Three years ago, India's Prime Minister Mr. Narendra Modi, had expressed his desire to see India amongst the top 50 nations in terms of ease of doing business.

On October 31st, 2017 with the release of the World Bank's Doing Business Report 2018 (Report), this dream is now racing towards to becoming a reality. After continuous and vigorous legislative overhauling, coupled with regulatory and infrastructural reforms, India surged up 30 places to the 100th rank among 190 countries. The Report lists India as one of the 10 improvers this year. We briefly explore the key reforms which have led to this historic jump in the rankings.

Leaps Across Sectors

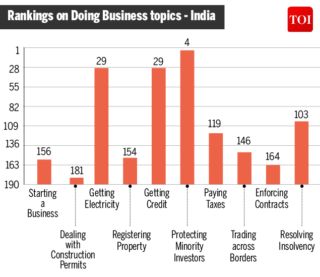

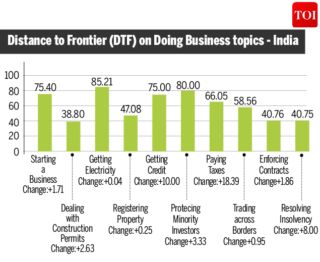

The Report is based on how easy it is for companies to do business, and it also takes into account certain regulations based on 10 parameters, which are listed below. India has improved its standing in 6 out of these 10 indicators. These are as follows:

(Doing Business Report 2018: Standing of India in comparison to last year's ranking)

| Parameters | India's ranking in Report 2017 | India's ranking in Report 2018 |

| Starting Business | 155 | 156 (↓) |

| Construction Permits | 185 | 181 (↑) |

| Getting Electricity | 26 | 29 (↓) |

| Getting Credit | 44 | 29 (↑) |

| Minority Invest | 13 | 4 (↑) |

| Paying Taxes | 172 | 119 (↑) |

| Trading Borders | 143 | 146 (↓) |

| Enforcing Contracts | 172 | 164 (↑) |

| Insolvency | 136 | 103 (↑) |

| Registering Property | 138 | 154 (↓) |

| (Source: Times of India, October 31st, 2017) |

These rankings are based on the reforms implemented in the past year (June 2nd, 2016 – June 1st, 2017) in Delhi and Mumbai, the two cities covered by the Report. Two historic events, the launch of the Goods and Services Tax (GST) (which occurred on July 1st, 2017) and demonetization (which was termed as a 'one-time event) do not form part of the assessment.

| (Source: Times of India, October 31, 2017) |

Key Reforms Triggering this Progress

This remarkable progress is the result of consistent and continuous changes, in almost all the sectors impacting business operations in India. In brief, this is how India has been able to move up the scale:

- Access to Credit and Insolvency: One of the most credible change which has resulted in the surge in rankings is the introduction of the Insolvency and Bankruptcy Code in late 2016 (IBC). It promotes ease of exit as required and provides facilitators for quick resolution, at the same time ensuring optimum utilization of resources. Provision with respect to moratorium during reorganization procedures, priority of secured creditors are few credible changes which have caused this upturn.

- Starting a business:

Digitization, one of Mr. Modi's favorite tools, was used to

transform the environment for starting a business. To smoothen the

process, region specific solutions were taken, including:

- Merger of pleas for profession tax and value added tax in Mumbai.

- Merging of applications for Permanent Account Number and Tax Account Number for approvals.

- Re-networking to cut down number of form filings.

- Protection of minority

investors: This is one parameter where India has

registered the most significant improvement. Key reforms which have

been introduced by Securities and Exchange Board of India

includes:

- Increased remedies available in cases of prejudicial transactions.

- Raising accountabilities of companies towards minority investors by mandating the formulation and disclosure of a dividend distribution policy.

- Disclosures as per Ind-AS accounting standards to obtain minority shareholders' approval on profit-sharing agreements.

- Restrictions on fundraising by 'willful defaulters'.

- Paying taxes: In both Delhi and Mumbai, paying taxes was made easier by requiring payments to the Employees Provident Fund to be made electronically, and introducing administrative measures that make it easier to comply with corporate income tax regulations.

- Dealing with construction permits: With the intent to give the country's infrastructural development a push and attract foreign investment in this sector, India reduced the number of procedures and time required to obtain a building permit by implementing an online system that has streamlined the process

- Enforcing contracts: In both Delhi and Mumbai, the introduction of the National Judicial Data Grid made it possible to generate case management reports on local courts, thereby making it easier to enforce contracts. This coupled with Commercial Courts, Commercial Division and Commercial Appellate Division of the High Courts Act, 2015 has resulted in a shift of India in the table upwards.

Expected Impact of the Report

- Political boost to the Government: The Government has faced severe criticism on account of demonetization and hasty introduction of GST and has been finding it hard to deal with the economic slowdown. Amidst all this, the Report has come at a very opportune time which is being used by the Government as a fitting reply to the skeptics.

- Attracting further foreign investment: India has recently been a preferred destination for foreign investors. However, a drop in economic growth predictions and skepticism over impact of GST had resulted in a certain degree of reluctance among investors. The Report presents a very clear signal that India is becoming a very attractive destination on the global investment horizon.

Way Forward

India's jump in the rakings is undoubtedly historic. This Report has enhanced optimism amongst investors and the Government which sees the 'Top 50' target as achievable.

India has recently ushered into a new era of doing business with monumental changes such as GST and IBC. As per India's Finance Minister, Mr. Arun Jaitley, 19 path breaking reforms are still in the pipeline. Work is in progress in many areas such as enforcement of contracts and building construction permits, and some of the reforms in starting a business have not been factored in. Tackling the challenging areas where India is still lagging behind will be key to India sustaining the momentum towards higher rankings next year. This will require not just the introduction of new laws and online systems, but deepening the ongoing investment in the capacity of States to implement change and transform the framework of incentives and regulation facing the private sector.

For now, the Report ushers a new ray of hope and prospect of a brighter future for India's economy.

* The piece was co-authored by Tanmay Patnaik, Principal Associate Designate and Shraddha Suryavanshi, Associate

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.