I. INTRODUCTION

With the intent of simplifying and consolidating labour laws, the 2nd National Commission on Labour recommended the rationalisation of existing labour laws into 4 to 5 groups. In pursuance of the recommendation, the Code on Social Security, 2020 ("Social Security Code" or "Code") received the assent of the President on 28 September 2020.

The Code aims to regulate the organised / unorganised (or any other) sectors and extend social security benefits, during sickness, maternity, disablement, etc. to all employees and workers across different organisations.

The Code undertakes to integrate nine existing labour laws relating to social security into one integrated Code.

II. COVERAGE AND APPLICABILITY

The Code applies to everyone on wages in an establishment, irrespective of occupation.

Earlier, under the Payment of Gratuity Act, 1972, the term "wages" included "all emolument which is earned by an employee while on duty or leave in accordance with the terms and conditions of his employment and which are paid or are payable to him in cash and includes dearness allowance but does not include any bonus, commission, house rent allowance, overtime wages and any other allowance".

Under the Social Security Code, the term "wages" includes all kinds of remunerations capable of being expressed in monetary terms including basic pay, dearness allowance, and retaining allowance. However, it does not include any overtime compensation, house rent, conveyance allowance, gratuity upon termination, or any retrenchment compensation.

The Code shall have an overriding effect over anything inconsistent in any other law or the terms of any award, agreement, or contract of service, whether it was made before or after this Code came into force.

III. CODE ON SOCIAL SECURITY: STRUCTURE AND PROCEDURE

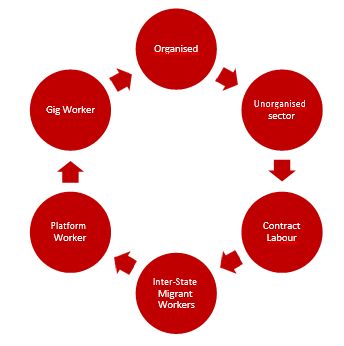

The Code deals with social security organisations, employees' compensation, provident fund, gratuity, Employees' State Insurance Corporation, social security for construction workers, unorganised workers, gig workers, and platform workers.

Every establishment shall mandatorily obtain registration under this Code, including the establishments already registered under any Central Act. Workers under different categories shall be required to register under applicable Chapters in the Code. Further, any business in the process of closure shall apply for registration cancellation under this Code.

With the intent to increase the authenticity of the Code, any employee or worker employed in the unorganised sector must establish their identity through aadhar numbers for seeking benefits available under the Code.

The Code has also included provisions for the establishment of several boards that would administer and enforce different schemes, such as State Building Workers Welfare Boards, National Social Security Board, State Unorganised Workers' Social Security Board, etc.

IV. SCHEMES

Under the Code, the Central Government shall, by notification, frame different schemes for employees such as the Employees' Provident Fund Scheme, Pension Scheme, Deposit Linked Insurance Scheme, etc. The contributions under the different schemes are as follows:

Applicability of Chapters under the Code

|

Chapter No. |

Chapter Name |

Applicability |

|

|

Existing Legislations |

Social Security Code |

||

|

III |

Employees' Provident Fund |

Every factory and other establishment employing 20 or more employees. |

Every establishment with 20 or more employees. |

|

IV |

Employees' State Insurance Corporation |

All factories other than the seasonal factories. |

Every establishment with 10 or more employees, other than seasonal employees. It shall also apply to establishment which conducts hazardous occupation. |

|

V |

Gratuity |

Every factory, plantation, port, oil field, mine, and the railway company. |

Every establishment employing 10 or more employees on any day of the |

|

Every shop or establishment which employed 10 or more employees on any day of the preceding 12 months. |

preceding 12 months. The Chapter shall also apply to every shop, factory, oilfield, mine, railway company, plantation, and port. |

||

|

VI |

Maternity Benefit |

Every establishment including mine, factory, and plantation, and to every establishment wherein persons are employed for the exhibition of equestrian, acrobatic, and other performances. |

Applicable to every establishment including Government institutions. It shall apply to every shop or establishment which employs or employed 10 or more employees in the preceding 12 months. |

|

VII |

Employees' Compensation |

To a certain class of employers for payment of compensation to their employees for injury by accident. |

Applicable to the employers and employees to whom Chapter IV does not apply. |

|

VIII |

Social Security and Cess in respect of Building and Other Construction Workers |

Every building and construction work. |

Applicable to every building and construction work. |

|

IX |

Social Security for Unorganised Workers |

Every worker employed in the unorganised sector. |

Applicable to the unorganised sector, gig workers, and platform workers. |

|

XIII |

Employment Information and Monitoring |

- |

Applies to career centres, vacancies, persons seeking career centre services, and employers. |

V. EMPLOYEES' STATE INSURANCE

The Employees' State Insurance Fund shall be set up for payment of benefits, medical treatment, and attendance to the insured person, travelling and compensatory allowances, pension, leave and joining allowances, and payment of contributions to the Government, among other costs that shall be defrayed by the Employees State Insurance Corporation for administration.

