Foreword

In the last few years, a large number of remote gaming operators have established themselves in Malta and the Lotteries and Gaming Authority has to date issued over 400 licences. The industry is in a trail-blazing stage with several countries changing policies seeking to find a stance that addresses the balance between citizen freedom and protecting the same citizen from fraud, crime and addiction.

PwC recognises the importance of the industry to the economy of Malta and supports the concept that good governance and regulation is the solution to protecting players and particularly vulnerable groups. History has shown that protectionism generally serves the unscrupulous more than the righteous.

As the leading and largest professional services organisation on the island, with nineteen partners and over 300 staff, we provide a range of assurance, tax and advisory services to a large and varied client base, including reputable remote gaming companies that choose Malta as a base.

This document presents an overview of how we perceive a dynamic and rapidly evolving industry and the services we are geared up to provide.

We look forward to being of service to you.

Kevin Valenzia

Territory Senior Partner

Remote Gaming Industry

Local Views

- Malta has rapidly evolved into becoming the gaming centre of Europe.

- There has been a steady increase in the number of gaming providers that moved their operations to Malta since the inception of the Lotteries and Other Games Act in 2001, but more pronouncedly since the Remote Gaming Regulations were introduced when Malta joined the European Union in 2004.

- In fact, Malta was the first EU Member State that established comprehensive legislation on remote gaming in 2004 and is currently considered by the industry to be one of the foremost tried and tested jurisdictions.

- In the past five years the Lotteries and Gaming Authority (LGA) has received hundreds of applications for a gaming license. Currently there are over 400 licensees across all classes that can conduct remote gaming activities.

- The LGA is responsible for the governance of all forms of gaming in Malta including remote gaming. The LGA has a licensing framework based on four different classes, as well as sophisticated evaluation and monitoring activities, systems and processes.

- Apart from a stable and comprehensive regulatory framework protecting both operators and players, there are various factors which have contributed to Malta's success in attracting remote gaming operations. Some of the principal advantages include:

-

- Attractive gaming licensing fees, gaming taxes and beneficial effective corporate tax rates on gaming operations

- Rapid, efficient and relatively low cost licensing application procedures

- Availability of an English-speaking skilled work-force and highly competitive salaries

- Malta has a sound reputation as an ICT hub with global operators present such as IBM, Oracle, Microsoft, and Cisco Systems

About PwC

How We Can Serve You

|

PwC provides industry-focused assurance, tax and advisory services to build public trust and enhance value for its clients and their stakeholders. More than 161,000 people in 154 countries across our network share their thinking, experience and solutions to develop fresh perspectives and practical advice. |

|

PwC Malta is the leading and largest professional services organisation on the island, with nineteen partners and over three hundred staff. We provide a range of assurance, tax, and advisory services to a large and varied client base. It is also the basis which has given our firm the critical mass required to attract and develop high quality specialists. You can be assured that PwC has the depth of resources locally and the breadth of experienced professionals that your company would require. In recognition of the continued and sustained growth of the i-Gaming sector in Malta and its requirements for high quality audit, tax and business advisory services, the Maltese firm is dedicating resources and professionals to serve this industry. We have a dedicated team that specialises in this particular sector. The scale of this experienced resource pool cannot be matched by any other service provider in Malta. |

- Gaming operators in Malta can benefit from industry knowledge, global resources and the reputation for quality of PwC.

- Since Malta's establishment as a leading jurisdiction in the remote gaming sector, the local firm has developed a team of experts to service some of the larger and more renowned gaming operators that are licensed in Malta. Over the past few years, our team has gained considerable expertise in a vast array of issues that gaming operators face, across all types of gaming sectors.

- Our firm benefits from an excellent relationship with the LGA, and we have advised the LGA in the areas of taxation, regulation, risk management and process improvement.

- Through our Advisory line of service, we have developed a specialist team that provides assistance to the LGA, in conducting system reviews as part of an applicant's licensing process.

- Industry experience includes some of the largest and most successful corporations in gaming today, and a large number of operators through compliance/systems reviews for the LGA.

