On 28 September 2023, the Monetary Authority of Singapore ("MAS") published its response to feedback received on its consultation paper on draft notices on the competency requirements for representatives conducting regulated activities under the Securities and Futures Act 2001 ("SFA") and Financial Advisers Act 2001 ("FAA").

This note summarises the key points from the consultation response.

1. Introduction

MAS had on 4 September 2020 published a Consultation Paper on Draft Notices on the Competency Requirements for Representatives Conducting Regulated Activities under the FAA and the SFA (the "2020 Consultation Paper"). The 2020 Consultation Paper had proposed legal amendments to FAA-N13 Notice on Minimum Entry and Examination Requirements for Representatives of Licensed Financial Advisers and Exempt Financial Advisers and SFA 04-N09 Notice on Minimum Entry and Examination Requirements for Representatives of Holders of Capital Markets Services Licence and Exempt Financial Institutions to implement changes to the Capital Markets and Financial Advisory Services Examination ("CMFAS") requirements for representatives conducting regulated activities under the SFA and FAA.

MAS has now published a Response addressing key feedback given in relation to the 2020 Consultation Paper. MAS noted that there was in general broad agreement from the industry on the draft legal amendments to the FAA Notice and SFA Notice. As such, MAS has incorporated some of the feedback received through revisions to the FAA Notice and the SFA Notice. With effect from 1 April 2024:

- FAA-N26 Notice on Competency Requirements for Representatives of Financial Advisers (the "revised FAA Notice") will replace the current Notice FAA-N13;

- SFA 04-N22 Notice on Competency Requirements for Representatives of Holders of Capital Markets Services Licence and Exempt Financial Institutions (the "revised SFA Notice") will replace the current Notice SFA04-N09.

We summarise below the clarifications provided by MAS in response to the feedback received and MAS' response to requests to broaden the scope of certain exemptions.

2. CMFAS Exam Requirements for Appointed Representatives of Licensed Fund Management Companies

In the 2020 Consultation Paper, MAS had proposed to:

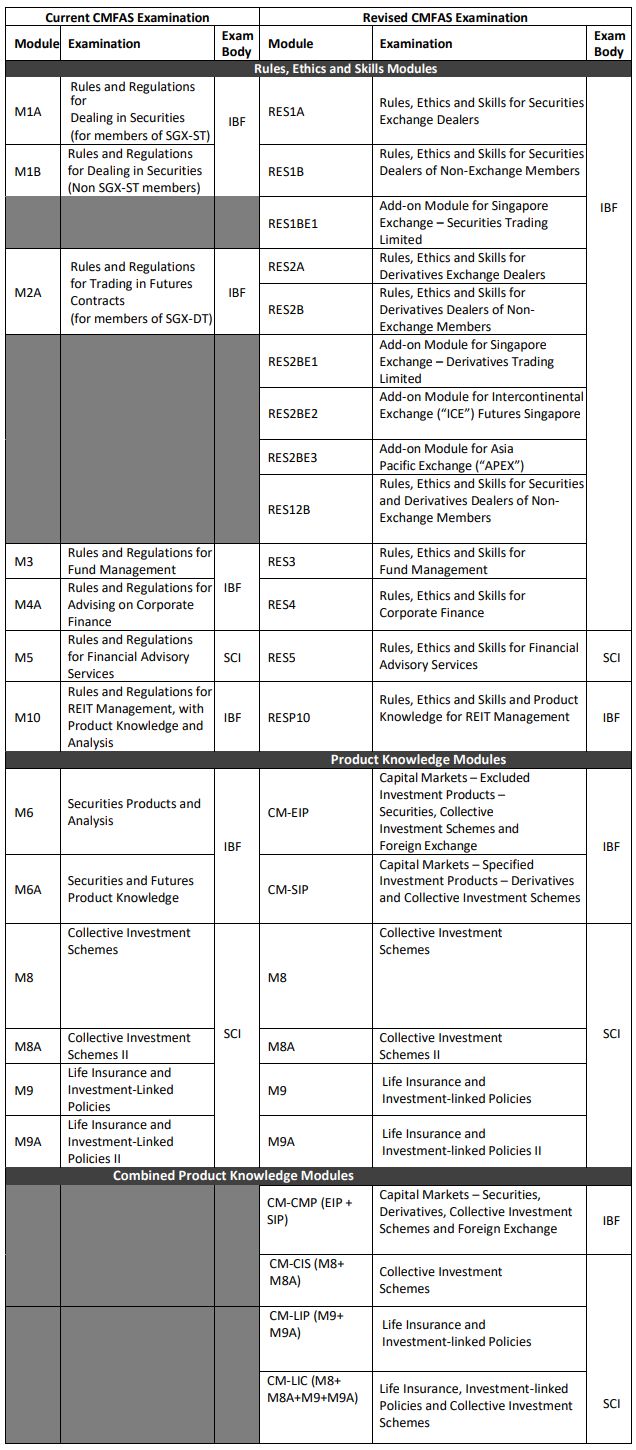

- introduce ethics and skills content into the rules and regulations modules of the CMFAS exams in the form of Rules, Ethics and Skills ("RES") modules, and tailor such content for appointed representatives trading on the respective securities and derivatives exchanges; and

- provide an option for appointed representatives to take new combined product knowledge modules.