The Code uniformly extends its coverage under the Employees' State Insurance to all establishments employing 10 or more persons and to plantation workers voluntarily. As per the Employees' State

Insurance Act 1948, the legislation was implemented as per the notification released by every State. However, under the Code, the Central Government may also extend the applicability to establishments which engage in hazardous occupations. The responsibility under this Chapter rests on the employer for registering their employees with the Employees' State Insurance Corporation, for payment of the contributions and for releasing the benefits to the workers. The Code provides an option to establishments employing less than 10 employees for voluntary membership under the Employees' State Insurance.

The insured persons under the Code shall receive benefits like periodical payments in case of sickness, miscarriage, or sickness due to pregnancy, disablement, and medical treatment. Dependents of an injured or deceased employee are entitled to receive such benefits under the Code.

VI. GRATUITY

Earlier, under the Payment of Gratuity Act, 1972, gratuity was payable to employees for rendering 5 years of continuous service on their superannuation, retirement, or death. It is applicable to employees who work on a fixed term basis and any such event as notified by the Central Government. Continuous service shall imply 3 years of service for working journalists and other newspaper employees.

Continuous service of 5 years is not mandatory for employees working on a fixed-term basis. Instead, such employees shall be paid gratuity on a pro-rata basis. It is a positive step for employees who work on a term basis of employment.

While the threshold of the gratuity amount payable to an employee is yet to be decided by the Central Government under the Code, the earlier gratuity amount under the Payment of Gratuity Act, 1972 was set at INR 20,00,000.

VII. OTHER BENEFITS

Maternity Benefits

- Every woman employed in an establishment shall be entitled to receive maternity benefits at the rate of average daily wage for the period of her

- To receive the benefits, such woman should have worked for at least 80 days in 12 months immediately preceding the date of her expected

- The maximum period for maternity benefits can be up to 26

- If no pre-natal confinement and post-natal care is provided by the employer, then such woman shall also be entitled to a medical bonus of INR 3,500 from her

Employee Compensation

- Workers are entitled to compensation from the employer for cases involving fatal accidents, bodily injury, or death during the work

- Accidents or occupational hazards for which employees are liable, have been listed out in the third schedule of the

- The amount of compensation provided is equal to 50% of the deceased employee's monthly wages which is multiplied to relevant

- For employees with permanent total disablement or 60% of the monthly wages of the injured employee multiplied by relevant factors which is determined by the Central

VIII. BUILDING AND OTHER CONSTRUCTION WORKERS

Cess is a tax that is levied for the promotion and development of social services. Under the Code, cess is levied to secure funds for the welfare and social security of workers. It shall be levied on the employer, at rates specified by the Central Government.

The levy and collection of cess for building and construction workers have been charged under the Code at a minimum of 1% and a maximum of 2%. However, unlike the Building and Construction Workers Welfare Cess Act, 1996, the Social Security Code differentiates itself by implementing a process for self-assessment on cess, previously done by government officers.

IX. UNORGANISED, GIGS AND PLATFORM WORKERS

The Code has distinguished itself from the Unorganised Workers Social Security Act, 2008 ("UWSSA") by creating a distinction between 'unorganised workers', 'gigs', and 'platform workers'. To that end, the Code elaborates on the framing of schemes which includes 'education' for unorganised workers and 'creche' for gigs and platform workers under its coverage, unlike the UWSSA.

Such schemes may be 'wholly' or 'partially' funded by the State Government and other sources, including corporate social responsibility funds. Proper records of the Schemes under this Chapter shall be maintained by the authority notified by the appropriate Government. To be eligible under the Code, a worker must satisfy two requirements: (a) completion of 16 years of age; and (b) submit a self-declaration certificate in the manner prescribed by the Central Government. Additionally, the State Government may provide a helpline facility for unorganised workers, gigs, and platform workers to assist them in registration and avail information relating to the social security schemes.

