A. INTRODUCTION

Initial publication of the Proposed Directive

The European Commission on the 22nd of December 2021 published a legislative proposal for a Directive to be issued, the Third Anti-Tax Avoidance Directive, known as ATAD 3, (the "Proposed Directive"), which sets forth rules to prevent the misuse of shell companies for tax purposes.

The Proposed Directive should have been adopted early 2022 by the European Union Council and be implemented by the Member States by the 30th of June 2023 at the latest. The provisions should subsequently be effective in all Member States as from the 1st of January 2024.

Reservations put forward

After the initial draft of the Proposed Directive which has been published by the European Commission on the 22nd of December 2021, doubts arose as to whether the Proposed Directive would succeed through the EU legislative process – requiring the unanimous approval of all EU Member States for adoption. Serious concerns were expressed by various bodies and authorities related to the legality of the measure, its effectiveness and its necessity.

On the 17th of January 2023, the European Union Parliament ("EU Parliament") approved a revised version of the Proposed Directive and suggested several amendments to be made on the initial draft.

Also, the current presidency of the European Council, Sweden, has circulated a compromise text on the Proposed Directive, suggesting various extensive changes to be effected and asked the opinion of all delegations on this draft. Various proposals have been put forward. It remains to be seen the final outcome and what recommendations will be put forward amending the current version of the initial draft.

The scope of the Proposed Directive

The Proposed Directive lays down a uniform test of procedure that will help Member States to identify EU resident undertakings that are engaged in an economic activity and which do not have minimum substance requirements and are misused for the purpose of obtaining tax advantages.

Once these minimum substance requirements are not met, the undertaking will be classified as "shell entity" and will sustain certain adverse tax consequences.

The procedure followed by the Proposed Directive to identify shell entities

There are 7 steps to be followed:

- Identification of undertakings being at risk to be classified as shell entities;

- Substance reporting requirements;

- Exempted undertakings from reporting;

- Presumption of being classified as a shell entity or not, for tax purposes;

- Rebuttal of the presumption of being classified as shell entity - Exemption;

- Tax Consequences of not meeting the substance requirements;

- Exchange of information, tax audits and Penalties.

This Publication

With this publication we shall deal with the recommendations put forward by the EU Parliament as indicated below and how these recommendations affect the text of the Proposed Directive. Also, a detailed analysis of the Proposed Directive as it stands today incorporating the recommendations of the EU Parliament will be provided.

B. EUROPEAN UNION PARLIAMENT RECOMMENDED CHANGES

The EU Parliament on the 17th of January 2023, approved a revised version of the Proposed Directive and suggested several amendments to be made on the initial draft.

The EU Parliament in its recommendations acknowledges the possible legitimate setting up of undertakings with minimal substance and according to its recommendations, this possibility must be observed, but on the other hand it urges to adopt stronger minimum substance requirements to be effective in combating tax fraud, evasion and aggressive tax planning through the use of shell entities.

It should be noted that these recommendations are not binding on the European Commission/Council but they will be taken into consideration. Some of the recommendations put forward make the Proposed Directive stricter and some of them adopt a more relaxed approach.

EU Parliament recommendations that make the Proposed Directive stricter

- More undertakings will be under the scope of the Proposed Directive. Thus, they propose to decrease the threshold amount of passive income as a proportion of the total income, from 75% to 65%.

- The percentage of the cross-border income of the undertaking concerned, which is earned or paid out through cross-border transactions, which income is one of the factors which need to be considered to identify whether the particular undertaking falls within the ambit of the Proposed Directive, it is suggested to be reduced from 60% to 55%, as a proportion of the total income of the undertaking, thus increasing the number of accountable undertakings.

- Also, another factor which is taken into account identifying whether the particular undertaking falls within the provisions of the Proposed Directive, which factor is related to the book value of the real estate assets and other valuable private property owned by the undertaking and which assets are located outside the EU Member State in which the undertaking concerned is resident in the preceding two tax years, it is suggested to be more than 55% (previously 60%) as a proportion of the total book value of the real estate assets and other valuable private property of the undertaking, thus increasing the number of the undertakings meeting this provision.

