INTRODUCTION

The European Commission on the 22nd of December 2021 published a legislative proposal for a Directive to be issued, the Third Anti-Tax Avoidance Directive, known as "ATAD 3", which sets forth rules to prevent the misuse of shell companies for tax purposes.

The Directive should be adopted early 2022 by the Council and be implemented by Member States by 30 June 2023 at the latest. The provisions should subsequently be effective in all Member States from 1 January 2024.

The Directive lays down a uniform test that will help Member States to identify undertakings that are engaged in an economic activity, but which do not have minimal substance and are misused for the purpose of obtaining tax advantages.

Once these minimum substance requirements are not met, the undertaking will be classified as "shell entity" and will sustain certain adverse tax consequences.

The methodology followed by the proposed Directive to identify shell entities

There are 7 steps to be followed:

- Identification of undertakings being at risk to be classified as shell companies;

- Substance reporting requirements;

- Exempted undertakings from reporting;

- Presumption of being classified as a shell entity or not, for tax purposes;

- Rebuttal of the presumption of being classified as shell entity - Exemption;

- Tax Consequences of not meeting the substance requirements;

- Exchange of information, tax audits and Penalties.

SUMMARY OF THE PROVISIONS OF THE PROPOSED DIRECTIVE

The proposed Directive will be applied following the above identified methodology, step by step.

At first, undertakings, tax residents of member states which are engaged in economic activity, will be examined whether they meet cumulatively the following three conditions:

- Whether the undertaking has passive income more than 75% of its revenues, such as interest, dividends and royalties; and

- Whether it is engaged in cross border activity; and

- Whether it outsources its management and administration to third parties.

Once ALL of the above prerequisites are met, the undertaking is considered as at risk to be classified as shell entity and misused to obtain tax advantages by reference to a set of features common in such entities.

Once this is observed, the undertaking must report the following, in order to examine if it meets minimum substance requirements:

- Whether the undertaking has an office space, (owned or rented), through which it exercises its activities;

- Whether the undertaking has an active EU bank account; and

- Whether at least one of its directors is an in-house director properly qualified to handle the business of the undertaking or the majority of its full - time employees reside in the same country as the undertaking.

Certain undertakings, such as listed companies, regulated financial undertakings and undertakings with at least 5 full - time employees, are exempted from this reporting.

Once the undertaking does not meet the minimum substance requirements and does not fall among the categories of exempted undertaking, it is presumed to be a shell entity.

The presumption can be rebutted if the undertaking can prove that it is conducting a genuine economic activity and / or it can prove that the undertaking does not create a tax benefit to itself, its group of companies or to its shareholders, despite the fact that it does not meet the substance requirements.

If the undertaking does not meet the substance requirements and has not reputed the presumption, certain adverse tax consequences will follow.

In addition, automatic exchange of information as to the shell entities, tax audit and heavy penalties for non-compliance as to substance reporting requirement, apply.

THE PROVISIONS OF THE PROPOSED DIRECTIVE IN DETAIL

Definitions - Interpretation

For the purposes of this Directive the following definitions shall apply:

"Undertaking" means any entity engaged in an

economic activity, regardless of its legal form, that is a tax

resident in a Member State1;

"Member State of the undertaking" means the

Member State where the undertaking is resident for tax purposes2;In effect, any type of a legal body engaged in economic activity, being tax resident in a Member State, is subject to the provisions of the Directive.

Cyprus Local or International Trusts, not being a legal person, and not liable as such to taxation in Cyprus, do not fall within the provisions of the Directive. Their subsidiary companies being tax residents of Cyprus might be caught by the provisions of the Directive unless exempted.

"Relevant income" shall mean income falling

under any of the following categories:

- interest or any other income generated from financial assets, including crypto assets,

- royalties or any other income generated from intellectual or intangible property or tradable permits;

- dividends and income from the disposal of shares;

- income from financial leasing;

- income from immovable property;

- income from movable property, other than cash, shares or securities, held for private purposes and with a book value of more than one million euro;

- income from insurance, banking and other financial activities;

- income from services which the undertaking has outsourced to other associated enterprises3.

