of the Insolvency and Bankruptcy Code, 2016 (IBC) on behalf of its members as the trade union is formed for the purpose of regulating the relations between workmen and their employer.

The court opined that a trade union is an entity established under the Trade Unions Act, and would therefore fall within the definition of "person" under Sections 3(23) of the IBC and therefore, an "operational debt", including a claim in respect of employment, could be made by a person duly authorised to make such claim on behalf of a workman.

The Court stated that "Rule 6, Form 5 of the Insolvency and Bankruptcy (Application to Adjudicating Authority) Rules, 2016 also recognises the fact that claims may be made not only in an individual capacity, but also conjointly. Further, a registered trade union recognised by Section 8 of the Trade Unions Act, makes it clear that it can sue and be sued as a body corporate under Section 13 of that Act. Equally, the general fund of the trade union, which inter alia is from collections from workmen who are its members, can certainly be spent on the conduct of disputes involving a member or members thereof or for the prosecution of a legal proceeding to which the trade union is a party, and which is undertaken for the purpose of protecting the rights arising out of the relation of its members with their employer, which would include wages and other sums due from the employer to workmen."

Click here to view the judgement dated 30 April 2019.

RDBA, SARFAESI Act and Insolvency Code do not prevail over PMLA, each to be construed and enforced in harmony: Delhi High Court

Justice R. K. Gauba of the Delhi High Court in a batch of appeals arising out of decisions of the appellate tribunal constituted under the Prevention of Money Laundering Act, 2002 (PMLA), has held that the Recovery of Debts and Bankruptcy Act, 1993 (RDBA), the Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act, 2002 (SARFAESI Act) and the IBC do not prevail over PMLA as the objective of the PMLA is distinct from the purpose of the latter three legislations. Accordingly, the decisions of the appellate tribunal were over-turned.

The court held that, "PMLA, by virtue of section 71, has the overriding effect over other existing laws in the matter of dealing with "money-laundering" and "proceeds of crime" relating thereto."

The court further held that the PMLA, RDBA, SARFAESI Act and IBC (or such other laws) must co-exist and each should be construed and enforced in harmony, without one being in derogation of the other with regard to the assets respecting which there is material available to show that the same has been "derived or obtained" as a result of "criminal activity relating to a scheduled offence" and consequently being "proceeds of crime", under PMLA.

Click here to view the judgement dated 2 April 2019.

Provisions for Foreign Investors and Foreign Assets under IBC

Section 234: Provides for a mechanism for the government to enter into reciprocal agreements with the governments of any country for the purpose of enforcing provisions of the Code; Includes agreements for application of the Code to assets and property of corporate debtors, including personal guarantors, situated in foreign countries.

Section 235: In the course of the insolvency/bankruptcy proceedings, resolution professional/liquidator/bankruptcy trustee may make an application to the relevant adjudicating authority seeking evidence or action in relation to assets of the debtor/guarantor in a country with which India entered into a reciprocal arrangement; Concerned adjudicating authority may issue a letter of request to a competent court or authority of that country.

Inadequacies in IBC and Need for Cross-border Insolvency Framework

- Reciprocal agreements require individual long-drawn-out negotiations with each country

- Reciprocal agreements do not bring about the efficiency otherwise achieved by a uniform code of co-operation between various jurisdictions

- Differing reciprocal agreements with different countries complicate insolvency proceedings

- Reciprocal agreement mechanism does not address issues relating to coordination/recognition of insolvency proceedings commenced in multiple jurisdictions and involving multiple branches of a single entity

- In the absence of reciprocal agreements, no guidance to an Insolvency Professional for availing evidence or taking action with respect to foreign assets

Cross border Insolvency in India - Journey so far

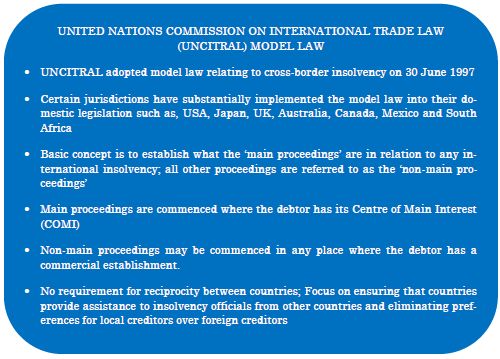

- Proposal for cross border insolvency framework based on UNCITRAL model law introduced in India

- The Insolvency Law Committee (ILC) submitted its 2nd report on 22 October 2018 to the Government, recommending adoption of the UNCITRAL model law of Cross Border Insolvency, 1997. The ILC also recommended a few carve outs to ensure that there is no inconsistency between the domestic insolvency framework and the proposed cross border insolvency framework.

On 12 March 2019, the Government of India reconstituted the ILC as Standing Committee for review of implementation of the IBC and address the issue of, inter alia, cross border insolvency framework. The ILC is expected to submit its recommendations and amendments soon.

DMD Advocates is a leading full-service law firm with expertise in litigation, corporate, taxation, regulatory and intellectual property rights. The firm has a pan-India presence with principal offices in Delhi and Mumbai and associated offices in Bangalore, Chennai, Hyderabad, Cochin and Bhubanes-war.

DISCLAIMER: The views and opinions expressed in this article are those of the author and does not constitute a legal opinion/advice by DMD Advocates. The information provided through this article is not intended to create any attorney-client relationship between DMD Advocates and the reader and, is not meant for advertising the services of DMD Advocates or for soliciting work by DMD Advocates. DMD Advocates does not warrant the accuracy and completeness of this article and, the readers are requested to seek formal legal advice prior to acting upon any information provided in this article. Further, applicable laws and regulations are dynamic and subject to change, clarification and amendment by the relevant authorities, which may impact the contents of this article. This article is the exclusive copyright of DMD Advocates and may not be circulated, reproduced or otherwise used by the intended recipient without our prior permission.