WHT on dividends, interest and royalties

Cyprus does not levy a WHT on dividends, interest and royalties paid to non-residents of Cyprus except in the case of royalties earned on rights used within Cyprus, which are subject to a WHT of 10% (5% in the case of cinematographic films). Such Cyprus WHT on royalties for rights used within Cyprus may be reduced or eliminated by double tax treaties entered into by Cyprus or by the EU Interest and Royalty Directive as enacted in the Cyprus tax legislation.

It is noted that, as from 31 December 2022, Cyprus applies WHT of 17% on dividends paid by non-quoted companies, 30% on payments of passive interest (excluding payments by individuals) and 10% on payments of royalties and similar type payments (excluding payments by individuals) if the recipient of the payment is a company in a jurisdiction included on the EU list of non-cooperative jurisdictions on tax matters (commonly referred to as the EU 'blacklist').

WHT on other types of income

Cyprus levies a 10% WHT on the remuneration of non Cyprus tax residents for technical services provided to Cyprus payers, subject to certain conditions. However no such WHT is levied if such services are performed via a permanent establishment in Cyprus of the non-resident or if performed between 'associated' companies as these are defined by the EU Interest and Royalty Directive as enacted in the Cyprus tax legislation.

Cyprus also levies a 10% WHT on the gross income/ receipts derived by a non- resident individual from the exercise in Cyprus of any profession or vocation and the remuneration of non-resident public entertainers (such as theatrical, musical including football clubs, other athletic missions, etc).

Further, a 5% WHT is levied on gross income derived from within Cyprus by non-residents with no local permanent establishment for services in regards to the exploration, extraction or exploitation of the continental shelf as well as the establishment and use of pipelines and other installations on the ground, on the seabed and on the surface of the sea.