STEP 1 - Identification of undertakings being at risk to be classified as shell companies

Undertakings meeting ALL the following criteria are considered as being at risk to be classified as shell entities and misused to obtain tax advantages by reference to a set of features common in such entities:

(a) more than 75% of the revenues accruing to the undertaking in the preceding two tax years is relevant income as relevant income is above identified;

(b) the undertaking is engaged in cross-border activity on any of the following grounds:

(i) more than 60% of the book value of the undertaking's assets that fall within the scope of points (e) and (f) above, was located outside the Member State of the undertaking in the preceding two tax years;

(ii) at least 60% of the undertaking's relevant income is earned or paid out via cross-border transactions;

(c) in the preceding two tax years, the undertaking outsourced the administration of day-to-day operations and the decision-making on significant functions4.

Once the undertaking meets ALL the above conditions, it is considered as an undertaking at risk to be classified as shell undertaking and which is misused to obtain tax advantages by reference to a set of features common in such entities.

Due to the fact that these undertakings are at risk to be classified as shell entities, they are asked to report on their substance in their tax return.

STEP 2 - Substance reporting requirements

Each undertaking considered at risk under Step 1 must declare in its annual tax return, for each tax year, whether it meets the following indicators of minimum substance:

(a) the undertaking has own premises in the Member State, or premises for its exclusive use;

(b) the undertaking has at least one own and active bank account in the Union;

(c) the undertaking meets one of the following two indicators:

(i) One or more directors of the undertaking:

(1) are resident for tax purposes in the Member State of the undertaking, or at no greater distance from that Member State insofar as such distance is compatible with the proper performance of their duties; and,

(2) are qualified and authorised to take decisions in relation to the activities that generate relevant income for the undertaking or in relation to the undertaking's assets; and,

(3) actively and independently use the authorisation referred to in point (2) on a regular basis; and,

(4) are not employees of an enterprise that is not an associated enterprise and do not perform the function of director or equivalent of other enterprises that are not associated enterprises;

(ii) The majority of the full-time equivalent employees of the undertaking are resident for tax purposes in the Member State of the undertaking, or at no greater distance from that Member States insofar as such distance is compatible with the proper performance of their duties, and such employees are qualified to carry out the activities that generate relevant income for the undertaking5.

A director's dedication to the activities of the undertaking may be demonstrated in his qualifications, which should be such as to allow the director to have an active role in the decision-making processes, the formal powers that he/she is vested and the director's actual participation in the day-to-day management of the undertaking.

Nominee directors used by service providers offering directorship services, will not meet the requirements of such position any more.

The undertakings that have the obligation to report their substance conditions as above, shall accompany their annual tax return declaration with documentary evidence.

The documentary evidence shall include the following information:

(a) address and type of premises;

(b) amount of gross revenue and type thereof;

(c) amount of business expenses and type thereof;

(d) type of business activities performed to generate the relevant income;

(e) the number of directors, their qualifications, authorisations and place of residence for tax purposes or the number of full-time equivalent employees performing the business activities that generate the relevant income and their qualifications, their place of residence for tax purposes;

(f) outsourced business activities;

(g) bank account number, any mandates granted to access the bank account and to use or issue payment instructions and evidence of the account's activity6.

STEP 3 - Exempted undertakings from reporting

The undertakings falling within any of the following categories are exempted from reporting of the substance conditions:

(a) companies which have a transferable security admitted to trading or listed on a regulated market or multilateral trading facility;

(b) regulated financial undertakings;

(c) undertakings that have the main activity of holding shares in operational businesses in the same Member State while their beneficial owners are also resident for tax purposes in the same Member State;

(d) undertakings with holding activities that are resident for tax purposes in the same Member State as the undertaking's shareholder(s) or the ultimate parent entity;

(e) undertakings with at least five own full-time equivalent employees or members of staff exclusively carrying out the activities generating the relevant income7.

STEP 4 - Presumption of being classified as a shell entity or not, for tax purposes

An undertaking that it has been classified under STEP 1 as a risk case, but whose reporting reveals that it has all relevant elements of substance set out above under STEP 2, and provides the satisfactory supporting documentary evidence, shall be presumed to have minimum substance for the tax year and shall be presumed not to be a "shell" for the purposes of the Directive i.e., it is not lacking substance and is not being misused for tax purposes.

