In recent past years, the retired population of Malta began to utilize their retirement funds at an increased rate. Retirement plans still have their fair share of limits and laws to abide by, which can make things complicated for those looking to use the benefits. This has given rise to occupational pension schemes surfacing in Malta.

Economic Policy

According to the official Ministry for Finance document from the Economic Policy Department, the older aged demographic that will utilize their pensions are "projected to increase from 29.1% to 55.8% with the peak year being in 2066." Pension schemes in Malta are all earnings-related, which means employers need to plan for the future with all hires regardless of age. The process of paying out pension schemes in Malta will impact thousands of people in the country.

Retirement Pension Qualifications

According to the Central Bank of Malta, the pension age will have its final increase to age "65 in 2026." Here is what some of the guidelines mean for those looking to collect:

- Those born between 1952 and 1955 can retire at age 62

- Those born between 1956 and 1958 can retire at age 63

- Those born between 1959 and 1961 can retire at age 64

- Those born on January 1, 1962, or later can retire at age 65

For those who retire and are looking to collect their pension, an application must be filed within 6 months of their retirement date. According to this article from Servizz in late 2020, this is the timeline necessary for applicants to follow:

2020 and Beyond

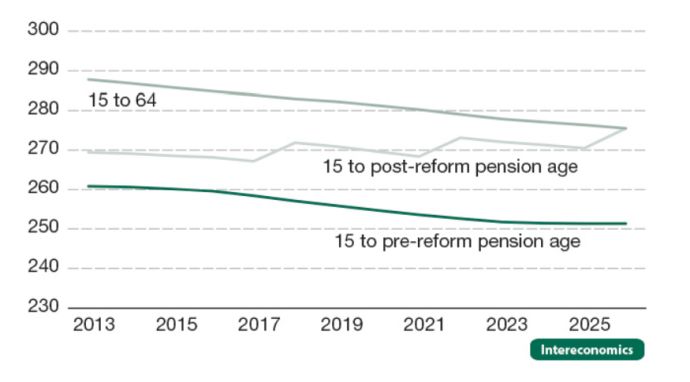

2020 was the fifth consecutive year Malta has seen an increase in occupational pension schemes. As of 2020, the new age requirement to collect a pension in Malta increased to 64 and is expected to make one final rise to age 65 by the year 2026, according to Inter Economics. The below graphs from Eurostat's 2013 projections help display this information.

Source: Eurostat's Europop 2013 projections

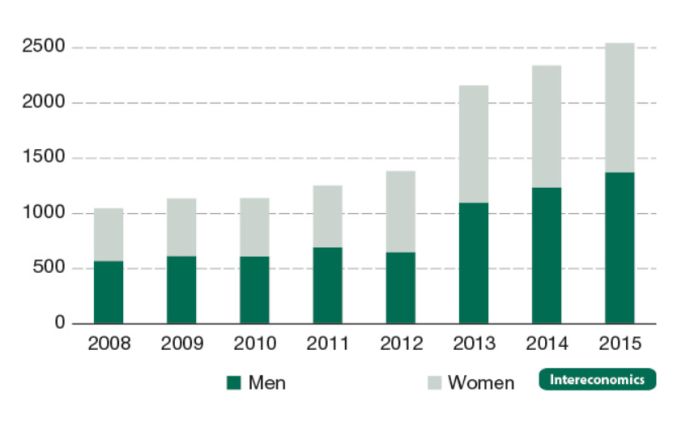

Source: Intereconomis; Registered employed in Malta – men aged 61 and women aged 60 and 61, 2008-2015

The graphs dictate that the year the pension age increased, beneficiaries also increased by about 550. Approximately 20% of men left their place of employment upon collection pension, and 36% of women left their place of employment. These are both less than they used to be. With the possibility of collecting a pension while remaining employed, it seems that is the choice taken by most. However, men appear more likely than women to meet the increasing requirements to collect a pension in Malta. The increase in pension age will likely not affect wages collected by the correlating cohorts by age.

Conclusion

If you live in Malta and are looking to utilize your pension in the coming years, please refer to the references linked here for more information on specific requirements that need to be met.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.