The first "Belt and Road Summit" will be held in May 2017 in Beijing, China. It is considered to be a key milestone and communication platform for China's "One Belt, One Road" initiative ("OBOR"), which is expected to shine brightly in the capital market and the physical economy in 2017.

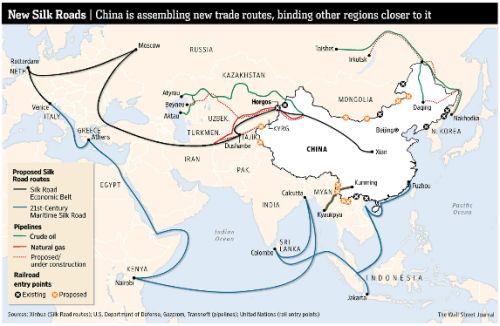

OBOR is a major economic strategy, initiated by China in 2013, aiming to develop trade/commerce, energy, real estate, agriculture, and transportation/logistics by establishing fundamental infrastructures across Asia, Africa and Europe. These include, though are not limited to, railways, sea ports and electricity networks. According to the OBOR Report (February 2017) issued by Min-sheng Securities' Research Institute, Southeast Asia shows the best performance in the trade/commerce sector. It also notes that countries in Southeast Asia, Middle Asia, West Asia and North Africa enjoy a relatively higher development potentiality compared to other regions, mostly because of the high demand of infrastructure establishments. Also notable is that European countries are foreseen to grow in the sectors of trade/commerce, finance and technology.

So far, China has invested USD 40 trillion in the Silk Road Fund, which finances OBOR. OBOR is the crucial motive for the creation of the Asian Infrastructure Investment Bank ("AIIB"), which has a total capital size of USD 50 trillion.

Indeed, Luxembourg is the first European founding member of the AIIB. For the OBOR initiative, Luxembourg's featured strengths in finance, logistics and ICT will play promising roles in ongoing and future cooperation between Luxembourg and China.

In terms of the most important infrastructure projects, Luxembourg is expected to emphasise the logistics sector. As Wort.lu has reported, Cargolux and HNCA started collaborating in 2013, and discussions have been underway since 2016 about developing a rail line linking Bettembourg, Luxembourg, with Zhengzhou, which is in the Henan province of China.

In the finance sector, currently, altogether six Chinese banks have set up their European headquarters in Luxembourg, functioning as true financial gateways connecting China to the European business realm.

In the ICT sector, Luxembourg has already earned the favour of Chinese e-commerce leader Alibaba and e-payment service provider Ping-Pong Financial, both of which have set up offices in Luxembourg from which to operate within the European business network. Ping-Pong Financial is a recent arrival, opening its Grand Duchy offices in 2017.

Luxembourg has its role to play in the accelerating OBOR expansion across Eurasia. KPMG Luxembourg's China Desk is your professional partner of financial services assisting you in discovering, developing and maintaining your business opportunities along the belt joining China and Europe—and Luxembourg specifically. You are welcome to contact us for more information.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.