An undertaking that it has been classified under STEP 1 as a risk case, and whose reporting also leads to the finding that it lacks at least one of the relevant elements of substance set out above under STEP 2, or does not provide satisfactory supporting documentary evidence, shall be presumed to be a "shell" for the purposes of the Directive i.e., it is lacking substance and is being misused for tax purposes8.

STEP 5 - Rebuttal of the presumption of being classified as shell entity -Exemption

Rebuttal

This step involves the right of the undertaking which is presumed to be shell and misused for tax purposes, for the purposes of the Directive, to prove otherwise, i.e., to prove that it has substance or in any case it is not misused for tax purposes. This opportunity is very important because the substance test is based on indicators and as such, may fail to capture the specific facts and circumstances of each individual case. Taxpayers will therefore have an effective right to make the claim that they are not a shell in the sense of the Directive9.

To claim a rebuttal of a presumption of shell the taxpayers should produce concrete evidence of the activities they perform and how. The evidence produced is expected to include information on the commercial (i.e., non-tax) reasons for setting up and maintaining the undertaking which does not need own premises and/or bank account and/or dedicated management or employees. It is also expected to include information on the resources that such undertaking uses to actually perform its activity. It is also expected to include information allowing to verify the nexus between the undertaking and the Member State where it claims to be resident for tax purposes, i.e., to verify that the key decisions on the value generating activities of the undertaking are taken there.

While the above information is essential and required to be produced by the rebutting undertaking, the undertaking is free to produce additional information to make its case.

This information should then be assessed by the tax administration of the undertaking's State of tax residence. Where the tax administration is satisfied that an undertaking rebuts the presumption that it is a shell for the purposes of the Directive, it should be able to certify the outcome of the rebuttal process for the relevant tax year.

As the rebuttal process is likely to create a burden for both, the undertaking and the tax administration while leading to the conclusion that there is minimum substance for tax purposes, it will be possible to extend the validity of the rebuttal for another 5 years (i.e., for a total maximum of 6 years), after the relevant tax year, provided that the legal and factual circumstances evidenced by the undertaking do not change. After this period, the undertaking will need to renew the process of rebuttal if it wishes to do so.

Exemption for lack of tax motives

An undertaking that meets the conditions of STEP 1 and/or does not fulfil the minimum substance requirements as per STEP 2, might be used for genuine business activities without creating a tax benefit for itself, the group of companies of which it is part or for the ultimate beneficial owner. Such an undertaking should have an opportunity to evidence this, at any time, and to request an exemption from the obligations of this Directive10.

To claim such an exemption, the undertaking is expected to produce elements allowing to compare the tax liability of the structure or the group to which it is part with and without its interposition.

STEP 6 - Tax Consequences of not meeting the substance requirements

If an EU tax-resident company is presumed to have inadequate substance based on its self-assessed reporting or a failed rebuttal process, the following consequences shall kick in:

- Other Member States will disregard application of tax treaties and disregard the application of the Parent-Subsidiary and Interest and Royalties Directives in relation to transactions with the reporting entity. The relevant Member State may nonetheless allow benefits under domestic law or tax treaties to apply in relation to the shareholder of the reporting company (i.e., look-through treatment)

- If the reporting entity has an EU shareholder, the EU jurisdiction of the shareholder will tax the relevant income of the reporting company as if it had accrued to them directly, according to its national rules, with a credit for taxes paid at the level of the reporting company, and

- The reporting entity will, in principle, no longer receive a certificate of tax residency, or the respective tax authority will issue an amended tax residency certificate indicating that the reporting company is no longer entitled to benefits of treaty or relevant EU Directives.

STEP 7 - Exchange of information, tax audits and penalties

Exchange of information

As a final step, the Commission proposes that all Member States shall have access to information on any entities considered at risk under STEP 1, even if such entities meet any of the exceptions in the subsequent steps. This information will be exchanged automatically.

Tax audit

Furthermore, a Member State would be able to request another Member State to audit a tax resident entity if the former suspects that this entity lacks minimal substance.

Penalties

Although the draft Directive leaves it to Member States to establish penalties, a minimum penalty for non-compliance is provided which is at least 5% of the entity's turnover.