A comparison between the existing exam modules and the proposed revised modules was included in the 2020 Consultation Paper. For ease of reference, this is reproduced below:

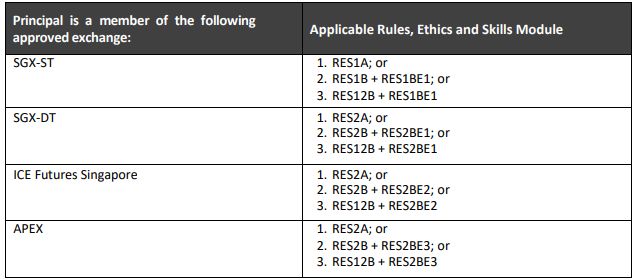

We also reproduce below the MAS summary in the 2020 Consultation Paper of the proposed RES modules applicable to an appointed representative whose principal is a member of an approved exchange:

In the Response, MAS provided the following clarifications in relation to CMFAS Exam Requirements for appointed representatives of licensed fund management companies ("LFMCs").

Firstly, in relation to the modules on RES for representatives of LFMCs who undertake dealing in capital markets products ("dealing representatives"), MAS explained that the applicable module should be aligned with the primary regulated activity of the LFMC and the types of regulatory knowledge and skills the dealing representative should be equipped with to perform the role effectively. MAS will update the revised SFA Notice so that individuals appointed as dealing representatives of LFMCs would have the flexibility to pass either RES3 or the RES modules in relation to dealing in capital markets products. However, in the case of an appointed representative of an LFMC who deals in funds that are managed by the LFMC and its related corporations, MAS stated that they should take RES3, which includes content on rules pertaining to LFMCs and dealing.

Secondly, in relation to the exemption from the CMFAS exams for dealing representatives of an LFMC where the LFMC manages funds only for accredited investors and/or institutional investors, MAS clarified that this exemption does not apply to representatives of other types of financial institutions such as banks. MAS will make this more explicit by amending the revised SFA Notice to refer instead to an individual whose principal is a holder of a CMS licence for fund management.

Thirdly, in relation to a representative who markets funds, MAS clarified that such representatives who market units in any collective investment schemes ("CIS") should pass RES3 and CM-EIP, unless they are otherwise exempted. MAS also clarified that going forward, such representatives need not pass RES5 and M8/M8A.

Fourthly, in relation to a representative who markets CIS units to distributors, such representatives will continue to be exempted from CMFAS exams and Continuing Professional Development ("CPD") requirements. The reference to "distributors" will include licensed financial advisers in Singapore, and MAS will update the relevant portions of the Frequently Asked Questions to incorporate this clarification.

Lastly, in relation to a representative who limits the scope of his financial advisory services by providing only customised information (i.e. information tailored to the particular client's financial situation and needs) on funds that are managed by the representative's own LFMC, some respondents had suggested the proposed exemption should extend to funds managed by the LFMC's related corporations. MAS has agreed to this and will incorporate this into the revised FAA Notice.

3. Exemptions for Private Banking Representatives from the CMFAS Exam Requirements – Grandfathering and Transitional Arrangements

With the revisions to the CMFAS exam modules, MAS had also indicated in the 2020 Consultation Paper that it would also exempt existing appointed representatives who are continuing with their current regulated activities from having to take the revised CMFAS exam modules. This is on the basis that such representatives have already fulfilled existing requirements and possess the relevant knowledge and experience.

In particular, two related exemptions were mentioned in the 2020 Consultation Paper.

Firstly, in relation to specialised private banking units that serve high net worth individuals and that had been given an exemption from certain FAA business conduct requirements pursuant to section 100(2) of the FAA, MAS had indicated that it would exempt representatives from such specialised units who continue to serve only accredited investors from the revised CMFAS exam requirements (the "Grandfathering Exemption"), even though the FAA exemption regime for such specialised private banking units has been abolished since 8 January 2021 following the adoption of the opt-in regime for accredited investors. In lieu of the CMFAS exam requirements, such representatives would be subject to the Singapore Private Banking Code of Conduct and would have to pass the Client Advisory Competency Standards ("CACS") exams or be exempted from having to pass them.

Secondly, MAS had also indicated that it would exempt private banking representatives who are appointed after 8 January 2021 from the revised CMFAS exam requirements, where they serve only accredited investors, engage in dealing activities that are incidental to their financial advisory roles, and provided that they have complied with the CACS requirements (the "Continuing Exemption").

Several issues arose in relation to these exemptions, which have been addressed by MAS in the Response to the 2020 Consultation Paper.

One respondent had requested MAS to consider extending an exemption to newly appointed representatives who engage in dealing activity by executing trade orders from private banking clients. However, MAS decided against this. It noted that trading irregularities could have market-wide adverse impact not only on private banking clients but also on other market participants. As such, MAS felt that such representatives ought to be required to pass the revised CMFAS exam requirements so that they have the requisite competency and knowledge.