- The provision excluding the undertakings from the applicability of the Proposed Directive on the basis that they have at least five full-time equivalent employees it is suggested to be removed. The number of employees it is suggested not to play any role and not to give any presumption of substance.

- Failure to comply with the reporting obligation carries a penalty. The Proposed Directive imposes as a minimum penalty a fine of at least 2% (previously 5%) of the revenue (previously turnover) of the undertaking concerned. The EU Parliament though, suggested that in case of a false declaration in the tax return, an additional penalty of at least 4% of the undertaking's revenue would be due. Initially, no distinction was made between failing to report and reporting incorrectly.

- The EU Parliament also added that the penalty would be based on the total assets of the undertaking concerned in case its revenue is below a threshold, which is to be set by EU Member States, and the undertaking concerned does not fall below another threshold to be set by the EU Commission. In this way, the consequences of the Proposed Directive might be fatal for undertakings deemed to be shell entities of which their revenue is low.

- As per the Proposed Directive, EU Member States can issue a certificate of tax residence indicating that the undertaking is not entitled to certain benefits. This possibility is no longer provided in the EU Parliament's version. Under the new suggested version where an undertaking does not meet minimum substance requirements in the Member State where it is a tax resident and it requests a certificate of tax residence for use in a different jurisdiction, this request must be denied by the Member State. The Member State shall also issue an official statement justifying this decision and stating that the undertaking in question shall not be entitled to claim the benefits of tax treaties.

- The undertaking must itself have at least one active bank account or e-money account in the EU. The recommendations further require that the relevant income of the undertaking be received through such bank account;

EU Parliament recommendations that give some hope for a less strict approach

- Outsourcing of the management and administration of the day-to-day operations and decision-making process of the undertaking on significant functions in the preceding two tax years, is a factor to be taken into account in falling within the provisions of the Proposed Directive. This provision does not clarify whether intragroup outsourcing was excluded. Outsourcing now as per the EU Parliament recommendations is clarified to mean outsourcing to a "third party". This additional wording implies that outsourcing operations and functions to an undertaking member of the same group with the undertaking in consideration will not bring the undertaking within the scope of the Proposed Directive.

- As regards the minimum substance requirements:

-

- The premises. The need for exclusive use of premises as provided in the Proposed Directive has been clarified to allow the sharing of premises within undertakings of the same group.

- Directors. The requirement in the Proposed Directive that the directors exercise their authority actively and independently on a regular basis and not to be an employee or director (or equivalent) of unaffiliated enterprise has been deleted.

- An undertaking that meets the "gateway" tests, as these are identified further below, may request an exemption from its reporting obligations under the Proposed Directive if the undertaking's existence does not reduce the tax liability of its beneficial owner(s) or of the group as a whole. The EU Parliament recommendations adopting this provision, require in addition that Member States allow undertakings to make such request, "without undue delay and excessive administrative costs". This requirement is supplemented by a new 9-month time limit within which a Member State is required to consider the request for exemption. If the Member State fails to respond to the request after the expiry of the 9-month period, the request will be deemed accepted. This is a positive step against the bureaucratic governmental procedures.

- Finally, the Proposed Directive is clearly clarified that it shall only apply to EU-resident undertakings, and as such, any undertakings resident outside of the EU would therefore not be within the scope of the Proposed Directive.

C. SUMMARY OF THE PROVISIONS OF THE PROPOSED DIRECTIVE INCORPORATING THE EU PARLIAMENT RECOMMENDATIONS

The recommendations of the EU Parliament are adopted in the following analysis and integrated with the basic provisions of the Proposed Directive. The seven steps procedure will be followed.