- Several of the gaming clients that we service operate across various jurisdictions. We are accustomed to operating as a global network working closely with our counterparts abroad, to offer a seamless service to our customers.

- We are committed to promoting the highest quality of professional standards and practices across all of our engagements.

- We provide assistance in evaluating operational, technology and financial performance of organisations bringing industry best practices and expertise from other industries for similar business issues.

- The financial, operational and tactical skills of our gaming specialists, combined with the full service resources of a global network, give us the unique ability to analyse relevant information, solve complex problems and ultimately assist our clients in making sound business decisions.

Our Experience in some more detail

- We have performed various types of engagements in relation to the gaming industry in Malta including:

-

- External financial audits of a number of the larger and more mature remote gaming operators in Malta. The work covered during the external financial audit includes an in-depth review of the risks and underlying processes of the operators. External financial audit clients include Portomaso Casino, Unibet, Betsson and Tipico.

- We have performed over 60 system reviews on behalf of the LGA, in which we review the gaming and control systems of prospective licensees to ensure compliance with relevant regulations and the LGA's policies.

- We have actively led and participated in various workshops with the LGA in relation to identifying changes that are necessary to improve the compliance reviews performed by the Authority.

- We have been working closely with the LGA and the industry to address VAT related regulatory aspects.

- We have performed an analysis of player behaviour patterns in utilising credit/debit card funds over time on behalf of a leading global bank serving major gaming operators. The task involved millions of transactions with a total value of several hundred million Euros.

- We performed a Business Process Review and a Tax Review of the Lotteries and Gaming Authority in Malta.

- We have reviewed the business plan and prepared the Terms & Conditions for remote gaming operators in the process of setting up in Malta.

- We have provided direct and indirect tax related services to various gaming clients and their related entities.

Our Services

Tax and Company Administration

- PwC Malta's tax practice has significant experience in dealing with international structures, including but not limited to clients in the gaming sector.

- Our firm has assisted a large number of clients in setting up Malta structures. Our expertise in this field is enhanced by our membership of the PwC network.

- Given the particular VAT related circumstances applicable to gaming entities, we have been at the forefront in advising on the VAT implications that are specific to this industry and in providing relative solutions.

- Tax planning and advisory services vary depending on the complexity of the structures and the issues arising. It is our experience that some investment is required particularly in the initial stages in assessing the VAT implications of operating in the gaming industry and exploring possible solutions.

- Our firm can provide assistance with the incorporation of a Maltese entity.

- In addition, companies are required to deal with annual income tax compliance as well as annual return submissions to the Registrar of Companies. Our firm is well placed to assist with both of these legal obligations.

- We also assist with any tax refund claims that may be applicable in certain circumstances both in advising on the setting up of an efficient tax refund process, as well as assisting in the compliance aspect of tax refund applications.

- Particularly in the case of foreign owned gaming businesses or those employing individuals who are not ordinarily resident in Malta, we have the necessary expertise to advise and assist with personal income tax matters.

- We also provide other human resource related services such as advice on organisation design, policies, assistance with global mobility matters, job evaluation and compensation, and payroll administration services.

- Our practice is also well placed to provide various accounting services to gaming operators, which could range from assistance with the production of monthly or quarterly management accounts to involvement in day-to-day book-keeping and reconciliation processes.

Our Services

Assurance

- PwC Malta provides audit services to some of the best-known names in the remote gaming sector. Services are provided to several segments including, casinos (and land-based casinos), sports betting, bingo, poker and land-based gaming through licensed betting offices.

- PwC commits to a quality audit that adds value to your business. Our audit approach can be summarised as follows:

-

- We start by obtaining an understanding of the business and risks, which drives our assessment of materiality and the identification of audit risks, including key risks – audit risks that require special audit consideration.

- We then scale our audit approach based on the size and complexity of the business and entity-level and information technology controls, taking into consideration management's approach to its evaluation and testing of internal controls.

- We gather audit evidence in a number of different ways – tests of controls through inquiry, observation, inspection and re-performance including walkthroughs, reliance on the work of internal audit (or equivalent) and substantive procedures.

