The Government encourages financing for ventures. Banking actors prevent negative effects for smaller loans.

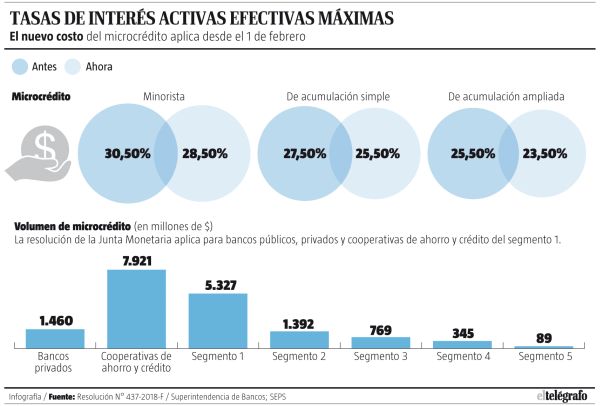

The interest rates of the three microcredit segments are 2% lower since February 1, when Resolution 437-2018-F issued by the Monetary and Financial Policy and Regulation Board (see infographic) came into effect.

Applies to public and private financial sector institutions, mutual funds and entities of segment 1 of the popular and solidary financial system. For the rest, the rates are maintained as before the resolution. Between private banks and the savings and credit cooperatives of segment 1, a total of $ 6,787 million was distributed in microcredits nationwide, according to data from the Superintendency of Banks (SB) and the Superintendence of Popular and Solidarity Economy (SEPS). 78% is from cooperative placements.

"The government seeks to encourage production in small and medium enterprises," said Wilson Vera, Executive delegate to the board. The resolution was based on technical reports presented in December by the Central Bank of Ecuador (BCE), the Superintendency of Banks, the Superintendence of the Popular and Solidarity Economy, and the National Corporation of Popular and Solidarity Finance (Conafips).

In addition, it would have been one of the topics requested by small entrepreneurs during the working tables of the Productive and Tax Advisory Council. "The idea was to stimulate the demand for microcredits, but on the other hand it is important to see the impact that could have on the income of cooperatives and banks," he said. Unlike consumer loans, which are generally granted to people in a dependency relationship, microcredits are paid with the income generated by the business for which the money was requested.

Juan Pablo Guerra, director of the Union of Cooperatives of Savings and Credit of the South (Ucacsur), which groups 16 entities, shares Vera's optimism that more dynamism will be generated in favor of the ventures. "Institutions should review their strategies to make more placements," Guerra said, noting that 80% of cooperatives grant loans below maximum costs. Other representatives of the banking and cooperative financial sector do see dangers, even warning that it would harm the delivery of the smaller segment (retail credit), due to the high risk involved.

Édgar Peñaherrera, manager of the Ecuadorian Integration Network of Savings and Credit Cooperatives (Icored), comprised of 39 first-tier cooperatives and a central bank, noted that it is attentive to the revenues planned by the entities, especially those that handle rates that border the permitted ceiling. "The smaller the amount (of credit) the more expensive the administration is (...) It affects financial inclusion," Peñaherrera warned, questioning that the Board did not socialize the methodology for the reduction. For Julio José Prado, executive director of the Association of Private Banks (Asobanca), this threatens the credit for very poor people who request amounts between $ 100 and $ 500. "Banks may have the need to review all of their microcredit projects if they do not cover the minimum cost."

Prado stressed that to reduce the cost, it is necessary to examine elements such as liquidity, profitability, among other items. The Vice President of Retail Banking of Produbanco, José Ricaurte, indicated that in a transaction of a small value it is necessary that the rate be sufficient for the bank to be well paid. "The lower the amount, the harder it is to think of a lower interest rate." This coincided with Angelo Caputi, executive president of the Bank of Guayaquil, who explained that beyond interest rates, efforts should focus on creating strategies to increase the level of bancarization (El Telégrafo). We will be glad to provide advice in the areas mentioned.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.