At first, undertakings, tax residents of a Member State, which undertakings are engaged in economic activity, will be examined whether they meet cumulatively the following "gateway" as called, three characteristics:

- Relevant Income: It will be examined whether the undertaking has in the previous two years passive income more than 65% (instead of 75% provided in the Proposed Directive) of its revenues, such as interest, dividends and royalties or if the assets of the undertaking consist of immovable property and valuable private property as specifically identified and the book value of these assets is more than 75% of the total book value of the undertaking's assets or if the undertaking holds assets that generate income as dividends and income from the disposal of shares, and the book value of these assets is more than 75% of the total book value of the undertaking's assets;

- Cross Border Activity: It will be examined whether the undertaking is engaged in cross border activity namely, if more than 55%, (instead of 60% provided in the Proposed Directive) of immoveable property and other valuable private property as specifically identified is held outside the Member State in the previous two years or at least 55%, (instead of 60% provided in the Proposed Directive) of relevant income earned is from cross border transactions; and

- Day-to-Day Management: It will be examined whether the undertaking outsources its management and administration to a third party in the preceding two years. The condition of third-party outsourcing, is the recommendation of the EU Parliament clarifying in effect that in house outsourcing is allowed.

Once ALL of the above prerequisites are met, the undertaking is considered as being at risk to be classified as shell entity and be misused to obtain tax advantages by reference to a set of features common in such undertakings.

Once this is observed, the undertaking classified as being at risk, the undertaking must report the following, in order to be examined if it meets minimum substance requirements:

- Whether the undertaking has an office space exclusively used or shared with other group undertakings, (owned or rented), through which it exercises its activities; and

- Whether the undertaking has an active EU bank account or e-money account within EU through which its relevant income is received; and

- Whether at least, sufficient connection is shown with the Member State, either:

-

- One or more directors appointed satisfy certain conditions, or

- the majority of the full-time equivalent employees of the undertaking have their habitual residence as set out in Regulation (EC) No 593/2008, instead of being tax residents for tax purposes as provided in the Proposed Directive, in the Member State of the undertaking, or are at no greater distance from that Member States insofar as such distance is compatible with the proper performance of their duties, and such employees are qualified to carry out the activities that generate relevant income for the undertaking.

The phrases in bold are the recommendations of the EU Parliament.

Certain undertakings, such as listed companies on a regulated market or MFT or regulated financial undertakings (e.g., a securitisation special purpose undertaking, UCITS, AIFM, credit institution, etc.,) and certain holding companies are exempted from the reporting provisions of the Proposed Directive.

Once the undertaking which meets the three gateway characteristics does not meet the minimum substance requirements and does not fall among the categories of exempted undertakings, it is presumed to be a shell undertaking.

Rebutting the presumption

The presumption can be rebutted if the undertaking can prove that it is conducting a genuine economic activity and / or it can prove that the undertaking does not create a tax benefit to itself, its group of companies or to its beneficiaries, despite the fact that it does not meet the substance requirements.

If the undertaking does not meet the substance requirements and has not rebutted the presumption, certain adverse tax consequences will follow.

Consequences

In addition, automatic exchange of information as to the shell undertakings, tax audit and heavy penalties for non-compliance as to substance reporting requirement, apply.

D. THE PROVISIONS OF THE PROPOSED DIRECTIVE IN DETAIL INCORPORATING THE EU PARLIAMENT RECOMMENDATIONS

Definitions – Interpretation

For the purposes of the Proposed Directive the following definitions shall apply:

"Undertaking" means any entity engaged in an economic activity, regardless of its legal form, that is a tax resident in a Member State1;

"Member State of the undertaking" means the Member State where the undertaking is resident for tax purposes2;

In effect, any type of a legal body engaged in economic activity, being tax resident in a Member State, is subject to the provisions of the Proposed Directive.

Cyprus International Trusts, not being able to be classified as tax resident undertakings, do not fall within the provisions of the Proposed Directive. Their subsidiary Cyprus companies though being tax residents of Cyprus are caught by the provisions of the Proposed Directive, unless exempted.

"Relevant Income"3 shall mean income falling under any one of the following categories:

- interest or any other income generated from financial assets, including crypto assets;

- royalties or any other income generated from intellectual or intangible property or tradable permits;

- dividends and income from the disposal of shares;

- income from financial leasing;

- income from immovable property;

- income from movable property, other than cash, shares or securities, held for private purposes and with a book value of more than one million euro;

- income from insurance, banking and other financial activities;

- income from services which the undertaking has outsourced to other associated enterprises.

