On 16 June 2017, Hong Kong Exchanges and Clearing Limited and its subsidiary The Stock Exchange of Hong Kong Limited (the "Exchange") launched a consultation on a package of proposals (the "Proposals") through two separate papers:

- the New Board Concept Paper (the "Concept Paper"); and

- the Consultation Paper on the Review of the Growth Enterprise Market (GEM) and Changes to the GEM and Main Board Listing Rules (the "Consultation Paper").

The Proposals are the result of a holistic review of the Hong Kong listing framework aimed at widening capital markets access by opening up to a more diverse range of issuers and improving the quality of the Exchange's markets. In the Concept Paper, the Exchange proposes the establishment of a New Board, which is separate from the Main Board and the GEM. The New Board will comprise two distinct segments, namely New Board PREMIUM and New Board PRO.

In the Consultation Paper, the Exchange proposes changes to the Main Board and GEM to ensure they reflect currently acceptable standards in the market and address the recent regulatory and market concerns on GEM applicants and listed issuers (largely by tightening up the requirements for GEM listings). The proposed changes to the Main Board eligibility requirements are to preserve the Main Board's position as a market for larger companies.

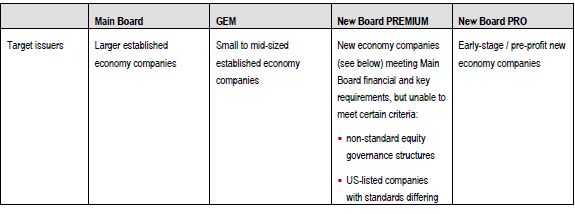

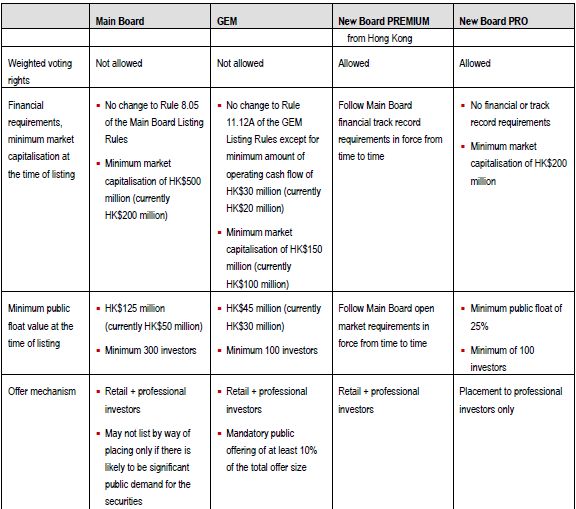

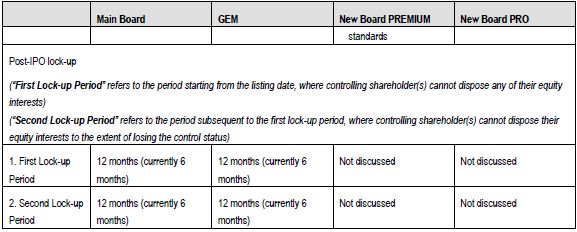

Synopsis of the Four Boards

Some of the key features of the Main Board, GEM, New Board PREMIUM and New Board PRO are summarized in the table below, should the Proposals be adopted:

Since New Board PRO would be open to professional investors only, it is proposed that a "lighter touch" approach will apply to initial listing requirements. Specifically, the existing sponsor regime will not apply to New Board PRO and a financial adviser is proposed to be appointed, who would be expected to exercise its own professional judgement as to what investigations are appropriate for the applicant and to ensure that the listing document provides accurate and sufficient information to enable professional investors to make an informed investment decision.

Under the Proposals, there would be no fast-track migration mechanism between the New Board and the Main Board or GEM, or from New Board PRO to New Board PREMIUM. The Exchange proposes removing the "stepping stone" concept (GEM as a stepping stone to the Main Board) and the streamlined process for transfers from GEM to the Main Board. This means that GEM transfer applicants will be required to appoint a sponsor and issue a "prospectus-standard" listing document. Further, the Exchange proposes all GEM transfer applicants to have published at least two full financial years of financial statements after their GEM listings before they can be considered for a transfer to the Main Board.

New Concepts from the Proposals

There are a few new concepts / terminologies introduced in the Proposals which Hong Kong capital markets practitioners and stakeholders should be familiarised with in order to understand the Proposals.

- New Economy Companies – New economy companies may encompass a range of different sectors including biotechnology, health care technology, internet and direct marketing retail, internet software and services, IT services, software, technology hardware and storage and peripherals. In light of the evolving nature of technology, no fixed definition is actually proposed for this terminology and the Listing Committee will retain the ultimate discretion to determine the listing eligibility for the New Board on a principle-based approach.

- Weighted Voting Rights ("WVR") – Picking up from where it left off after the roadblock to the "Concept Paper on Weighted Voting Rights" back in 2014, the Exchange is proposing to allow companies with WVR to list in Hong Kong through New Board PRO and New Board PREMIUM. The Exchange admitted that one major attraction of the US market for many companies is that WVR structures are permitted there, whereas the Hong Kong market does not allow them. Two approaches are proposed to regulate companies seeking a listing on the New Board with a WVR structure. One option would be to take a disclosure-based approach. This would require such companies to prominently disclose that they have a WVR structure and the risks associated with the structure. An alternative approach would be to impose mandatory safeguards in addition to disclosure requirements. Examples of such safeguards include restrictions on the types of persons that can hold WVR, the minimum equity that they must hold in the company on an ongoing basis and restrictions on the transfer of WVR to other persons, and requirement that the WVR structure fall away after a pre-determined period of time.

- Private Market – The Exchange is also exploring the creation of a Private Market, a platform on which unlisted, or pre-listing companies with a market value below HK$150 million could be registered. Registration on the Private Market would enable private companies to manage their shareholder registers, investor communications and corporate actions, and would help prepare companies for an eventual transition to listed status.

Consultation Period The consultation period for the Proposals is two months and the deadline for responses is 18 August 2017. The Exchange emphasized that these interlinked Proposals should be viewed and considered holistically when deciding the way forward. That said, the Exchange expects the amendments to the GEM Listing Rules and the Main Board Listing Rules to take effect approximately six months after the date of the Consultation Paper, i.e., around December 2017.

The Concept Paper and the Consultation Paper are available at:

- http://www.hkex.com.hk/eng/newsconsul/mktconsul/Documents/cp2017061.pdf

- http://www.hkex.com.hk/eng/newsconsul/mktconsul/Documents/cp2017062.pdf .

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.