WHT on dividend, interest and royalties tables

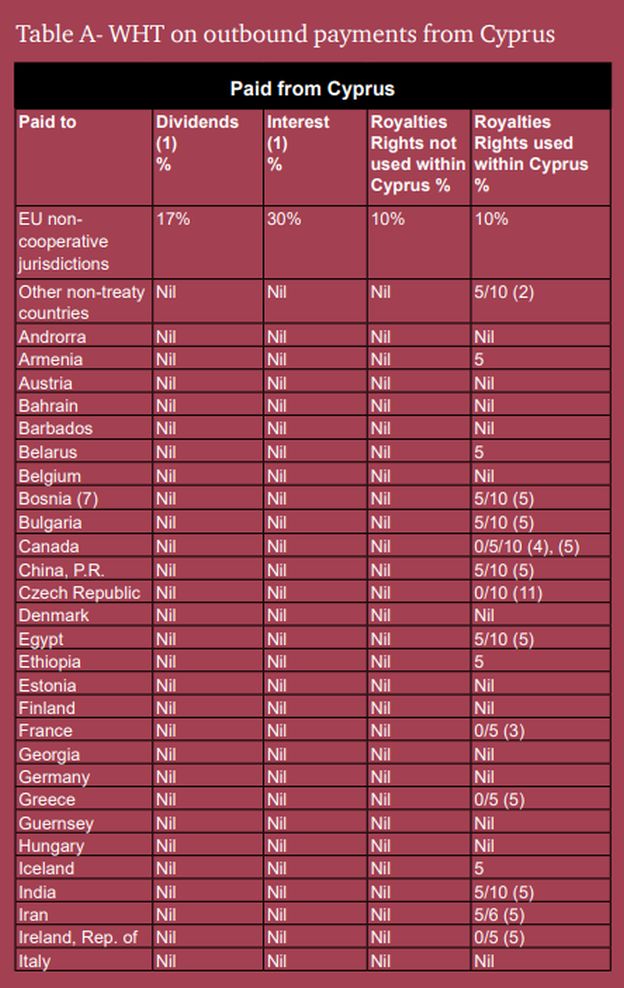

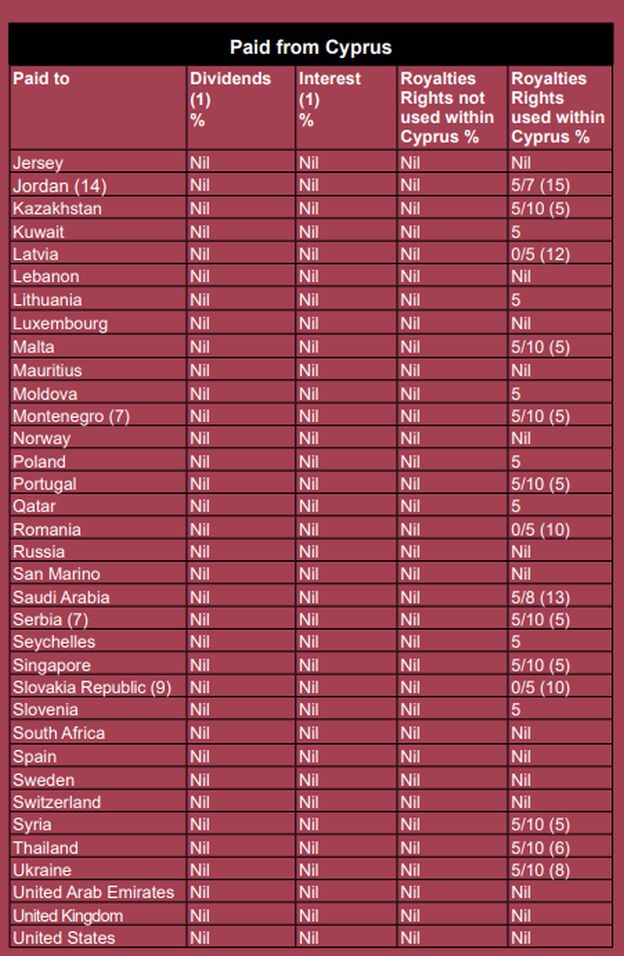

Table A below illustrates the applicable Cyprus WHT rates on outbound dividend, interest and royalty payments.

Table B, further below, illustrates the WHT rates provided for in the double tax treaties entered into by Cyprus. This table illustrates the maximum tax rates on Cyprus inbound payments which the treaty partner country may charge on such type incomes qualifying under the respective treaty. The actual WHT rate charged may be lower/eliminated based on each paying country's domestic law provisions.

Notes- Table A- outbound Payments from Cyprus

- Under Cyprus legislation, there is no WHT on dividends and interest paid to non residents of Cyprus. Further, there is also no WHT on royalties paid to non-residents of Cyprus for rights not used within Cyprus.

- Royalties earned on rights used within Cyprus are subject to WHT of 10% (except royalties relating to cinematographic films, where the WHT rate is 5%).

- A WHT rate of 5% is applicable on royalties for cinematographic films including films and video tape for television.

- . 0% on literary, dramatic, musical, or artistic work (excluding motion picture films and works on film or videotape for use in connection with television).

- The WHT rate of 5% is applicable on cinematographic film royalties.

- 5% WHT applies for any copyright of literary, dramatic, musical, artistic, or scientific work.

- Serbia, Montenegro and Bosnia apply the Yugoslavia/ Cyprus treaty.

- . A 5% WHT will be levied on payment of royalties in respect of any copyright of scientific work, any patent, trademark, secret formula, process, or information concerning industrial, commercial, or scientific experience and cinematographic films.

- The Cyprus-Czechoslovakia treaty applies with the Slovak Republic.

- 5% WHT rate applies for patents, trademarks, designs or models, plans, secret formulas, or processes, or any industrial, commercial, or scientific equipment, or for information concerning industrial, commercial, or scientific experience.

- 10% WHT rate applies for patent, trademark, design or model, plan, secret formula or process, computer software or industrial, commercial, or scientific equipment, or for information concerning industrial, commercial, or scientific experience.

- . Nil applies if the payer is a company that is a resident in Cyprus and the beneficial owner of the income is a company (other than partnership) that is a resident in Latvia. 5% WHT rate applies for all other cases.

- A WHT rate of 5% is applicable on royalties for the use of, or the right to use, industrial, commercial or scientific equipment and on royalties for cinematographic films including films and video tape for television. A WHT rate of 8% applies in all other cases.

- . The treaty is effective as from 1 January 2023.

- A WHT rate of 7% is applicable on royalties and fees for technical services. A WHT rate of 5% is applicable on royalties for cinematographic films including films and video tape for television.

To read this Report in full, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.