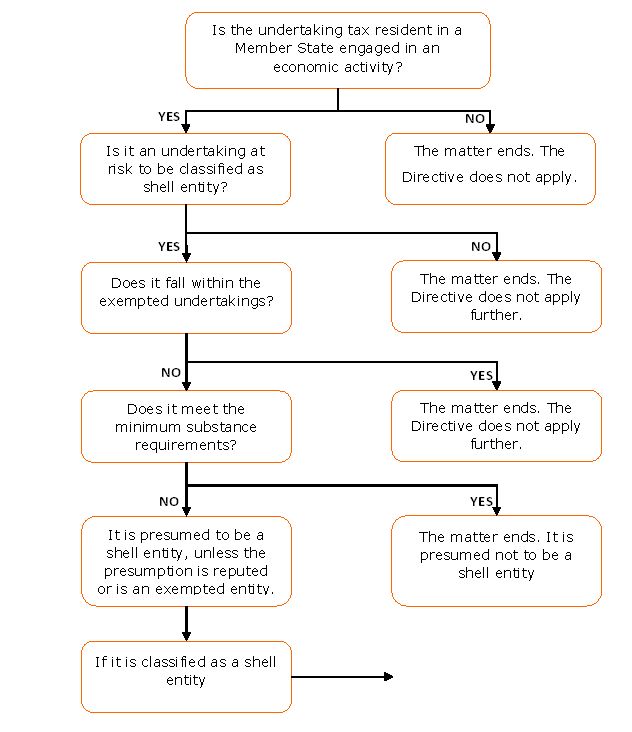

THE PROCESS OF THE PROPOSED DIRECTIVE IN A DIAGRAM

The methodology of the proposed Directive in order to identify shell entities proceeds as follows:

OUR OBSERVATIONS

Tax residency of Cyprus Companies and substance requirements under ATAD 3

The proposed Directive is applicable only to tax resident undertakings having economic activity.

As per art. 2 of the Income Tax Law No. 118(I)/2002 as amended, a company, anywhere registered, is tax resident of Cyprus only if its management and control is exercised in Cyprus. In addition, as from 31/12/2022 Cyprus registered companies, which are managed and controlled from abroad, will be automatically considered as tax residents of Cyprus by registration, unless they are tax residents of any other foreign country. Relevant analysis of this concept has been given in our publication, "The Management and Control Test – Taxation of Cyprus and Foreign Companies" published, January 2022, which can be found at https://www.kinanis.com/Publications

The Income Tax Law above, does not specify the meaning of management and control, neither the Commissioner of Income Tax has given any guidance as to the interpretation of this principle, so as to identify which companies are managed and controlled from Cyprus and consequently to be tax residents of Cyprus. In this respect, in order to interpret and apply this notion, we refer to UK court cases as we have pointed out in detail in our above-mentioned publication.

As per the interpretation given to the principle of management and control, if the directors of the company meet and decide independently the business issues of the company in Cyprus, the company is considered as having its management and control in Cyprus and consequently the entity is a tax resident of Cyprus.

Important role to identify whether the board of directors meets and decides in Cyprus, is the substance issue of the company and especially if the company maintains an office in Cyprus where the board of directors meets and decides the company issues accordingly.

Also, important issue is the residency of the directors and whether the company employs personnel stationed in Cyprus to undertake the business of the company from Cyprus.

These were crucial factors in identifying whether the management and control of the Cyprus company is exercised in Cyprus but were not officially framed so far.

ATAD 3 with its requirement as to particular substance conditions so that the characterization of the company as a shell company is avoided, officially gives a way out to the substance issue which should have been present in identifying the management and control of a company.

In effect, once the substance requirements of ATAD 3 are met, in the case where the in-house qualified director has been appointed, and is indeed managing the affairs of the company from Cyprus, the management and control test identifying the tax residency of a company is strengthen and supports the allegation that such a company is managed and controlled from Cyprus and therefore is a tax resident of Cyprus.

The substance requirement as per ATAD 3 is also met if the majority of the full-time employees are resident for tax purposes in the Member State of the undertaking.

