The Regulations are also a part of the UAE's commitment to implement all minimum standards of the flagship BEPS project of the OECD.

Click Here Key highlights of FAQs on Economic Substance Regulations in UAE

Click Here Introduction of Economic Substance Regulations in UAECompliance requirement

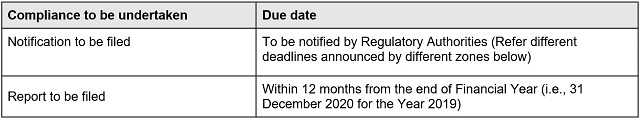

The Regulations require all covered licensees to undertake mandatory compliance as under:

Failure to follow the above compliances may attract an administrative penalty between the range of AED 10,000 to AED 300,000.

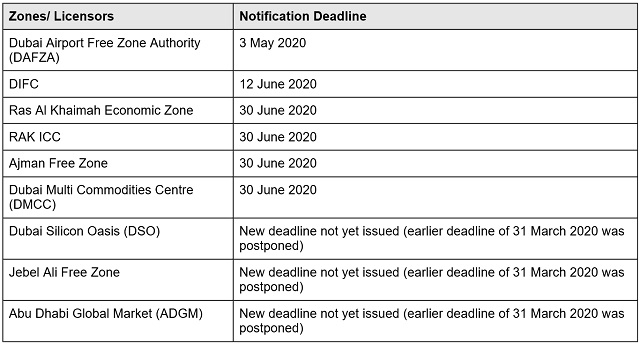

Statutory timelines to furnish notification for the year 2019

Recently, Dubai International Finance Centre (DIFC) has informed its licensees that a notification would be required to be furnished on or before 12 June 2020. Further, DIFC shall release the said notification form on 1 May 2020.

Similarly, most of the other zones within the UAE have also prescribed timelines for furnishing the notification for the year 2019, as below:

Guidance on Relevant Activities released by Ministry of Finance, UAE

Since the introduction of Regulations, the ministry has been very actively releasing various guidelines and FAQs to enable licensees to test the compliance requirement in their case. Recently, the Ministry of Finance, UAE, has released additional guidance on the 'Relevant Activities' and their associated 'Core Income Generating Activities' (CIGAs) to understand the scope and application of the Regulation.

It has been clarified that additional guidance should be read in conjunction with the Regulation, Frequently Asked Questions (FAQs) and guidance issued earlier.

Our Comments

The initial implementation was always expected to be challenging. Besides, certain stages of the implementation require a structural change in the operations of the business, which was not possible to be executed in the first year itself. The convergence of the change in operating structure to meet the economic substance test is a gradual process.

The challenges have further compounded due to lockdown situations, not just in UAE but at a global level due to the COVID-19 pandemic. It remains to be seen how businesses would be able to meet the stringent substance test requirement in the current environment. For example, the Regulations suggest a key test as 'directed and managed' by conducting board meetings in the UAE. However, due to the lockdown in progress, the board members might not be able to travel. A situation of this proportion calls for certain relaxation from the Ministry's side.

Originally published 28 April, 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.