In recent months, there has been a noticeable surge in interest by controlling shareholders to privatise the companies of which they hold a controlling stake and to delist them from the Hong Kong Stock Exchange ("privatisation"). This has, in turn, led to an increased demand for financing options to support such privatisation efforts. We set out some key practical points below for lenders looking to offer this product.

Ways of privatisation in Hong Kong

Privatisations can be effected by way of:

- a contractual offer made by the offeror to the target's shareholders to acquire their shares and other equity instruments (a "general offer"); or

- a statutory procedure whereby the listed company agrees to cancel all the issued shares and other equity instruments held by shareholders (other than the offeror), issue new shares to the offeror and pay consideration to its former shareholders (a "scheme of arrangement").

Some of the key differences between a general offer and a scheme of arrangement which are pertinent to a privatisation financing are set out in the table below. As a scheme of arrangement generally requires a lower approval threshold (compared to an offer conditional upon 90 per cent acceptance) and, once approved, no squeeze-out is necessary, it offers more certainty in terms of process and timing. It is more common for privatisations in Hong Kong to be effected this way.

| GENERAL OFFER | SCHEME OF ARRANGEMENT | |

|---|---|---|

| Completion | Completion (and timing) depends on the level of acceptances

received and satisfaction of other conditions (if any). Level of

acceptance is usually set at 90 per cent of the shares to which the

offer relates. Once the level of acceptances required for compulsory acquisition is reached, the offeror may (depending on the offeree's jurisdiction of incorporation) invoke statutory procedures to compulsorily buy out the remaining shareholders, otherwise also known as a "squeeze-out". |

Completion subject to approval1 by the

shareholders and sanction2 of the court in the

jurisdiction of incorporation of the company. Once these conditions are met and the court issues the court sanction, the scheme will bind all the shareholders of the company. |

| Methodology | Contractual arrangement to purchase each target shareholder's shares. | Commonly done by way of a "cancellation" scheme whereby the offeree shareholders' existing shares are cancelled and new shares are issued to the offeror. |

| Funding |

Settlement of the consideration is staggered. In relation to subsequent acceptances after the offer has become unconditional, payment is required within 7 business days of the acceptance. It is common for the offeror to group acceptances for the purposes of settlement of payments. |

Settlement of scheme consideration is required within 7 business days after the scheme becomes effective. |

Key practical points to take note of from a financing perspective

- Cash confirmation

Under the Codes on Takeovers and Mergers and Share Buy-backs (the "Codes") issued by the Securities and Futures Commission of Hong Kong (the "SFC") and administered by the Executive Director of the Corporate Finance Division of the SFC (or any of his delegates) (the "Executive"), the offeror and its financial advisers are required to be satisfied that it can and will continue to be able to pay the full consideration for the privatisation, and the financial advisers are required to confirm to the SFC that the offeror has sufficient resources to fund the privatisation in full.

(a) Implications on financing documentation

Where loan financing is concerned, the lenders will be expected to provide certainty of funds through a series of "certain funds" provisions in the facility agreement. These include limiting the number of drawstops to key events (e.g. insolvency, illegality, repudiation, non-payment, breaches of representations relating to the constitution of the initial obligors and their authority to act, and breaches of undertakings relating to certain key restrictions on the initial obligors' corporate activities) , ensuring that the lenders have limited rights to cancel or transfer their commitment during the certain funds period and ensuring that the conditions precedent to funding are clearly set and within the control of the borrower.

(b) Discharge of financial advisers' duties

The financial advisers would need to provide written confirmation to the Executive of sufficiency of financial resources prior to the offeror's announcement of a firm intention to make the offer and prior to the despatch of the offer document or scheme document. The financial advisers are not expected to provide to the Executive with copies of all relevant documentation such as loan agreements and evidence of cash balances, unless requested to do so by the Executive. The announcement of a firm intention to make the offer and the offer document or scheme document must include confirmation from the financial advisers that resources are available to the offeror to satisfy full acceptance of the offer.

The comfort that the financial advisers obtain before giving the confirmation will vary depending on the source of the funding and their knowledge of the offeror. Where the financial advisers are represented, they may obtain a cash confirmation letter of advice from their external counsel. Where they are not represented, they can often form a view as to the certainty of funding on the basis of the conditions precedent confirmation letter from the lender. - Structure and nature of loan

The loan financing is invariably supported by guarantees by the ultimate controlling shareholder (if the loan is made to a special purpose vehicle established by it) and secured on the acquired shares. The term of the loan can vary but often they are structured as bridge term loans to be refinanced within 12 months.

As a general offer will likely consist of different stages and consideration may have to be posted at different times, multiple utilisations may be required to finance a privatisation by way of a general offer. For a privatisation by way of a scheme of arrangement, the Codes require settlement to occur within 7 business days after the scheme becomes effective so a term loan with single drawdown is usually sufficient. - Timing for entering into the financing documents

The facility agreement should be finalised and signed before announcement of the offer as part of the cash confirmation requirement. Security documents and outstanding documentary conditions precedent are usually executed or in agreed forms. - Financial assistance

The giving of guarantee or security by the offeree to support the loan obtained by the offeror may constitute prohibited financial assistance under the relevant companies law. In the case of a Hong Kong company, financial assistance is generally prohibited unless a solvency test and certain specified procedures are satisfied. The three procedures set out in the Companies Ordinance (the "Companies Ordinance") are (a) a board resolution as long as the aggregate financial assistance given is less than 5 per cent of the shareholders' funds; (b) a written resolution of all members of the company supported by a director resolution; and (c) a resolution passed by a simple majority of the shareholders subject to any application for a restraining order by dissenting shareholders representing 5 per cent of total voting rights or total members. - Control over the privatisation process

Lenders should consider the level of control they require over the offer process and when and how certain discretions and decisions are to be exercised and made by the offeror. Lenders may want to ensure that there will not be any material change to the offer or scheme documents, in particular, in relation to the offer price or waiver of any condition. They may want to ensure compliance with relevant rules and legislation and have the ability to require certain actions (such as sending of offer documents or implementation of squeeze-out) to be taken earlier than the permitted time limits.

