On December 15, 2020, Thailand's Revenue Department (RD) announced a further extension for e-tax filing and payment until January 31, 2024.

The RD's announcement is meant to support the government's Thailand 4.0 policy by encouraging use of the online system for filing and paying taxes. The RD has been promoting the use of e-tax filing and payment since 2012 by granting eight-day extensions to anyone who submits online, rather than using traditional paper filing. Initially, this eight-day extension program was due to expire on January 31, 2021, but the RD has now further extended it for another three years, until January 31, 2024.

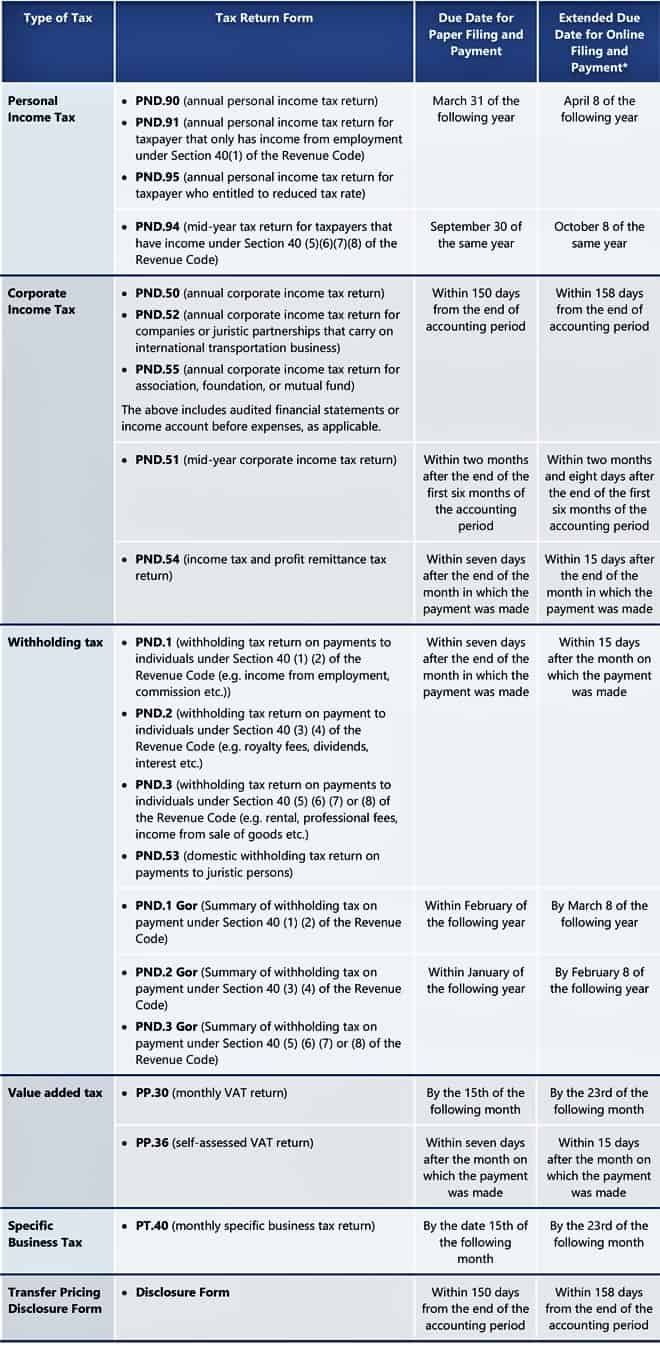

Tax Filing and Payment Schedule for Eligible Tax Returns

* Notification of the Ministry of Finance Re: Extension of Period for Tax Return Filing and Tax Payment via Internet System (No.3) dated December 15, 2020.

It should be noted that tax returns and supplemental tax returns must be submitted via the e-filing system to qualify for the eight-day extension. If a taxpayer has submitted their tax return in paper form, they will not be entitled to the extension even if they resubmit via e-filing system. The reverse is also true—a tax payer who submits via the e-filing system, and resubmits in paper form, will not be eligible for the eight-day extension.

For personal income tax payments set up as three instalments, the first instalment can be paid together with the e-filing and that tax payment is also entitled to eight-day extension. The second instalment can be paid within one month after the extended due date of the first instalment, and the third instalment can be paid within one month after the due date for the second instalment.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.