STEP 1 - Identification of undertakings being at risk to be classified as shell entities

Undertakings meeting ALL the following criteria will be considered as being at risk to be classified as shell entities and misused to obtain tax advantages by reference to a set of features common in such undertakings:

- more than 65%, (as per the EU Parliament recommendation), of the revenues accruing to the undertaking in the preceding two tax years is Relevant Income or if the assets of the undertaking consist of immovable property and valuable private property as specifically identified and the book value of these assets is more than 75% of the total book value of the undertaking's assets or if the undertaking holds assets that generate income as dividends and income from the disposal of shares, and the book value of these assets is more than 75% of the total book value of the undertaking's assets; and

- the undertaking is engaged in cross-border activity on any one

of the following grounds:

- more than 55%, (as per the EU Parliament recommendation), of the book value of the undertaking's assets that fall within the scope of points (e) and (f) above of Relevant Income, was located outside the Member State of the undertaking in the preceding two tax years; and/or

- at least 55%, (as per the EU Parliament recommendation), of the undertaking's Relevant Income is earned or paid out via cross-border transactions; and

- in the preceding two tax years, the undertaking outsourced the administration of its day-to-day operations and the decision-making on significant functions to a third party4.

The third-party condition has been recommended by the EU Parliament and if adopted gives some relaxation as outsourcing of the relevant functions within the group will not bring the undertaking within the ambit of the Proposed Directive.

Once the undertaking meets ALL the above conditions, it is considered as an undertaking being at risk to be classified as shell entity and which is misused to obtain tax advantages by reference to a set of features common in such undertakings.

Due to the fact that these undertakings are at risk to be classified as shell entities, they are asked to report on their substance in their tax return which lead to the second step.

STEP 2 - Substance reporting requirements

Each undertaking considered at risk under Step 1, must declare in its annual tax return, for each tax year, whether it meets the following indicators of minimum substance. Note: If the undertaking falls within the exempted undertakings as specified further below the undertaking is excluded from such reporting.

The substance requirements

- the undertaking has its own premises in the Member State, or premises for its exclusive use or premises shared with entities of the same group; and

- the undertaking has at least one own and active bank account or e-money account in the Union through which the relevant income is received; and

- the undertaking meets one of the following two indicators:

-

- One or more directors of the undertaking:

- are resident for tax purposes in the Member State of the undertaking, or at no greater distance from that Member State insofar as such distance is compatible with the proper performance of their duties; and,

- are qualified and authorised to take decisions in relation to the activities that generate relevant income for the undertaking or in relation to the undertaking's assets; The provision in the Proposed Directive that the directors must be qualified and authorised to take decisions is recommended by EU Parliament to be deleted, and be replaced with the phrase: are authorised to take decisions in relation to the activities that generate relevant income for the undertaking or in relation to the undertaking's assets; and,

- the provision in the Proposed Directive that the directors must actively and independently use the authorisation referred to in point (2) on a regular basis, is recommended by EU Parliament to be deleted; and,

- the provision in the Proposed Directive that the directors are not employees of an enterprise that is not an associated enterprise and do not perform the function of director or equivalent of other enterprises that are not associated enterprises is recommended by EU Parliament to be deleted.

- the majority of the full-time equivalent employees of the undertaking have their habitual residence as set out in Regulation (EC) No 593/2008, instead of being tax residents for tax purposes as provided in the Proposed Directive, in the Member State of the undertaking, or are at no greater distance from that Member States insofar as such distance is compatible with the proper performance of their duties, and such employees are qualified to carry out the activities that generate relevant income for the undertaking5.

- One or more directors of the undertaking:

The phrases in bold are recommendations of the EU Parliament.

Our Comment

The suggestion put forward by the EU Parliament above, namely, to remove the qualifications of the directors and actively and independently issue their decisions and the relevant deletion of the connection of the employees with non-associate undertakings, seems rather difficult to be accepted. In any event, the undertaking must report in the documentary evidence to be submitted, the relevant qualifications of the directors and in an indirect way the qualifications are checked and considered for the decision-making process. Also in a rebuttal process as will be clarified below, the qualifications of the directors /employees play an important role.