Information undertakings may be built-in to keep the lenders informed of the progress. - Confidentiality

If the loan facility is to be provided by a syndicate of lenders, it may have to be underwritten by a very limited group of arrangers and not syndicated until after the offer has been announced as there must be absolute secrecy before the announcement is made.

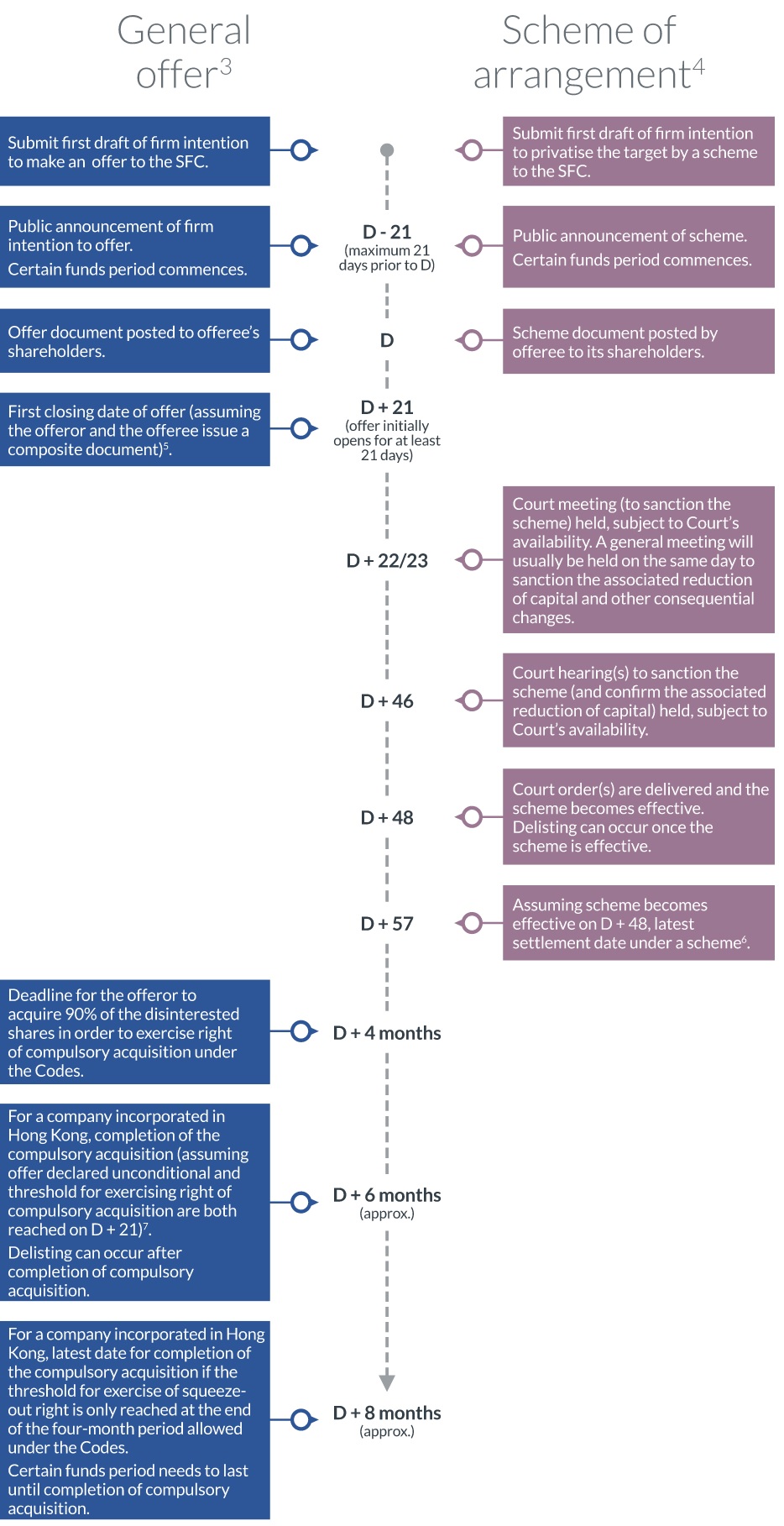

Appendix – Indicative timelines for a general offer and a scheme of arrangement

Footnotes

1 Approval threshold required is governed by the laws of the place of incorporation of the listed company and the Codes.

2 For a company incorporated in Hong Kong, the procedures for a court sanction for a scheme are set out in the Companies Ordinance.

3 Certain timing may be extended with SFC approval.

4 Timeline varies depending on the Court's availability.

5 Assuming the offer becomes unconditional on the first closing date (D +21), consideration in respect of valid acceptances received prior to the first closing date has to be posted before D +30 (7 business days after all conditions satisfied). Once a conditional offer is declared unconditional, it needs to remain open for acceptance for not less than 14 days thereafter – consideration in respect of valid acceptances received during this period must be posted within 7 business days after receipt of such acceptances.

6 Consideration has to be posted within 7 business days after the scheme becomes effective.

7 Assuming offer declared unconditional and threshold for exercising right of compulsory acquisition reached on the first closing date (D +21) and compulsory acquisition notices are issued on the last date allowed under the Companies Ordinance (for a Hong Kong company), minority shareholders are entitled to apply to the Court to object to the squeeze-out before D +6 months (approximately). Completion of compulsory acquisition should take place shortly after the end of the objection period.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.