Another respondent had highlighted that some representatives from its specialised private banking unit had not taken the CACS exams because they were not required to do so under the Singapore Private Banking Code of Conduct. Yet two other respondents pointed out that some representatives from their specialised private banking units were also serving institutional investors for legacy reasons. Accordingly, it was suggested that MAS could consider slightly broadening the exemption proposed to be given to representatives from the specialised private banking units. In the Response, MAS indicated that it was agreeable to these suggestions and that the exemption for representatives from specialised private banking units would be slightly extended to cover representatives who were not required to take exams under the CACS standards and representatives who served institutional investors.

MAS also further clarified that it would allow representatives from a special private banking unit to continue to benefit from the exemption if they shifted employment from one private bank to another. To operationalise this aspect, MAS noted that the private banking industry has generally agreed to issue attestation letters in relation to representatives from their private banking units and to cooperate in responding to reference check requests.

Finally, in the case of a bank client who opts out from being treated as an accredited investor or who ceases to be eligible to be treated as an accredited investor, MAS clarified and confirmed that a financial institution may continue to treat such a client as an accredited investor in respect of the specific transactions that occurred prior to the change in the client's status.

There appears to be some ambiguity as to whether a private banking representative needs to be from a specialised unit previously exempted under section 100(2) of the FAA in order to qualify for the Continuing Exemption. Under the revised SFA Notice, both the Continuing Exemption and Grandfathering Exemption can be found under Division 12, which is titled "Transitional arrangements for previously exempted specialised units serving high net worth individuals". This seems to imply that private banking representatives would need to be from a specialised unit previously exempted under section 100(2) of the FAA to be eligible for the Continuing Exemption. In contrast, the Response appears to distinguish between: (a) representatives from units previously exempted under section 100(2) of the FAA, who would be eligible for the Grandfathering Exemption; and (b) representatives who may not have necessarily been part of a section 100(2) unit but who fulfil certain conditions, who would be eligible for the Continuing Exemption. This would be consistent with the plain language of the Continuing Exemption set out at paragraph 5.12.2 of the revised SFA Notice, which does not require the representative to be from a specialised unit previously exempted under section 100(2) of the FAA. If this is the case, a private banking representative who is not from a specialised unit previously exempted under section 100(2) of the FAA but who satisfies the relevant criteria for the Continuing Exemption would be eligible for the Continuing Exemption. However, until there is greater clarity concerning the scope of the Continuing Exemption, it remains to be seen whether the Continuing Exemption requires representatives to be from specialised units previously exempted under section 100(2) of the FAA.

4. Minimum Academic Requirements and CPD Requirements

In the Response, MAS also provided clarification concerning minimum academic requirements and CPD requirements under the SFA Notice and/or FAA Notice and responded to requests from respondents to extend or broaden the scope of certain exemptions.

Firstly, a few respondents had highlighted that there are existing representatives from specialised units, that had been given an exemption from section 100(2) of the FAA, that do not meet the minimum academic requirements under the FAA Notice. Accordingly, they had asked MAS to consider providing a grandfathering exemption for these representatives. MAS has agreed and will exempt private banking representatives from such specialised units from having to meet the minimum academic requirements under the revised FAA Notice. MAS also clarified that this exemption will continue to apply to these representatives even if they move to a non-private banking role subsequently.

Secondly, MAS will broaden the scope of the exemption from CPD requirements under the SFA Notice to bring it in line with the equivalent exemption under the FAA Notice in response to suggestions from respondents. While the SFA Notice exempts representatives who serve only accredited investors and/or institutional investors from the CPD requirements, the exemption from CPD requirements under the FAA Notice applies to representatives who serve only accredited investors, institutional investors and/or expert investors. MAS has accordingly updated the revised SFA Notice so that representatives who serve only accredited investors, institutional investors and/or expert investors would be exempted from the CPD requirements.

Thirdly, MAS will allow the training hours undertaken by representatives as part of Institute of Banking & Finance ("IBF") Certification to be counted towards fulfilling their CPD hours under the revised FAA Notice.

Fourthly, MAS has worked with Central Provident Fund ("CPF") Board, IBF and Singapore College of Insurance ("SCI") to enhance CPF-related content in the CMFAS exams and CPD training. This will help to equip financial advisory representatives with the relevant knowledge to incorporate CPF schemes into holistic financial advice and better assist consumers with retirement planning. To this end, training hours from relevant CPD courses that are conducted by the CPF Board can be counted towards fulfilling the minimum of six hours of Core CPD training under the revised FAA Notice.

5. Conclusion

The revised SFA Notice and revised FAA Notice will come into effect on 1 April 2024.

Given the substantial changes to the relevant competency requirements for representatives, financial institutions should review their systems and processes so that they may accommodate these changes within the six-month transition period.

A copy of MAS' consultation response can be found here.

This Client Update was authored by Genevieve Pang (Senior Associate).

Originally published October 11, 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.