Capital Gains Tax (CGT) is imposed (where the disposal is not subject to income tax) at the rate of 20% on gains from the disposal of immovable property situated in Cyprus including gains from the disposal of shares in companies which directly own such immovable property. Further, as from 17 December 2015 shares of companies which indirectly own immovable property located in Cyprus and at least 50% of the market value of the said shares derive from such immovable property are subject to Capital Gains Tax. In the case of share disposals only that part of the gain relating to the immovable property situated in Cyprus is subject to CGT.

Disposal for the purposes of CGT specifically includes; exchange, leasing, gifting, abandoning use of right, granting of right to purchase, and any sums received upon cancellation of disposals of property.

Shares listed on any recognised stock exchange are excluded from these provisions.

Exemptions

The following disposals of immovable property are not subject to CGT:

- Subject to conditions, land as well as land with buildings, acquired at market value (excluding exchanges, donations, and foreclosures) from unrelated parties in the period 16 July 2015 up to 31 December 2016 will be exempt from CGT upon their future disposal.

- Transfers arising on death

- Gifts made from parent to child or between husband and wife or between up to third degree relatives

- Gifts to a company where the company's shareholders are members of the donor's family and the shareholders continue to be members of the family for five years after the day of the transfer

- Gifts by a family company to its shareholders, provided such property was originally acquired by the company by way of gift. The property must be kept by the donee for at least three years

- Gifts to charities and the Government

- Transfers as a result of reorganisations

- Exchange or disposal of immovable property under the Agricultural Land (Consolidation) Laws

- Expropriations

- Exchange of properties, to the extent that the gain made on the exchange has been used to acquire the new property. The gain that is not taxable is deducted from the cost of the new property, i.e. the payment of tax is deferred until the disposal of the new property

- Donations to a political party

Determination of capital gain for CGT purposes

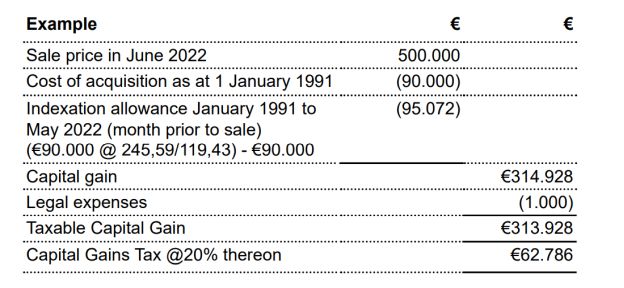

Liability arises only on gains accruing as from 1 January 1980, i.e. deducted from gross proceeds on the disposal of immovable property are its market value at 1 January 1980, or the costs of acquisition and improvements of the property, if made after 1 January 1980, as adjusted for inflation up to the date of disposal on the basis of the consumer price index in Cyprus.

Expenses that are related to the acquisition and disposal of immovable property are also deducted, subject to certain conditions e.g. interest costs on related loans, transfer fees, legal expenses etc.

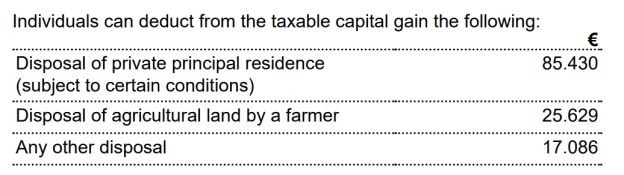

Lifetime Exemptions

The above exemptions are lifetime exemptions subject to an overall lifetime maximum of €85.430

To read this Report in full, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.