This article is addressed to clients and groups considering restructuring and aims to clarify one of the key obstacles in restructuring involving Cypriot companies, by explaining which structures are permitted and which structures are prohibited by section 28 of the companies law, Cap 113 (the Companies Law).

Section 28 of the Companies Law is essential to consider when contemplating a restructuring, as the prohibition it contains on certain persons' membership in Cypriot companies1 may impact the restructuring decisions of our clients.

Section 28 of the Companies Law restricts the ability of some companies to hold shares in their holding companies. This section states that "...a body corporate2 cannot be a member of a company3 which is its holding company4, and any allotment or transfer of shares in a company to its subsidiary5 shall be void." We shall refer to this section in the remainder of this article as either "section 28", or the "Prohibition".

Before contemplating whether a structure falls within the Prohibition as shown within the examples below, one must consider whether the companies within the structure constitute a holding company and subsidiary within the meaning of the Companies Law. If the companies within the structure do not constitute a holding company and a subsidiary, the Prohibition will not be applicable.

For the purpose of the examples we have used a BVI body corporate and a Cypriot company, however the BVI body corporate used in the examples can be replaced by any foreign body corporate.

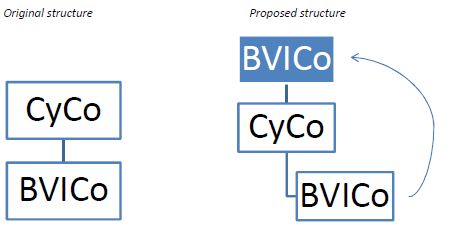

Prohibited structure: Cypriot company (CyCo) is the holding company of a BVI body corporate (BVICo)

In the scenario above we consider a CyCo which is the holding company of the BVICo. The BVICo proposes to acquire shares in the CyCo. This situation would fall within the Prohibition, as the acquisition of CyCo shares by the BVICo would amount to the body corporate acquiring shares in a Cypriot company which is its holding company and any allotment or transfer of the CyCo shares to the BVICo would be void.

BVICo is the holding company of CyCo

In the scenario above we consider a BVICo which is the holding company of the CyCo. The CyCo proposes to acquire shares in the BVICo. This situation would not fall within the Prohibition and is permitted, as the acquisition of BVICo shares by the CyCo does not amount to a body corporate acquiring shares in a Cypriot company which is its holding company. Had the CyCo been acquiring shares in a Cypriot company, the Prohibition would have applied.

Exceptions

There are a number of exceptions to the Prohibition contained in Companies Law, for example, the provisions allowing public companies to purchase their own shares in section 57A either directly or through a person acting in his own name on behalf of the company, the rules for a body corporate to acquire shares in a public company in section 57F and the exceptions contained in section 28, applicable when trustee companies/nominees are involved in the structure. As our focus is on private companies, we will explore the exceptions contained in section 28, which are as follows:

- The Prohibition will not apply where the subsidiary will acquire its holding company's shares in its capacity as a personal representative/trustee, provided that (i) the holding company or a subsidiary thereof is not beneficially interested under the trust; and (ii) the holding company or subsidiary thereof is not interested only by way of security for the purposes of a transaction which it has entered into in the ordinary course of its business involving the lending of money.

- If a subsidiary was already a member of its holding company prior to the Companies Law coming into force, it may continue to be a member, however it will have no right to vote at a general meeting of the holding company, nor a meeting of any class of members of the holding company.

For the sake of clarity, although exception 1 above allows the subsidiary to acquire shares in its holding company as a personal representative or trustee for a person other than its holding company or a subsidiary thereof, it would be prohibited for a nominee of the subsidiary to acquire shares in the holding company on the subsidiary's behalf if such acquisition by the subsidiary would fall within the Prohibition as per the examples above.

Conclusion

Therefore, when considering whether your subsidiary may acquire shares in its holding company you must consider:

- whether you have a structure, the entities in which, fall within the definitions of 'subsidiary' and 'holding company'; if yes,

- whether your structure is a permitted structure, or whether it is captured by the Prohibition; and if so,

- whether your structure falls within the exceptions discussed above and thus may be permitted.

Footnotes

1In this article we have considered private limited companies only. For information on the restrictions placed on public companies, please contact the authors.

2 "Body corporate" is reference to any legal person, whether a Cypriot company or a foreign legal entity.

3 "company" is reference to a Cypriot company.

4 "holding company" is reference to a body corporate which shall be deemed to be another's holding company if, but only if, that other is its subsidiary.

5 "subsidiary" is reference to a body corporate which, is the subsidiary of another (for the purpose of this definition defined as the "TopCo"), only if:

1. The TopCo is either:

(a) a member of the body corporate and controls the composition of its board of directors; or

(b) holds the majority of the voting rights in the body corporate; or

(c) is a member of it and holds the majority of voting rights of its members by virtue of an agreement concluded with its other members.

2. The first mentioned body corporate is a subsidiary of any body corporate which is the TopCo's subsidiary.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.