We believe that such provisions in the Proposed Directive, attack the nominee structures created by the service providers appointing in such positions non-qualified personnel, not eligible to handle the affairs of the companies and this is the purpose of such conditions imposed by the Proposed Directive. The aim of the Proposed Directive is to eliminate such structures using nominee directors and businesses should plan their future outside of such vulnerable schemes.

Documentary evidence

The undertakings that have the obligation to report their substance conditions as above, shall accompany their annual tax return declaration with documentary evidence.

The documentary evidence shall include the following information:

- address and type of premises;

- amount of gross revenue and type thereof;

- amount of business expenses and type thereof;

- type of business activities performed to generate the relevant income;

- the number of directors, their qualifications, authorisations and place of residence for tax purposes or the number of full-time equivalent employees performing the business activities that generate the relevant income and their qualifications, their place of residence for tax purposes;

- outsourced business activities;

- bank account number, any mandates granted to access the bank account and to use or issue payment instructions and evidence of the account's activity6.

- (ga) an overview of the structure of the undertaking and associated enterprises and any significant outsourcing arrangements, including the rationale behind the structure, described in the context of a standardised format;

- (gb) a summary report of the documentary evidence submitted under this paragraph, containing in particular:

-

- a brief description of the nature of the activities of the undertaking;

- the number of employees on a full-time equivalent basis;

- the amount of profit or loss before and after taxes.

Subparagraphs (ga) and (gb) are the recommendations of the EU Parliament to be included.

STEP 3 - Exempted undertakings from reporting

As per the Proposed Directive, the undertakings falling within any of the following categories are not subject to the requirements of reporting under Step 2. The EU Parliament suggests that the wording of this provision should be: The following undertakings are not subject to requirements reporting:

- companies which have a transferable security admitted to trading or listed on a regulated market or multilateral trading facility;

- regulated financial undertakings;

- undertakings that have the main activity of holding shares in operational businesses in the same Member State while their beneficial owners are also resident for tax purposes in the same Member State;

- undertakings with holding activities that are resident for tax purposes in the same Member State as the undertaking's shareholder(s) or the ultimate parent undertaking;

- undertakings with at least five own full-time equivalent employees or members of staff exclusively carrying out the activities generating the relevant income7.

The EU Parliament recommends that this provision, (e), should be deleted. In effect, if this recommendation will be adopted, the number of employees will not give an exception to the undertaking making the provisions of the Proposed Directive stricter.

STEP 4 - Presumption of being classified as a shell undertaking or not, for tax purposes

An undertaking that it has been classified under STEP 1 as a risk case, but whose reporting reveals that it has all relevant elements of substance set out above under STEP 2, and provides the satisfactory documents, (the EU Parliament suggests that the word satisfactory to be replaced with the word required), shall be presumed to have minimum substance for the tax year and shall be presumed not to be a "shell entity" for the purposes of the Proposed Directive i.e., it is not lacking substance and is not being misused for tax purposes.

An undertaking that it has been classified under STEP 1 as a risk case, and whose reporting also leads to the finding that it lacks at least one of the relevant elements of substance set out above under STEP 2, or does not provide satisfactory (the required), supporting documentary evidence, shall be presumed to be a "shell entity" for the purposes of the Proposed Directive i.e., it is lacking substance and is being misused for tax purposes8.

STEP 5 - Rebuttal of the presumption of being classified as shell undertaking - Exemption

Rebuttal

This step involves the right of the undertaking which is presumed to be a shell entity and misused for tax purposes, to prove otherwise, i.e., to prove that it has substance or in any case it is not misused for tax purposes. This opportunity is very important because the substance test is based on indicators and as such, may fail to capture the specific facts and circumstances of each individual case.

Taxpayers will therefore have an effective right to make the claim that they are not a shell in the sense of the Proposed Directive9.

To claim the rebuttal of the presumption of the shell entity, the taxpayers should produce concrete evidence of the activities they perform and how. The evidence produced is expected to include information on the commercial (i.e., non-tax) reasons (business reasons as per the EU Parliament), for setting up and maintaining, (in the particular Member State where the business is performed, as per the EU Parliament recommendation), the undertaking which does not need own premises and/or bank account and/or dedicated management or employees.

