1 REGULATORY FRAMEWORK

1.1 What legislation governs the establishment and operation of Alternative Investment Funds?

The Securities and Investment Business Act, 2010, as amended ("SIBA") and its subsidiary legislation, including the Securities and Investment Business (Incubator and Approved Funds) Regulations, 2015, provides for the regulation of open-ended mutual funds, among other matters. Responsibility for regulation under SIBA rests with the Financial Services Commission (the "Commission") of the British Virgin Islands (the "BVI").

In addition, the Mutual Fund Regulations, 2010 (the "MFR") provide further detail regarding the obligations of mutual funds. Public funds are also subject to the Public Funds Code, 2010.

1.2 Are managers or advisers to Alternative Investment Funds required to be licensed, authorised or regulated by a regulatory body?

A manager or advisor which is established or, in the case of a foreign company, registered in the BVI and which conducts "investment business", whether or not that investment business is carried on in the BVI, will fall within the scope of SIBA. Managers and advisors holding a full licence under SIBA are regulated by the Commission and are subject to the Regulatory Code, 2009 (the "Code"); managers and advisors approved under the Investment Business (Approved Managers) Regulations, 2012, as supplemented by the Approved Managers (Amendment) Regulations, 2013 (the "Approved Managers Regulations"), are regulated by the Commission, but are not subject to the Code.

"Investment business" is defined as being engaged, by way of business, in any activity which is of a kind that is specified in Schedule 2 Part A and is not excluded by Schedule 2 Part B to SIBA. Those activities include managing investments belonging to another person on a discretionary basis, acting as the manager or investment advisor of a mutual fund and advising in relation to investments, if the advice is given to someone in their capacity as investor or potential investor or in their capacity as agent for an investor or a potential investor and the advice is on the merits of that person (whether acting as principal or agent) buying, selling, subscribing for or underwriting a particular security or exercising any right conferred by a security to buy, sell, subscribe for or underwrite a security. "Investments" are defined in Schedule 1 to SIBA and include most forms of shares and stock, debt instruments, options, futures, contracts for differences, and derivatives.

Any person conducting investment business in, or from within, the BVI must be licensed by the Commission or be an approved investment manager or advisor under the Approved Managers Regulations, unless that person is exempt from holding a licence. A licence may be restricted (meaning that securities investment business may only be transacted with particular clients) or unrestricted. A licence may also be issued subject to conditions or may be unconditional.

Schedule 2 Part B to SIBA specifically excludes certain activities from the definition of investment business, although those exclusions are unlikely to apply to a person conducting discretionary investment management or investment advisory activities for a mutual fund.

Under Schedule 2 Part C to SIBA, a person carrying on investment business may be excluded from the requirement to obtain a licence or to be approved under the Approved Managers Regulations. It is unlikely that such exclusions would apply to a person conducting discretionary investment management or investment advisory activities for a mutual fund.

An "Excluded Person" includes:

- a company carrying on investment business exclusively for one or more companies within the same group;

- a person who is a participant in a joint enterprise and conducts such investment business for the purposes of, or in connection with, the joint enterprise;

- a person who is a partner in a partnership and conducts such investment business for the purposes of, or in connection with, the partnership; and

- a person who is a director of a company and conducts such investment business for the purposes of, or in connection with, the company,

in each case, provided that the person does not otherwise carry on or hold himself out as carrying on investment business, and does not receive remuneration for carrying on the investment business separate from the remuneration the person receives for acting in the relevant capacity specified.

1.3 Are Alternative Investment Funds themselves required to be licensed, authorised or regulated by a regulatory body?

Only BVI Alternative Investment Funds that fall under the definition of a "mutual fund" require to be regulated under SIBA. Traditional private equity and other closed-ended structures are not regulated, although a BVI manager or advisor to such a fund would require to be regulated. SIBA defines a mutual fund as a company incorporated, a partnership formed, a unit trust organised or other similar body formed or organised under the laws of the BVI or the

laws of any other country which:

- collects and pools investor funds for the purpose of collective investment; and

- issues fund interests (defined as the

rights or interests, however described, of investors in a mutual

fund with regard to the assets of the fund, but does not include a

debt) that entitle the holder to receive on demand, or within a

specified period after demand, an amount computed by reference to

the value of a proportionate interest in the whole or in a part of

the net assets of the company, the partnership, the unit trust or

other similar body, as the case may be, and includes:

- an umbrella fund whose fund interests are split into a number of different class funds or sub-funds; and

- a fund which has a single investor which is a mutual fund not registered or recognised under SIBA.

There are five main categories of mutual funds under SIBA: private; professional; public; incubator; and approved funds. In addition, foreign mutual funds may be registered as Recognised Foreign Funds provided for under SIBA. Of the five main categories of mutual fund, the overwhelming majority are private or professional funds.