- Our field work will be performed by a team made up of qualified staff members. All fieldwork completed by the audit team will be reviewed by the team manager. The engagement leader's review will focus on the more material/high risk balances where significant levels of judgement or complex disclosure are required.

- We are experienced in managing the smooth delivery of company

audits and in co-ordinating the review process in accordance with

pre-agreed timetables.

|

With PwC you get:

|

SPA (System and Process Assurance) is understandably integral to the audit of a gaming company. The following diagram maps the links between the audit of the financial statements and the systems related work.

SPA processes in some more detail:

Our audit will focus on the key risk areas in the context of the financial statements. Typical key audit risks include:

Our Services

Advisory

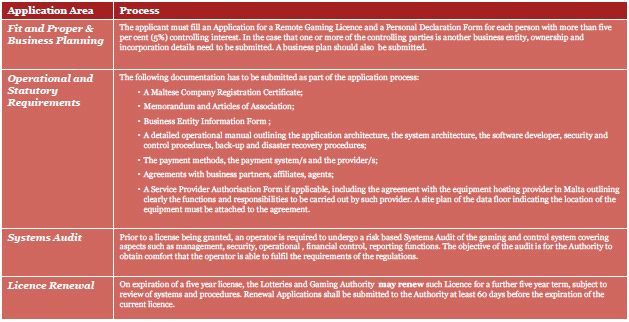

- PwC Malta provides advisory services throughout the licensing process. These include:

-

- Fit and Proper & Business Planning

-

- Introduction to Maltese regulatory authorities and requirements for remote gaming

- Assist in the preparation and review the financial components in the business plan prior to submission to the Authorities

- Operational and Statutory Requirements

-

- Assist in the compilation of documentation required throughout the license application process.

- Assist in the compilation of the organisation's policies

and procedures including:

- Risk Management

- Information Security

- Know Your Client

- Acceptable usage

- User/Player Terms & Conditions

- Data Protection

- Incident Management

- Backups Management

- Design or review a Business Continuity Plan

- Systems Audit

-

- Readiness assessment in preparation for the Systems Audit performed by the Authority

- Threat and vulnerability assessment and testing.

- PwC Malta provides other advisory services in the Transactions and Performance Improvement domains such as:

-

- Merger and acquisition

We identify merger and acquisition candidates, perform acquisition advisory procedures and disposition assistance of gaming operations. We assist our clients through every stage of a transaction, including deal structuring and fund raising, and help clients adapt quickly to the resultant changes. - Financial analysis

Our finance specialists prepare prospective financial analyses for proposed and existing operations. We evaluate actual results, and analyse the effectiveness of an entity's accounting and internal control systems for regulatory compliance and other purposes. Financial analysis services also include assisting entities in structuring joint venture agreements, negotiating management contracts and providing direction in the development of financial terms and the overall capital structure with lending institutions and investment banks. - Performance Improvement

Our gaming industry specialists work within an organisation to assess areas for operational improvement and enhanced financial performance. This includes in-depth analysis by department of current practices, funds flow, staffing, departmental objectives, marketing initiatives and internal communication tools to enhance customer satisfaction and property earnings. As part of our Performance Improvement expertise, we can also assist operators improve on the ongoing compliance with laws and regulations efficiently and effectively. We use our experiences with standard industry practices and benchmarks to develop operational refinements and process improvement recommendations.

- Merger and acquisition

Appendix A

Regulatory Framework in Malta (www.lga.org.mt)

Appendix B

Licensing Costs

Gaming Tax

Appendix C

Doing Business and Investing in Malta

- This Guide has been prepared for the assistance of those

interested in doing business in Malta. It is not intended to cover

exhaustively the subjects it addresses but rather to answer some of

the important, broad questions that may arise for a potential

investor. When specific problems occur in practice, it will often

be necessary to refer to the laws, regulations and decisions of the

country and to obtain appropriate accounting and legal

advice.

|

The material contained in this guide was assembled up to September 2009 and, unless otherwise indicated, is based on information available at that time. |

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.