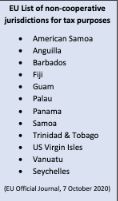

On 6 October 2020, the Council of the EU revised the EU list of non-cooperative jurisdictions for tax purposes (the 'List'). The last List revision took place in February 2020, and the Council is now committed to updating it twice per year. The principal change announced in October is the addition of both Anguilla and Barbados to the List following their adverse peer review reports published by the Global Forum on Transparency and Exchange of information for tax purposes.

The List exists as part of the EU's drive to improve international tax governance and as a method of tackling unfair tax competition from countries external to the EU. It is intended to be a tool with which to battle:

- Tax fraud or evasion: illegal non-payment or underpayment of tax

- Tax avoidance: use of legal means to minimize tax liability

- Money laundering: concealment of the origins of illegally obtained money

When presented with an EU level list, Member States have the opportunity and incentive to work together and apply combined pressure on 'offending' nations to encourage them to change their tax legislation and practices. The List is included as Annex 1 of the Council conclusions on the EU list of non-cooperative jurisdictions for tax purposes. The preferred EU strategy is co-operation with recalcitrant nations to encourage them to move towards the adoption of international tax standards. Jurisdictions are assessed on criteria concerning tax transparency, fair taxation, and implementation of international standards against tax base erosion and profit shifting. Non-EU countries which do not comply with all international standards can avoid being placed on the List if they provide sufficient undertakings to reform their tax policies and demonstrate improvement over time. Such countries are identified in Annex 2 in a 'state of play' document and their progress in meeting their undertakings is monitored.

Recent beneficiaries of this approach have been Oman and the Cayman Islands. The Cayman Islands was removed from the list after it adopted reforms to its framework on Collective Investment Funds in September 2020. Oman was also removed after ratifying the OECD convention on Mutual Administrative Assistance on Tax Matters (MAC), enacting legislation to enable automatic exchange of information and, taking all steps needed to activate exchange of information relations with all EU Member States. The 6 October communication also confirmed the removal of Mongolia, and Bosnia and Herzegovina from Annex 2 following their depositing the instruments of ratification of MAC, as amended. It also extended the deadlines for signing and ratifying MAC, for countries included in Annex 2, from 31 December 2020 to 31 December 2021 due to the impact of the Covid 19 pandemic.

The current List contains 12 jurisdictions. The full justifications for recent amendments to it may be viewed here. It is probably fair to say that thanks to the OECD and the EU, time is certainly running out for 'tax- havens'. When it does, that can only be to the advantage of legitimate low tax jurisdictions such as Cyprus.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.