The Professional Fund

A professional fund is a mutual fund the constitutional documents of which specify that the fund interests shall only be issued to professional investors and the initial investment by each investor in the fund, other than exempted investors, is not less than US$100,000 or its equivalent in any other currency. A "professional investor" is defined in SIBA as a person: (a) whose ordinary business involves, whether for that person's own account or the account(s) of others, the acquisition or disposal of property of the same kind as the property, or a substantial part of the property of the fund; or (b) who has signed a declaration that he, whether individually or jointly with his spouse, has a net worth in excess of US$1,000,000 or its equivalent in any other currency and that he consents to being treated as a professional investor. Exempt investors include the investment manager and promoter of the fund and its employees.

The Private Fund

A private fund is a mutual fund the constitutional documents of which specify either: (a) that it will have no more than 50 investors; or (b) that the making of an invitation to subscribe for, or purchase, fund interests issued by the mutual fund is to be made on a private basis only. An invitation to subscribe for, or purchase, shares issued by a mutual fund on a private basis includes an invitation which is made: (i) to specified persons (however described) and is not calculated to result in fund interests becoming available to other persons or to a large number of persons; or (ii) by reason of a private or business connection between the person making the invitation and the investor.

The Public Fund

A public fund is recognised by the Commission, provided that the Commission is satisfied with the following:

- the fund is a BVI business company or unit trust that is governed by the trust laws of the BVI and has a trustee based in the BVI;

- the fund satisfies the requirements of SIBA and, where applicable, the Public Funds Code with respect to its application;

- the fund will, on registration, be in compliance with SIBA and any practice directions issued by the Commission and applicable to the fund;

- the fund's functionaries satisfy the Commission's "fit and proper" criteria;

- the fund has, or on registration will have, an independent custodian;

- the fund's name is not undesirable or misleading; and

- registering the fund is not against the public interest.

The Incubator Fund

An incubator fund is a mutual fund which is limited to having no more than 20 investors, who must each invest at least US$20,000 as an initial investment, and a net asset value of US$20 million. The fund is authorised to operate for an incubation period of two years, which may be extended to three years on application, without the need to appoint external managers, administrators, custodians or auditors. It must have an authorised representative in the BVI and at least two directors, make semi-annual returns regarding its assets and number of investors and, annually, submit financial statements, which need not be audited, to the Commission. It is not required to have an offering document; however, it must issue written risk warnings to investors in a form prescribed by the implementing legislation. At the end of the incubation period, it must either: (i) convert into a different type of regulated fund; (ii) cease to be an open-ended fund; or (iii) liquidate.

The Approved Fund

An approved fund is a mutual fund which is limited to having no more than 20 investors and a net asset value of US$100 million. The fund is authorised to operate for an unlimited period, without the need to appoint external managers, custodians or auditors. It must have an external administrator based in a recognised jurisdiction, an authorised representative in the BVI and at least two directors. It must make a return regarding its assets and number of investors and submit financial statements, which need not be audited, to the Commission annually. It is not required to have an offering document; however, it must issue written risk warnings to investors in a form prescribed by the implementing legislation.

1.4 Does the regulatory regime distinguish between open-ended and closed-ended Alternative Investment Funds (or otherwise differentiate between different types of funds or strategies (e.g. private equity v hedge)) and, if so, how?

Yes; closed-ended funds (such as private equity funds) are not subject to regulation under SIBA, while open-ended funds that fall within the definition of "mutual fund" under SIBA (such as most hedge funds) are subject to regulation under SIBA. The key distinction between open-ended and closed-ended funds is the ability of investors to require the redemption or repurchase of some or all of their investment by reference to the net asset value of the interest they have prior to winding up. Where long lockup periods, commonly in excess of five years, are part of a fund's terms, BVI practitioners and the Commission generally consider such investment funds to be closed-ended funds, although this will be fact-specific.

1.5 What does the authorisation process involve and how long does the process typically take?

- The authorisation process for all

funds involves the submission of an application form, together with

supporting documents and the requisite fee.

Documents required to be filed for private and professional funds are:

- an offering memorandum;

- the Application Form F100 (Parts 1, 4, and 6);

- the certificate of incorporation of the fund;

- the constitutional documents of the fund (which must contain the applicable fund disclosure required by SIBA); and (v) a written consent of each of the fund's lawyer and the fund's auditor confirming acceptance of each of their appointments by the fund.

- Where an offering document is required, offering documents of BVI mutual funds must contain certain investment warnings required by SIBA and such information as is necessary to enable a prospective investor to make an informed decision as to whether or not to invest. The subscription documents must contain an acknowledgment by investors that each investor has been provided with an investment warning and, in the case of a professional fund, a confirmation that the investor is a "professional investor".

- Incubator and approved funds must, at

a minimum, submit:

- Form IB-A2-IAF;

- the constitutional documents of the fund;

- the offering document, inclusive of investment warning and investment strategy (optional);

- an investment warning (required in the absence of an offering document); and

- a written description of investment strategy (required in the absence of an offering document).