It is also expected to include information about the employee profiles, including the level of their experience, their decision-making power in the overall organisation, role and position in the organisation chart, the type of their employment contract, their qualifications and duration of employment; The EU Parliament recommends to include information about the full-time, part-time, and freelance employee profiles, identifying in this way the level of their experience.

It is also expected to include information on the resources that such undertaking uses to actually perform its activity and information allowing to verify the nexus between the undertaking and the Member State where it claims to be resident for tax purposes, i.e., to verify that the key decisions on the value generating activities of the undertaking are taken there. Concrete evidence that decision-making concerning the activity generating the relevant income is taking place in the Member State of the undertaking should be provided.

While the above information is essential and required to be produced by the rebutting undertaking, the undertaking is free to produce additional information to make its case.

This information should then be assessed by the tax administration of the undertaking's State of tax residence.

As per EU Parliament recommendation, The Member State shall consider a request for the rebuttal of the presumption within a period of nine months after the introduction of the request and it shall be considered to be accepted in the absence of an answer from the Member State after the expiry of that nine-month period.

Where the tax administration is satisfied that an undertaking rebuts the presumption that it is a shell for the purposes of the Proposed Directive, it should be able to certify the outcome of the rebuttal process for the relevant tax year.

As the rebuttal process is likely to create a burden for both, the undertaking and the tax administration while leading to the conclusion that there is minimum substance for tax purposes, it will be possible to extend the validity of the rebuttal for another 5 years (i.e., for a total maximum of 6 years), after the relevant tax year, provided that the legal and factual circumstances evidenced by the undertaking do not change. After this period, the undertaking will need to renew the process of rebuttal if it wishes to do so.

Exemption for lack of tax motives

An undertaking that meets the conditions of STEP 1 and/or does not fulfil the minimum substance requirements as per STEP 2, might be used for genuine business activities without creating a tax benefit for itself, the group of companies of which it is part or for the ultimate beneficial owner. Such an undertaking should have an opportunity to evidence this, at any time, and to request an exemption from the obligations of the Proposed Directive10.

To claim such an exemption, the undertaking is expected to produce elements allowing to compare the tax liability of the structure or the group to which it is part with and without its interposition.

A Member State may grant that exemption for one tax year if the undertaking provides sufficient and objective evidence that its interposition does not lead to a tax benefit for its beneficial owner(s) or the group as a whole, as the case may be. That evidence shall include information about the structure of the group and its activities. (As per the EU Parliament the applicant company must include a list of its employees working on full-time equivalence). That evidence shall allow to compare the amount of overall tax due by the beneficial owner(s) or the group as a whole, as the case may be, having regard to the interposition of the undertaking, with the amount that would be due under the same circumstances in the absence of the undertaking.

As per EU Parliament recommendation, a Member State shall consider the exemption request within a period of nine months after the introduction of the request and it shall be considered to be accepted in the absence of an answer from the Member State after the expiry of the nine-month period.

STEP 6 - Tax Consequences of not meeting the substance requirements

If an EU tax-resident company is presumed to have inadequate substance based on its self-assessed reporting or a failed rebuttal process, the following consequences shall kick in:

- Member States other than the Member State of the undertaking, will disregard application of tax treaties and disregard the application of the Parent-Subsidiary and Interest and Royalties Proposed Directives in relation to transactions with the reporting undertaking. The relevant Member State may nonetheless allow benefits under domestic law or tax treaties to apply in relation to the shareholder of the reporting undertaking, (i.e., look-through treatment);

- If the reporting undertaking has an EU shareholder, the EU jurisdiction of the shareholder will tax the relevant income of the reporting undertaking as if it had accrued to them directly, according to its national rules, with a credit for taxes paid at the level of the reporting undertaking, and

- Where an undertaking does not have the minimum substance for tax purposes in the Member State where it is resident for tax purposes, that Member State shall, as per the Proposed Directive, take any of the following decisions:

- (As per the EU Parliament recommendations must deny any request for a certificate of tax residence to the undertaking for use outside the jurisdiction of that Member State).