X. COMPLIANCES UNDER THE CODE

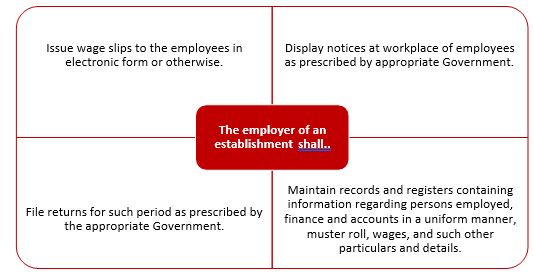

File returns for such period as prescribed by the appropriate Government.

Maintain records and registers containing information regarding persons employed, finance and accounts in a uniform manner, muster roll, wages, and such other particulars and details.

XI. LIABILITY OF EMPLOYERS

The Code states that the employer shall not reduce an employee's wages or the total amount of benefits to which he is entitled because of his obligation to pay any contributions required under this Code. Further, the employer shall be liable to pay simple interest on the amount due under this Code from the due date till the date of payment at a rate as may be notified by the Central Government from time to time.

The Code also states that when an employer transfers his establishment by sale, gift, lease, licence, or in any other way, the employer, and the transferee will be jointly and severally liable to pay the amount due for any liabilities, cess, or any other amounts payable under this Code till the date of such transfer. However, the liability of the transferee shall be limited to the value of the assets obtained by him through such transfer.

XII. REPORTING OF VACANCIES TO CAREER CENTRES

Under the Code, for filling up any vacancies, the establishments will be required to report such vacancies to career centres, from such date as specified in the notification issued by the appropriate government. However, the employer shall be under no obligation to recruit any person through career centres, merely because a vacancy has arisen. Such reporting of vacancies to career centres shall not apply to employment like agriculture (private sector establishment) except employment in plantation, domestic service, staff of Parliament, or any State Legislature, employment for a term of fewer than 90 days, a non-governmental establishment with less than 20 employees, etc.

XIII. OFFENCES AND PENALTIES

|

Offence |

Punishment |

|

If any person being an employer fails to pay any contribution under this Code: |

Imprisonment for a term which may extend to 3 years: · which shall not be less than 1 year and a fine of INR 1,00,000 if the employee's contribution has been deducted from his wages and not paid by the employer; and · which shall not be less than 2 months but may be extended to 6 months and a fine of INR 50,000, in any other case. |

|

If any person is an employer: · Fails to provide any maternity benefit; · Fails to produce any register or document on demand by inspector-cum-facilitator; · Fails to pay the cess for building workers; · Dishonestly makes a false return, report, statement, or information for submission; · Obstructs any inspector-cum-facilitator or other officer of a competent authority in the discharge of his duties; and · Dismisses, discharges, reduces in rank, or penalises a woman employee in contravention of the provisions of this Code. |

Imprisonment for a term which may extend to 6 months or with a fine which may extend to INR 50,000, or both. |

|

If any person being an employer fails to pay any amount of gratuity: |

Imprisonment for a term which may extend to 1 year or with a fine which may extend to INR 50,000, or both. |

|

If any person being an employer: · Deducts or attempts to deduct any part of the employer's contribution from the wages of an employee; · Reduces the wages or any privilege admissible to an employee in contravention of this Code; · Fails to submit any return, report, statement, or information; · Fails to pay any compensation to an employee; |

Fine which may extend to INR 50,000. |

|

· Fails to send a statement to the competent authority as per Chapter VII (Employee's Compensation); · Contravention of any provision of this Code for which no special penalty is given; · Obstructs executive officers in exercising their functions; · Fails to comply with the condition subject to which exemption from the provisions of this Code by the appropriate government; and · Fails to pay administrative or inspection charges. |

In case of any subsequent offence, the penalty will be imprisonment for a term which may extend to 2 years and with a fine of INR 2,00,000. However, where such subsequent offence is regarding failure by the employer to pay any contribution, charges, cess, maternity benefit, gratuity, or compensation as per this Code, the penalty will be imprisonment for a term which may extend to 3 years, but which shall not be less than 2 years and with a fine of INR 3,00,000.

If the offence is committed by a company, then every person who at the time of the commission of the offence was the in-charge and responsible for the conduct of the company, will be responsible and deemed to be guilty.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.