- Public funds require a prospectus to be approved in advance of the registration being granted. The prospectus must have been prepared in accordance with the Public Funds Code. In addition, the public fund must satisfy the Commission concerning the matters identified in question 1.3 above.

- In terms of timing, following the filing of an application with the Commission, (i) a private or professional fund will generally be recognised by the Commission within five to seven business days of submission of the application, provided the requisite documentation is complete and no exemptions have been applied for (and a professional fund may commence business up to 21 days prior to receiving formal confirmation of recognition, provided it complies with all other requirements of SIBA and submits an application for recognition within seven days of commencing business); (ii) a public fund will generally be registered by the Commission within six to nine weeks; and (iii) incubator and approved funds may commence trading two business days after a completed application is submitted to the Commission.

- The fee payable on submitting an application for recognition of a professional or private fund is US$700 and, once recognised, there is an annual recognition fee of US$1,000 payable upon recognition and annually by 31 March until the fund's certificate of recognition is cancelled. The application fee payable by an incubator or approved fund is US$1,500 and, once approved, there is a fee of US$1,000 payable upon approval and due annually by 31 March until the fund is no longer approved as an incubator or approved fund.

1.6 Are there local residence or other local qualification requirements?

There are no local residence requirements. Each approved, recognised or registered mutual fund must, however, appoint an authorised representative in the BVI to represent it when dealing with the Commission.

1.7 What service providers are required?

Private and professional funds must, at all times, have a fund manager, a fund administrator, and a custodian (collectively described, together with investment advisors and prime brokers, as "functionaries"). The custodian of a private fund or a professional fund must be a person who is functionally independent from the fund manager and the fund administrator. The Commission may, on written application made by or on behalf of a private or professional fund, exempt the fund from the requirement to appoint a custodian or a fund manager, and an application for such an exemption can be made together with the application for recognition as a BVI mutual fund or at any subsequent time. However, no exemption is available in respect of the requirement to have an administrator.

A public fund must at all times have a manager, an administrator and a custodian (unless the fund is exempted by the Commission from the requirement to appoint a custodian). Each functionary of a public fund must be functionally independent from every other functionary of the fund.

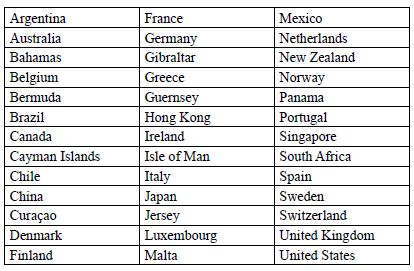

An incubator fund is not required to have any functionary appointed; an approved fund must have an administrator appointed at all times, but is not required to have any other functionary appointed. The Commission will recognise and accept any functionary of a fund that is established and located in a "Recognised Jurisdiction". The current list of Recognised Jurisdictions is as follows:

Where a functionary of a fund is not established and located in a recognised jurisdiction, the Commission may recognise and accept the functionary if they are satisfied that the functionary's jurisdiction of establishment and location has a system for the effective regulation of investment business.

Directors

A private, professional, incubator and approved fund must at all times have at least two directors, at least one of whom must be an individual. A public fund must at all times have at least two directors. Only individuals can serve as directors of public funds. Although not required, it is becoming market practice for regulated funds to appoint independent directors. Directors of regulated funds are not required to be based in the BVI.

Authorised representative

All entities subject to approval, recognition, registration or licensing under SIBA are required to appoint an authorised representative in the BVI in order to represent them in their dealings with the Commission, save where the entity has a substantial presence in the BVI.

1.8 What rules apply to foreign managers or advisers wishing to manage, advise, or otherwise operate funds domiciled in your jurisdiction?

SIBA provides that no person shall carry on, or hold out as carrying on, investment business of any kind in or from within the BVI unless he or she holds a licence authorising him or her to carry on that kind of investment business. Accordingly, foreign managers or advisers that carry on investment business of any kind (including managing, advising or operating BVI funds) in or from within the BVI will be required to obtain a licence for such investment business activities.

The term "in or from within" the BVI applies to:

- persons occupying premises in the BVI for the purpose of offering to provide a service that constitutes investment business; or

- persons soliciting other persons in the BVI (such as a mutual fund) for the purpose of offering to provide a service that constitutes investment business.

Foreign managers or advisers that manage, advise or operate BVI funds but do not carry out such activities in or from within the BVI fall outside of the provisions of SIBA and are not required to obtain a licence from the Commission.

1.9 What co-operation or information sharing agreements have been entered into with other governments or regulators?

The BVI has Tax Information Exchange Agreements ("TIEAs") and similar bilateral and multilateral arrangements with 28 countries as at 24 April 2018 and is on the OECD "white list" with respect to the exchange of tax information. In addition, the Commission has entered into bilateral regulatory co-operation agreements pursuant to the EU Directive on Alternative Investment Fund Managers ("AIFMD") with the competent authorities of 26 of the EU and EEA Member States.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.