This condition though, cannot be connected with the management and control of the company which is a notion related to the directors' powers. If the substance requirement as per ATAD 3 is met only with the majority of the employees stationed in Cyprus in the absence of the directors' involvement and capacity residing and deciding from Cyprus, then such a company might not be managed and controlled form Cyprus and in this respect, it might not be a tax resident of Cyprus and the Directive will not be applicable to it.

The below diagram clarifies the particular situation under discussion.

Factual situation of a Cyprus Company |

Do we have a Cyprus Tax Resident Company? |

Do we meet Substance Requirements of ATAD 3? |

If the Directors manage and control the Company from Cyprus – In house Directors (No nominees) |

YES |

YES |

If the majority of full-time employees are stationed in Cyprus (Management and Control is not exercised in Cyprus) |

NO |

YES |

As from 31/12/2022, If the Majority of the full-time employees are stationed in Cyprus (Management and Control is not exercised in Cyprus), BUT the company is a Cyprus registered Company but without being tax registered in any other country in the world |

YES |

YES |

So, in the case where the company has the majority of its employees stationed in Cyprus, but the management and control is outside Cyprus, the directors meet and decide abroad, such a company is not a tax resident of Cyprus and consequently the Directive does not a apply despite the fact that the coamony meets the substance requirements. If the company is a Cyprus registered company a from 31/12/2022, irrespectively of the fact that the management and control will be exercised abroad, and provided that such company does not have a tax residency in any country abroad, it will be considered, by reason of its registration in Cyprus, as tax resident of Cyprus as well.

Corporate Service Providers

The substance requirements of ATAD 3 and the whole approach of the Directive points to the fact that the tax resident company, in order to meet the substance requirements must have a self-managed office situated there where is tax resident.

This requirement, in addition to the requirement of the Income Tax Law, that in order to have a tax resident Cyprus company the Cyprus company must be managed and controlled from Cyprus, renders redundant the provision of administrative services such as nominee directorships by the various corporate service providers. If the Directive will be implemented the provision of such services will be considerably weakened and the role of the administrative service providers will be diminished.

Also, the provision of the well-known services of "virtual offices" without real substance and without full-time employees working in the office of the tax resident company will be diminished and gradually will come to an end.

Real headquartering structures will then be brought up creating a more solid business environment with in house management and real substance in Cyprus.

Criticism of the proposed Directive

The proposed Directive has received a strong criticism as not being in compliance with the EU Law and especially with the principles of proportionality and subsidiarity. It is not though the aim of this article to discuss these possible complications and if these principles are infringed. In any event, we do not consider that such arguments will easily walk through or have positive outcome, having also in mind the political aspect of such type of Directives and their background.

It is certain that, if the Directive is finally implemented as it is proposed, it will affect drastically holding companies without substance which are used extensively. As a result, the allocation of taxes among the Member States will be disturbed and re-distributed.

The exceptions though provided in the Directive, might give sufficient protection and a way out for holding companies that can prove that they exercise genuine business activities or that the structure implemented does not create any tax benefit to themselves or to their groups or to their shareholders. The particular facts of each case will need to be examine accordingly.

What the proposed Directive has not provided for, is what happens with the subsidiary companies of a parent company which parent meets the substance requirements. Do all the companies in the row need to fulfil the substance requirements, in addition to the parent, or the fulfilment of the conditions by the parent will be satisfactory?

It remains to be seen if this issue will be clarified.

Future Planning

Tax resident companies which do not fall within the exceptions of the Directive must plan their future set up to avoid the disadvantages of being characterised as shell companies.

Shell companies, unless they fall within the exceptions do not have future. They will face, from various angles, adverse tax consequences.

Headquartering has a promising future once is based in real business environment, with real substance and proper central management and control form Cyprus.

Footnotes

1. Article 3(1) of the proposed Directive.

2. Article 3(4) of the proposed Directive.

3. Article 4 of the proposed Directive.

4. Article 6(1) of the proposed Directive.

5. Article 7(1) of the proposed Directive.

6. Article 7(2) of the proposed Directive.

7. Article 6(2) of the proposed Directive.

8. Article 8 of the proposed Directive.

9. Article 9 of the proposed Directive.

10. Article 10 of the proposed Directive.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.