Entities such as companies, trusts, foundations, partnerships, and other types of legal persons and arrangements conduct a wide variety of commercial activities. While they play an essential role in the economy, their unique legal structure also makes them amenable to be used in complex transactions designed to conceal the actual owner and reason for doing the particular transaction. These entities were being used (or misused) as a vehicle for various illicit purposes like money laundering, tax evasion, insider dealing, terrorist funding, etc.

In the wake of increased misuse of these entities as vehicles to attain illegal objectives, there was a growing need to address this concern globally. It was felt that misuse could be significantly contained if information regarding both the legal owner and the beneficial owner, the source of the entity's assets, and its activities becomes available to the authorities in a timely manner.

That necessity formally introduced the concept of identifying ultimate beneficial ownership.

In India, the regulators, in their commitment before global forums, have been tightening the rules pertaining to the identification of beneficial owners. This article covers an overview of beneficial ownership and intends to increase its awareness.

Historical Perspective

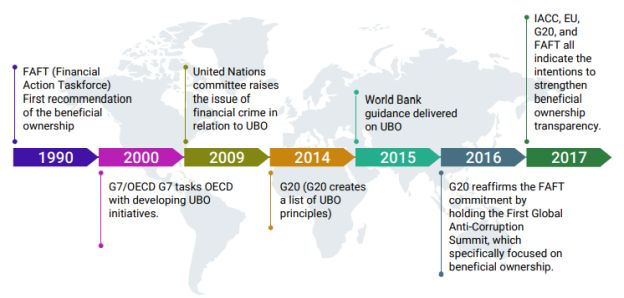

The world-historical emergence of the concept of addressing an ultimate beneficial ownership issue is as follows:

In the Indian corporate world, the historical timeline of the origin of the concept of beneficial ownership is as follows:

It dates back to the Companies Act 1956, which was introduced through the Companies Amendment Act (1974)1 read with the Companies (Declaration of Beneficial Interest in Shares) Rules, 1975; the reference to the terms beneficial interest and beneficial owner was brought under Section 187C and Section 187D. Later on, these Sections were abolished by the Companies (Amendment) Act, 2000. However, the definition of beneficial interest and ownership was not introduced till the onset of the Companies Act 2013, wherein it was eventually introduced through the Companies (Amendment) Act 2017.

The Prevention of Money-laundering Act, 2002, as amended (the PML Act), defines the "beneficial owner" as an individual who ultimately owns or controls a person who is engaged in a financial transaction or activity with a reporting entity (i.e., banking company, financial institution, intermediary or a person carrying on a designated business or profession under the PML Act) or the person on whose behalf a transaction is being conducted and includes a person who exercises ultimate effective control over a juridical person.

The RBI's Master Direction on Know Your Customer (KYC) Direction, 2016 dated 25 February 2016 and the RBI's Master Circular on "Know Your Customer (KYC) norms/Anti-Money Laundering (AML) standards/Combating Financing of Terrorism (CFT)/Obligation of banks and financial institutions under the PML Act" dated 1 July 2015, each as amended from time to time, require the identification of beneficial owners of regulated entities. The tests for the identification of such beneficial owners are similar to PML rules.

Under the securities law, the intermediaries registered with the SEBI are required to identify beneficial owners of clients (such as foreign portfolio investors that seek to open custodian accounts and entities that seek to open depository accounts) at the time of opening securities accounts. Under the applicable guidelines, a beneficial owner is a natural person(s) who ultimately owns, controls, or influences a client and/or persons on whose behalf a transaction is being conducted; such beneficial owner could also include those persons who exercise ultimate effective control over a legal person or arrangement. The tests for the identification of such beneficial owners are similar to PML rules.

In 2020, the Ministry of Finance issued an order specifying conditions for bidders from countries sharing a land border with India. The terms "bidder from a country which shares a land border with India" and "beneficial owner" are defined in such order, and the tests for identification of beneficial owners are similar to those in the PML Rules.

The Central Government issued a circular and subsequent amendment in 2020 to regulate the foreign investment from the countries that share a land border with India. The said amendments seek to regulate foreign investment where the "beneficial owner" is situated in countries sharing a land border with India.

Concept of beneficial and legal owner

Beneficial owner refers to the natural person(s) who ultimately owns or controls a customer and/or the natural person on whose behalf a transaction is being conducted. It also includes those natural persons who exercise ultimate effective control over a legal person or arrangement. Only a natural person can be the ultimate beneficial owner, and more than one natural person can be the ultimate beneficial owner of a given legal person or arrangement. In simple words, legal or registered owner means a person whose name the asset's ownership is registered but who is not the real owner or beneficiary of such asset. A beneficial owner is a person in whose name ownership of the asset is not registered but who is the real owner and beneficiary of such an asset.

The concept of the beneficial owner has been defined in some of the regulatory frameworks in the following manner:

- The Financial Action Task Force (FATF), an intergovernmental body established in 1989 by the G7 group of major economies, has defined 'beneficial owner' as: "The natural person(s) who ultimately owns or controls a customer and/or the natural person on whose behalf a transaction is being conducted. It also includes those persons who exercise ultimate effective control over a legal person or arrangement."

- The distinction between beneficial ownership and legal ownership is discussed in the 2014 FATF recommendations. However, the crucial component in the FATF definition is to consider the actual natural person who takes control or takes advantage of the capital or assets of the legal persons. Legal ownership refers to the natural or legal persons who have the ownership and the control to make the decisions as per the legal framework; for instance, a company may be legally owned by another company, with the second company's beneficial owners having control over it. The inclusion of natural persons on whose behalf a transaction is being carried out, even in the absence of actual or legal ownership of a corporate vehicle, is another aspect of the FATF recommendations.

- According to OECD's Beneficial Ownership Implementation Toolkit, a beneficiary owner is defined as a natural person who owns or has control over a legal entity, such as a company, trust, or foundation.

- Beneficial interest has been defined in the following manner for Sections 89 and 90 of the Act, 2013 as follows:

- (10) For the purposes of this Section and Section 90,

beneficial interest in a share includes, directly or indirectly,

through any contract, arrangement, or otherwise, the right or

entitlement of a person alone or together with any other person to:

- exercise or cause to be exercised any or all of the rights attached to such share; or

- receive or participate in any dividend or other distribution in respect of such share.

- The Companies (Significant Beneficial Owners) Rules, 2018, also defines the "significant beneficial owner."

- The LLP Act, 2008 has also introduced the concept and reporting of the beneficial owner in relation to limited liability partnership.

Therefore, the concept of ascertaining the ultimate beneficial owner emanates from the global need to strengthen the mechanism to curb malpractices of holding benami assets and money laundering issues. The ultimate beneficial ownership disclosure helps in understanding the true and beneficial owner of the assets.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.