-

- deny a request for a certificate of tax residence to the undertaking for use outside the jurisdiction of this Member State;

- grant a certificate of tax residence which prescribes that the undertaking is not entitled to the benefits of agreements and conventions that provide for the elimination of double taxation of income, and where applicable, capital, and of international agreements with a similar purpose or effect and of Articles 4, 5 and 6 of Proposed Directive 2011/96/EU and Article 1 of Directive 2003/49/EC. The reporting undertaking will, in principle, no longer receive a certificate of tax residency, or the respective tax authority will issue an amended tax residency certificate indicating that the reporting company is no longer entitled to benefits of treaty or relevant EU Directives.

The EU Parliament recommends subparagraphs (a) and (b) above, should be deleted and the following to be added in their replacement:

When denying a request for such certificate, the Member State shall issue an official statement duly justifying such decision and prescribing that the undertaking is not entitled to the benefits of agreements and conventions that provide for the elimination of double taxation of income, and, where applicable, capital, or of international agreements with a similar purpose or effect and of Articles 4, 5 and 6 of Directive 2011/96/EU and Article 1 of Directive 2003/49/EC.

In cooperation with Member States, the Commission shall ensure that those tax consequences are well articulated in relation to existing bilateral tax agreements with third countries so that they receive the information on the presumed shell companies.

STEP 7 - Exchange of information, tax audits and penalties

Exchange of information11

As a final step, the Commission proposes that all Member States shall have access to information on any undertakings considered at risk under STEP 1, even if such undertakings meet any of the exceptions in the subsequent steps. This information will be exchanged automatically.

The EU Parliament further recommends that, where the competent authority of a Member State identifies other Member States likely to be concerned by the reporting of the undertaking, the communication referred to in those paragraphs shall include a specific alert to those Member States deemed to be concerned.

Penalties12

Although the draft Proposed Directive leaves it to Member States to establish penalties, a minimum penalty for non-compliance is provided which is at least 5% of the undertaking's turnover in the relevant tax year, if the undertaking that is required to report pursuant to Article 6 of the Proposed Directive does not comply with such requirement for a tax year within the prescribed deadline or makes a false declaration in the tax return.

The EU Parliament recommends the following as to the penalties:

Member States shall ensure that those penalties include an administrative pecuniary sanction of at least 2% of the undertaking's revenue in the relevant tax year, if the undertaking that is required to report pursuant to Article 6 does not comply with such requirement for a tax year within the prescribed deadline and an administrative pecuniary sanction of at least 4 % of the undertaking's revenue if the undertaking that is required to report pursuant to Article 6 makes a false declaration in the tax return under Article 7. In case of an undertaking with zero or low revenue, defined as being below a threshold determined by the national tax authority and not falling below a minimum threshold set by the Commission in an implementing act, the penalty should be based on the total assets of the undertaking.

Tax audit13

Furthermore, a Member State would be able to request another Member State to audit (Jointly as per the EU Parliament) a tax resident undertaking if the former suspects that this undertaking lacks minimal substance.

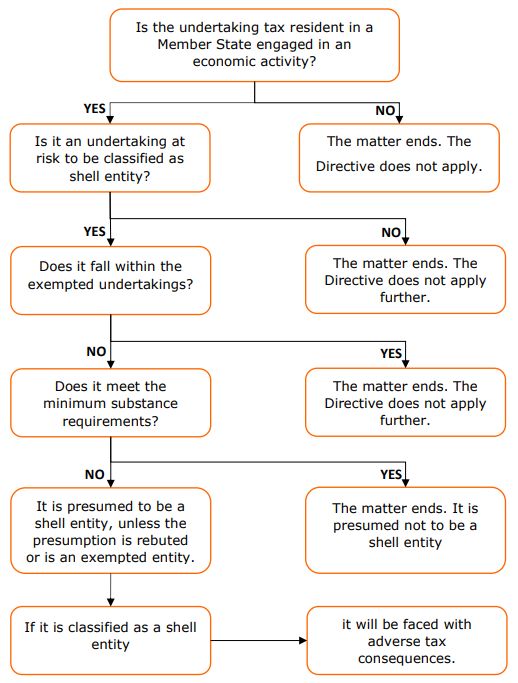

E. THE PROCESS OF THE PROPOSED DIRECTIVE IN A DIAGRAM

The methodology of the Proposed Directive in order to identify shell undertakings proceeds as follows:

F. OUR OBSERVATIONS

The substance requirements of the Proposed Directive and its whole approach wording and spirit, points to the fact that a tax resident entity in a Member State, in order to meet the substance requirements must have a self-managed office, with qualified personnel situated there where it is tax resident.

This requirement, renders redundant the provision of administrative services such as nominee directorships by the various corporate service providers. If the Proposed Directive will be implemented, the provision of such services will be considerably weakened and the role of the administrative service providers will be diminished as to this role.

A director's dedication and capability as to the handling of the activities of the undertaking will need to be demonstrated in his/her qualifications, which should be such as to allow the director to have an active role in the decision-making processes, the formal powers that he/she is vested and the director's actual participation in the day-to-day management of the undertaking.

Nominee directors used by service providers offering directorship services, will not meet the requirements of such position any more.

Also, the provision of the well-known services of "virtual offices" without real substance and without full-time employees working in the office of the tax resident company will be diminished and gradually will come to an end.

Real headquartering structures will then be brought up creating a more solid business environment with in house management and real substance in Cyprus.

The EU parliament acknowledges though that there might be cases that a legitimate setting up of undertakings with minimal substance and according to its recommendations, this possibility must be observed, but on the other hand, it urges to adopt stronger minimum substance requirements to be effective in combating tax fraud, evasion and aggressive tax planning through the use of shell entities.

A balance to safeguard all legitimate possibilities must be observed.

Criticism of the Proposed Directive

The Proposed Directive has received a strong criticism as not being in compliance with the EU Law and especially with the principles of proportionality and subsidiarity. Serious concerns were also expressed as to the effectiveness and necessity of this measure in view of the existence of other similar enactments to safeguard legitimate operations.

It is not though the aim of this article to discuss these possible complications and if these principles are infringed. In any event, we do not consider that such arguments will easily walk through or have positive outcome, having also in mind the political aspect of such type of Directives and their background.

It is certain that, if the Proposed Directive is finally implemented as it is proposed, it will affect drastically holding companies without substance which are used extensively, unless they fall within the exceptions or manage to rebut the presumption of shell entities. As a result, the allocation of taxes among the Member States will be disturbed and re-distributed.

The exceptions though provided in the Proposed Directive, might give sufficient protection and a way out for holding companies that can prove that they exercise genuine business activities or that the structure implemented does not create any tax benefit to themselves or to their groups or to their shareholders. The particular facts of each case will need to be examined accordingly.

What the Proposed Directive has not provided for, is what happens with the subsidiary companies of a parent company which parent meets the substance requirements. Do all the companies in the row need to fulfil the substance requirements, in addition to the parent, or the fulfilment of the conditions by the parent will be satisfactory? It remains to be seen if this issue will be clarified.

Future Planning

Tax resident companies which do not fall within the exceptions of the Proposed Directive must plan their future and take the appropriate decisions on time to avoid the disadvantages of being characterised as shell companies.

Shell companies, unless they fall within the exceptions do not have future. They will face, from various angles, adverse tax consequences.

Headquartering in Cyprus has a promising future once it is based in a real business environment, with real substance and proper central management and control from Cyprus.

The Proposed Directive seems to have serious impact on holding companies and some requirements to meet the tests and parameters employed have retrospective effect as from 2022. In this respect, planning as from now seems imperative.

G. HOW KINANIS LLC CAN HELP YOU

We shall be glad to assist you to assess the impact of this Proposed Directive on your structure and examine the steps that need to be taken in case of final implementation.

Footnotes

1. Article 3(1) of the Proposed Directive.

2. Article 3(4) of the Proposed Directive.

3 Article 4 of the Proposed Directive.

4. Article 6(1) of the Proposed Directive.

5. Article 7(1) of the proposed Directive.

6. Article 7(2) of the proposed Directive.

7. Article 6(2) of the proposed Directive.

8. Article 8 of the proposed Directive.

9. Article 9 of the proposed Directive.

10. Article 10 of the proposed Directive.

11.. Article 13 of the Proposed Directive

12. Article 14 of the Proposed Directive

13. Article 15 of the Proposed Directive

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.